Vietnam now mostly imports raw cashew nuts from Cambodia, Tanzania and Ivory Coast. The imports from Cambodia have been increasing, with 386,000 tons in March alone, worth $449 million. The cashew import volume rose by 65.6 percent, while import turnover increased by 40 percent.

In the first quarter of 2024, Vietnam spent $593.2 million to import 462,400 tons of cashew nuts from Cambodia, up 32.6 percent in quantity and 45.7 percent in value compared with the same period last year.

The figures accounted for 69.7 percent of total cashew import volume and 71.8 percent of total value.

Vietnam is a big cashew nut exporter, but in recent years it has been increasingly reliant on raw imports, especially from Cambodia. Domestic supply can satisfy only 12 percent of the demand of processing companies.

The Ministry of Agriculture and Rural Development (MARD) reported that the total cashew growing area in Vietnam fell from 440,000 hectares in 2007 to 314,000 hectares in 2023 (down 8,300 hectares). In 2023, Vietnam’s cashew nut output was 345,000 tons.

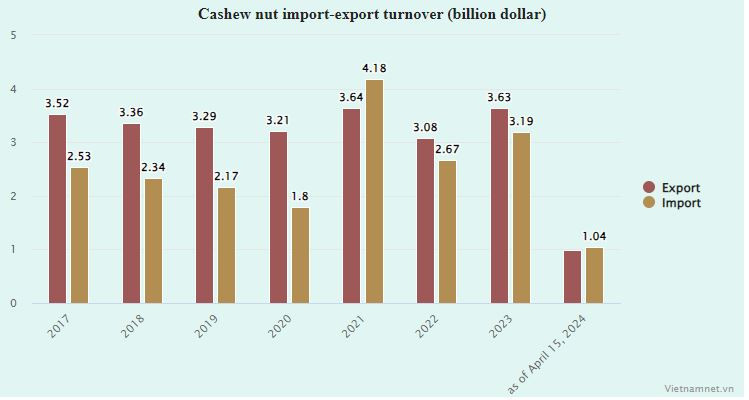

The reduced cashew growing area has forced processors to increase their raw imports, thus leading to the trade deficit. In 2021, the cashew sector for the first time witnessed a record-high trade deficit after three decades of a trade surplus.

Vietnam has always been first in the world in terms of processed cashew nut exports. However, increased reliance on imports has caused difficulties for cashew nut processors.

Previously, the world cashew nut market was controlled by Vietnam and India, with Vietnam accounting for 80 percent. However, new suppliers have emerged recently, especially in Africa, resulting in a drop in the Vietnamese cashew market share.

According to the director of a cashew nut processing company, African countries export raw materials but also now process cashew nuts. As the countries have a supply of raw materials and a cheap labor force, their processed exports are very competitive.

To ensure sustainable development of the cashew processing industry, enterprises have asked MARD to draw up solutions for cashew varieties, techniques, planning and concentrated production areas.

Pham Van Cong, chair of the Vietnam Cashew Association, said Vietnam doesn’t have a growing material area large enough to serve large-scale production. As the growing area in Vietnam has shrunk, processors have had to seek materials from other countries.

Tam An