Many distributors of But Son, Cong Thanh, and Tam Diep cement rose their product prices in April, following an 8.36 per cent increase in electricity prices on March 20.

A number of local producers also plan to increase their selling price shortly. No company wants to increase prices, but electricity and coal make up a large proportion of input costs in cement production, according to Mr. Nguyen Van Trung from the Technical Department at the Nghi Son Cement Corporation, so local manufacturers need to make appropriate adjustments.

POWER PRICE RISES, BUSINESSES SUFFER

But Son, a subsidiary of the Vietnam Cement Industry Corporation (VICEM) and whose monthly power bill averages VND20 billion ($855,730), announced it would increase prices by VND30,000 ($1.3) per ton immediately after the power price rose.

According to calculations from the Vietnam Cement Association (VCA), an increase of 8.36 per cent results in cement production costs rising VND15,000 ($0.6) per ton.

In addition to the power hike, the price of coal sold to cement producers also increased by 2.5-5.8 per cent, depending on the type of coal. The rise in the power price contributed 10 per cent to the rise in the coal price.

Meanwhile, the Vietnam National Coal and Minerals Industry Holding Group (Vinacomin) has not provided sufficient coal to cement producers, with higher-priced coal being imported to cover the shortfall.

Cement companies can’t afford to just soak up the increase in input costs and were forced in turn to increase their own prices. Some local cement producers plan to increase prices by VND50,000 ($2.16) per ton.

“The power price hike significantly affected production and business activities in the industry,” Mr. Nguyen Van Cung, Chairman of the VCA, told VET. “It put them under pressure when balancing prices and costs, because the industry is so competitive.”

The power price hike also affected producers of steel construction materials. The SSE Steel Company increased its prices by VND200,000 ($8.6) per ton, while Thai Nguyen Steel and Viet Steel raised prices by between VND150,000 ($6.4) and VND200,000 ($8.6) per ton. The Vietnam Italy Steel JSC will increase its prices by 2 per cent, or VND61,000 ($2.63), per ton.

Electricity costs account for 8-9 per cent of production costs while average profits are just 5 per cent of revenue. It’s simply impossible for steel producers to avoid increasing their retail prices, according to Mr. Nguyen Van Sua, Deputy Chairman of the Vietnam Steel Association (VSA). Import prices of iron ore and steel billets are also heading upwards this year, affecting steel production costs.

As an energy-intensive industry, textile and garment companies have also had to deal with the higher power price. Mr. Nguyen Quoc Lap, Director of the Kyung Viet Co. in northern Hung Yen province, said it created problems for the company. Electricity bills are a fixed and regular cost and account for a large proportion of its production cost.

The price rise inevitably leads to higher input costs, while the price of the company’s products is fixed in signed contracts. Kyung Viet pays VND100 million ($4,390) every month on electricity and the price rise will see it pay an additional VND10 million ($430.9) or so. Mr. Truong Van Cam, Secretary General of the Vietnam Textile and Apparel Association (VITAS), told VET that local companies specializing in dyeing and yarn production will be affected the most. Selling prices in the industry, he calculates, will increase by 25-35 per cent.

The Ministry of Industry and Trade (MoIT), when proposing the power price hike, said it was urgently needed to compensate rising input costs of electricity utility companies. Deputy Minister of Industry and Trade Hoang Quoc Vuong told local media that the hike would see cement, steel, and certain other industries pay between VND13 million ($560) and VND95 million ($4,093) more on electricity each month.

According to the Electricity Regulatory Authority of Vietnam (ERAV) at MoIT, some 1.4 million manufacturers in Vietnam that now pay an average of VND12.4 million ($530) per month on electricity will be up for a further VND870,000 ($37.2).

According to calculations from MoIT and the General Statistics Office, the hike will shave 0.22 percentage points off GDP and increase the CPI by 0.29 percentage points.

STRUGGLING TO COPE

|

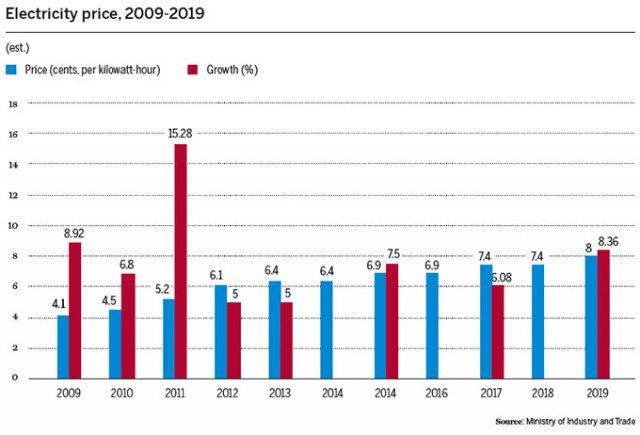

Electricity prices have increased nine times since 2010. The highest increase was in 2011, of 15.3 per cent. Increases have been fewer since 2013 and by lower amounts, from 5 to 9 per cent. Vietnam’s electricity prices are equal to 91.9 per cent of those in China and India, 81.7 per cent of Laos’, and 73.5 per cent of Indonesia’s.

Even with this latest increase, prices of $0.08 are on par with China and India and lower than in Laos, at $0.09, Indonesia, at $0.10, and Canada, at $0.11, according to ERAV.

While consumption is expected to rise 10 per cent this year, electricity projects by private investors have seen slow progress, Mr. Vuong added, generating insufficient power to meet demand.

This is also why foreign investors are not interested in investing in electricity projects in Vietnam.

Mr. Trung from Nghi Son Cement believes any increases to power prices need to be considered carefully. Average per capita GDP in Vietnam is lower than many regional countries, so simply comparing the unit price of electricity can’t fully explain the competitiveness of the country’s electricity price.

When prices go up, local businesses struggle to balance costs and profits, he said. Production in the cement industry has far exceeded domestic demand in recent years, which makes life tough for local producers. Many cement mills still use low technology and equipment, while only a few have installed modern equipment and energy-saving technology.

Nghi Son Cement can find other sources of inputs to cut costs, he added, but it is difficult to cut down on electricity consumption.

Local economists said the hike would pressure local businesses to improve their technology and become more aware of the use of power saving devices.

This is in line with trends towards sustainable development: green production and a reduction of waste and emissions into the environment.

The Garment 10 Corporation has implemented a host of solutions in recent years to minimize its electricity costs, such as using electricity saving globes and new-generation sewing machine motors and installing windows to increase natural light.

Others believe the price hike threatens local enterprises’ competitiveness against rivals in the Southeast Asian region and those in member countries of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP).

This in turn should encourage local companies to enhance the application of cutting-edge, power-saving technical measures in the hope of slashing product costs.

Some companies could shift their main production from daytime to nighttime to enjoy lower electricity tariffs, of course. Garment 10 plans to deploy a solar power system at its headquarters to partly supply electricity for their operations and to reduce consumption from the national power grid.

In terms of energy efficiency, the energy consumption at companies like Zamil Steel Building Vietnam does not entirely depend on production lines, but also on the type and quality of fuel (ore, coal), operation control technology, and material efficiency.

Even when production lines vary in origin and energy consumption, sophisticated energy management systems can be used to ensure efficient use and recovery of energy throughout the steel making process.

Some of Zamil’s suppliers’ mills have been equipped with such systems to bolster energy efficiency. “The hike, which might be considered a challenge, is not the first we have seen,” said General Director Mr. Alakesh Roy. “We understand the country’s need for development, and it is our responsibility to cope with changes to sustain our business.”

From the perspective of a small and medium-sized enterprise (SME), Mr. Nguyen Manh Quang, CEO of the Manh Quang Co., said the hike would affect the company and many industries and some will incur a reduction of at least 5 per cent in profit this year.

Minh Quang applies modern management methods such as lean manufacturing to reduce waste in production and business.

According to the BIDV Securities Company (BSC), lean manufacturing has been applied at many businesses of different scale and industry and good results have been recorded.

A BSC representative believes it represents a sound method for businesses to increase their market competitiveness. Vietnam Economic Times

Nghi Do

Upbeat outlook for M&A in Vietnamese solar power sector

Foreign investors are expanding in the Vietnamese solar power sector via M&A deals or by establishing joint ventures with local players to save time as the commercial operation deadline for the coveted $9.35 cent feed-in tariff looms.

Vietnam among most improved middle powers in Asia: report

Malaysia, Vietnam and New Zealand are among the most improved middle powers in the region, according to the Asia Power Index 2019 recently released by Australian think tank Lowy Institute.

Local developers unlock power of green building

Green building represents one of the most significant opportunities for sustainable growth at both the national and global levels, and local developers have begun paying more attention to this concept.

Local manufacturers have had to adjust their production and business activities in the wake of an electricity price rise in March.

Local manufacturers have had to adjust their production and business activities in the wake of an electricity price rise in March.