|

French logistics and transport company FM Logistic began construction of its first owned XXL 5.2-ha multi-client warehouse early this year, at VSIP Bac Ninh in Vietnam’s north, with high standards in fire prevention and protection, ventilation, and energy savings. Investment stands at $30 million and the first phase will be put into operation next April.

It also opened a 6,500 sq m distribution center in southern Binh Duong province in May, which was designed to store fast-moving consumer goods (FMCG) and retail and consumer goods for distribution to Ho Chi Minh City and elsewhere.

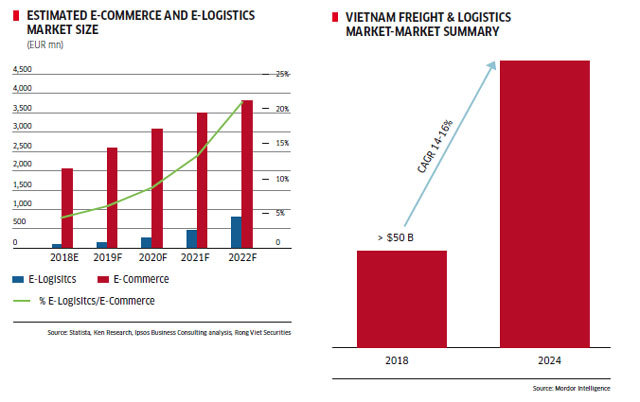

As rapid change continues to be seen in Vietnam’s logistics market, rising demand is being driven by higher wages, greater consumption, the country’s young population, booming e-commerce, and the appearance of omni-channels, according to Mr. Hamza Harti, Country Managing Director of FM Logistic Vietnam.

Vietnam’s entire supply chain is expected to be digitized in the near future, since Industry 4.0 technologies are altering customer behavior and forcing logistics providers everywhere to adapt to around-the-clock service provision.

E-commerce & tech boost

Using mobile devices is now common practice among consumers. The transformation of the shopping experience away from bricks-and-mortar stores and towards e-commerce represents a major challenge for retailers and manufacturers alike as well as the associated logistics and supply chains.

Consumers and businesses expect a seamless shopping and B2B experience, so retailers and those in supply chains need to adapt to omni-channel demands without delay.

There is a shift in consumer purchasing behavior that has changed the way products flow through the supply chain.

“The distribution of goods has evolved from a somewhat predictable and easily planned process to a more personalized service level and delivery models,” said Dr. Robert McClelland, Head of the Department of Management at RMIT University Vietnam.

Omni-channel warehousing and fulfilment centers have appeared to facilitate this, he went on, but these require more flexibility in size, services, and location to react to demand in the shortest time possible.

Anytime, anywhere delivery models will also be required to meet promises made to end-consumers. To satisfy consumer expectations, companies will also have to provide new services that facilitate easy returns.

Growing B2B commerce will require specialized delivery services as well, especially for high-value, time-critical deliveries, and cross-channel omni-channel platforms shared between manufacturers, retailers, and logistics providers will be essential to gain complete visibility of customer interactions and, more importantly, for data and inventory between warehouses and other platforms to easily shift to meet peaks in demand.

There needs to be advanced analytics and AI for this to happen, which will play a crucial role for these platforms.

One of the biggest players in the local logistics market, Lazada E-logistics (LEL) Vietnam, has invested heavily in expanding its footprint around the country through new fulfilment centers, with five in Ho Chi Minh City, Hanoi, and Da Nang, new sorting centers to increase speed and accuracy, and then last mile hub expansions and automation implementation to optimize performance and lead time.

“The last 18 months have been an exciting period for the e-logistics industry, full of growth, new infrastructure, and the newest technology,” Mr. Fabian Wandt, CEO of LEL Vietnam, told VET.

Meanwhile, many experts say that Vietnam is also facing challenges regarding the digital aspect of logistics, as Industry 4.0 technologies such as the Internet of Things (IoT), big data, and augmented reality are turning the industry upside down.

These digital innovations promise to slash shipping costs, improve the tracking of shipments, and ensure the security of cross-border cargo.

Digital innovation has vastly improved visibility, transparency, compliance, and reliability in supply chains.

“Digitizing is affecting all parts of the supply chain,” said Mr. Mark Cheong, Head of Marketing and Sales at DHL Global Forwarding.

“Customers want quicker service, and the question is whether logistics providers can meet that demand. DHL is working closely with the Vietnam Logistics Association to explore solutions, including digital ones, that can help bring down logistics costs.”

Adaptive strategies

|

Industry 4.0 will allow Vietnam’s logistics industry to leap-frog into the future, especially with the growth of local startups that use technology to transform the shipping and warehousing segment. “The challenge and the opportunity both lie in technology,” said Dr. McClelland.

“Technology constantly throws up new and innovative ways of altering the way we work, providing us with the chance to steal a march on our rivals and find that extra 5 or 10 per cent. Invest in and deploy the right software and hardware and you could become more efficient operationally. Sit still and your business can very quickly look slow-moving and behind the times.”

In order to adapt to the domestic market, FM Logistic is working with clients using some of its global innovations, such as the e-commerce trolley, for implementation next year.

The first technological solution the firm implemented in Vietnam was its Warehouse Management System, which offers the latest powerful functionalities suitable for retail, e-commerce and omni channel warehouse operations, optimizing both the quality, the productivity, and also the speed of operations while minimizing all the paperwork, and all of this at a cost suitable for Vietnam.

At LEL Vietnam, the company launched the first-of-its-kind self-collection service in Ho Chi Minh City in June.

“Lazada customers can now choose to pick up at a collection point before checkout and then re-direct their parcel to any location of their choosing,” said Mr. Wandt.

“Technology allows us to enable information sharing in real time through system integration with all our partners in the ecosystem. Real time information sharing allows us to better optimize our day-to-day logistics utilization and also increases efficiency. These are the two biggest drivers in improving costs.”

LEL has also launched the new Alibaba Retail and Supply-Chain Platform (ASCP) in Southeast Asia. The new platform enables it to drive towards two important strategies: enabling all small and medium-sized enterprises (SMEs) to access global trade and end-to-end optimizing of the supply chain for brands and retailers.

“Our new systems will significantly improve our suppliers’ experience, empower our sellers, and drive automation across the whole value chain,” he said.

“The new system fully automates our selling processes, from forecasting and replenishment to pricing, service levels, inventory management, and stock placement. All our processes are now supported by AI.”

Meanwhile, DHL Express’s recent technological innovations include courier scanners, e-shipping tools, and customs declaration processes that help customers follow exactly where their packages are at all times.

“We have invested over $8 million here in the past three years and have a plan for a similar pace of investment in the years to come,” said Mr. Shoeib Reza Choudhury, Country Manager of DHL-VNPT Express Vietnam.

“We have also recently started accepting new cashless payment technologies to offer customers new ways to pay and switched to e-invoicing in the past year, which is not only more convenient for customers but helps us save around 720,000 sheets of paper each year.”

Major constraints

In logistics, information is king, according to Mr. Cheong from DHL. “Technology will allow us to provide information to customers in an effective manner and help them with their decision-making process,” he explained.

“Again, Vietnam’s logistics infrastructure might be sufficient for now, but for long-term growth we need more muscle to push ideas ahead and cut red tape.”

According to the United Nations Economic and Social Commission for Asia and the Pacific (ESCAP), infrastructure investment demand in Vietnam in the 2016-2020 period has been projected at some $24 billion; almost double the need in the previous five years.

Dr. McClelland indicated that the key challenges here are fiscal constraints and less room to finance large transport projects from State funding, inefficient investment planning and public finance allocation, undeveloped capital markets, a lack of necessary in-country capacity, and a lack of an enabling environment for private investment.

Moreover, there are different challenges in every country when it comes to laws and infrastructure, and Vietnam is no different, according to Mr. Russell Reed, Managing Director of UPS Thailand and Vietnam.

For example, highways in the country don’t have the same capacity as those found elsewhere in Southeast and East Asia, and this can lead to bottlenecks, often during peak periods, when transport infrastructure really needs to perform at its best.

However, at the same time, he’s optimistic about the focus the Vietnamese Government is placing on upgrading and expanding the country’s infrastructure, with $52 billion worth of PPP projects currently underway.

The upcoming North-South Expressway will be especially useful in cutting congestion. Meanwhile, on the legal front, Vietnam’s ratification of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and other trade deals means that the government is grappling with issues such as customs harmonization and intellectual property; issues that are vitally important to ensuring Vietnam is able to continue forward as a reliable and safe trading partner.

Hong Nhung

VN’s logistics firms remain small despite potential

There are 4,000 Vietnamese businesses operating in the logistics field but most of them are small-scale with weak human resource quality, the Ministry of Industry and Trade (MoIT) reported.

Bottlenecks in logistics need to be cleared

The logistics sector has long been considered the backbone of trade activities. However in Vietnam, that backbone seems to have a lot of problems.

Leading logistics providers are looking to technological investment and e-logistics as Vietnam's limits in infrastructure and connectivity continue.

Leading logistics providers are looking to technological investment and e-logistics as Vietnam's limits in infrastructure and connectivity continue.