Vietnam is a growing heavyweight in Asia thanks to competitive wages, growth in manufacturing and foreign investment.

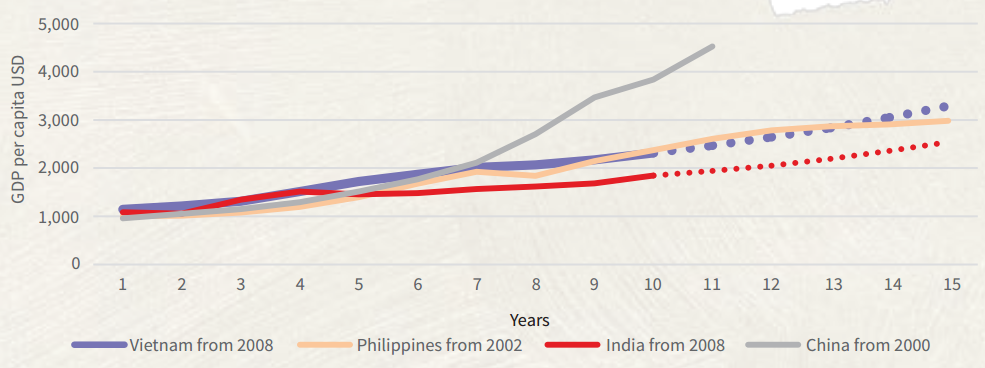

Pace of growth after GDP exceeds USD1,000 per capita. Source: IMA, JLL Research |

More foreign companies and investors focus on this bright spot in the context that uncertainties cloud the global economic outlook, according to a report by DBS Bank, a Singapore-based multinational banking and financial services corporation.

The bank pointed out a number of factors that are fueling the country’s economic expansion.

First of all, its economy grew by 7.1% in 2018, making it the fastest growing in ASEAN.

Secondly, Vietnam ranks second-largest electronics exporter in ASEAN. In less than a decade, Vietnam has leapfrogged ahead of some of the more established electronics manufacturing hubs to become the second-largest.

Its surge in manufacturing was partly due to a structural shift in the regional electronics supply chain. In addition, the country has captured market share from many of its peers.

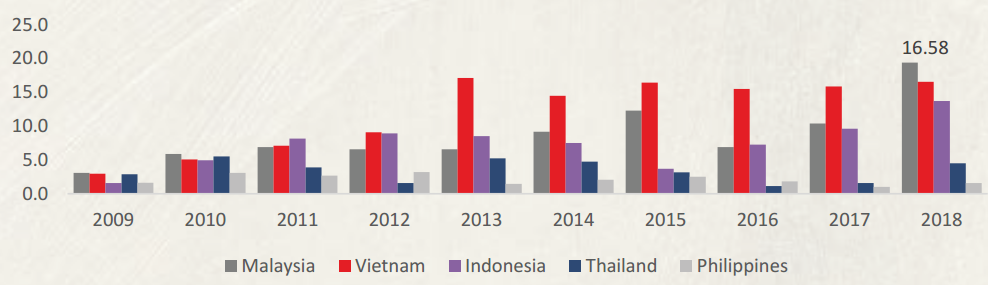

Vietnam top the SEA in FDI in manufacturing sector, 2009-2018 (USD billion). Source: National State Bank, JLL Research |

Thirdly, Vietnam’s wages, which are among the lowest in ASEAN, have helped draw a large number of foreign companies. In a report released in April, JLL said that labor cost in Vietnam is pretty low, at around US$1.5 per hour, compared to roughly US$3.5/hour in China. JLL noted that rising labor cost is one of the factors that trigger shifting of manufacturing locations from China to Vietnam.

Fourthly and the strongest factor, robust growth in investment to make it one of the manufacturing hubs in the region. The electronics cluster has propelled Vietnam’s economic rise.

Investment in electronics is growing quickly, and high-tech electronics players such as Samsung, LG and Microsoft have set up shops in Vietnam, marking a shift away from China, according to Asiatimes.

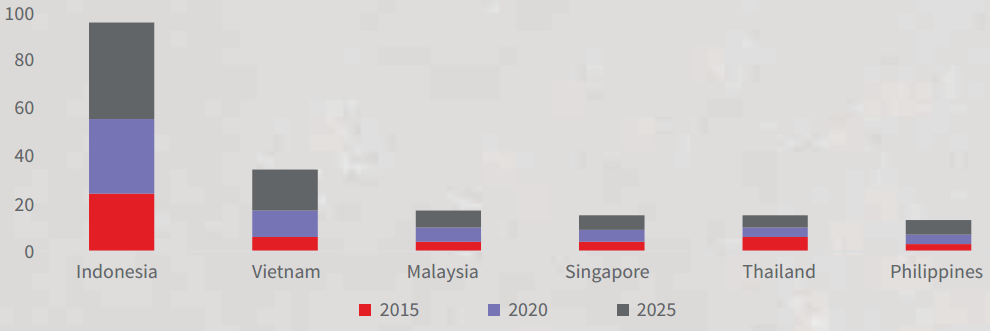

Vietnam has the second highest spending on transport infrastructure (road, rail, sea and airports) (In USD billion). Source: Oxford Economics, PwC, JLL Research |

The Japanese news agency NNA said in its 2019 survey that Vietnam is viewed as the most attractive destination in Asia for Japanese investment this year.

Japan is now the largest investor in Vietnam, accounting for almost a quarter of US$35.4 billion worth of FDI pouring into the country in 2018.

South Korea, which is Vietnam’s second largest investor, is also rapidly increasing its investment in the Southeast Asian country, especially as Seoul reduces its investment in China.

Samsung Group has invested some US$17 billion in Vietnam, making the country the second biggest exporter of smartphones behind China. This company is one of the most profitable businesses in Vietnam. In 2017, Samsung fetched US$58 billion of revenues in Vietnam.

Vietnam’s economy predicted to soon catching up with Singapore’s

DBS Bank predicted that Vietnam’s economy will be bigger than Singapore’s in 10 years.

In terms of economic growth, Vietnam posted 7.1% in 2018 in comparison with 3.1% by Singapore, Straitstimes quoted the Singaporean Ministry of Trade and Industry as saying.

Vietnam’s economy is now worth US$224 billion, equal to about 70% of Singapore’s.

However, a number of economists argued that Singapore’s gross domestic product (GDP) per capita, which measures the economic output per person, is among the world’s highest, and it will be difficult for Vietnam to reach that level within 10 years.

CIMB Private Bank economist Song Seng Wun said that it is not as difficult for Vietnam, which is a much bigger country than Singapore, to have a higher GDP, according to Straitstimes.

In terms of GDP per capita, the World Bank’s statistics showed that Singapore’s was US$57,714 in 2017, Malaysia’s was US$9,952, followed by Thailand with US$6,595, Indonesia’s US$3,846, the Philippines with US$2,989, and Vietnam’s was US$2,342.

DBS senior economist Irvin Seah said Vietnamese policymakers are now focusing on longer-term economic stability and sustainability, rather than the pace of growth intrinsically. Hanoitimes

Linh Pham

Foreign investment in Vietnam’s banks depends on ownership limit

As the domestic capital market is underdeveloped, Vietnamese banks are in dire need of foreign capital to meet Basel II standards by 2020 as required by the central bank.

Hanoi remains Vietnam's most appealing destination for foreign investment

Among 53 cities and provinces having received FDI in the first four months this year, Hanoi has attracted the largest portion of capital commitments with over US$4.47 billion, accounting for 30.6% of total investment in the period.

Vietnam's garment, textile industry expected to lure much foreign investment this year

According to economic experts, the garment and textile industry of Vietnam will advance further in global market thanks to several existing advantages such as skilled laborers with sophisticated technique.

Vietnam has outpaced regional peers in attracting foreign investment over the last years.

Vietnam has outpaced regional peers in attracting foreign investment over the last years.