|

The Kido Group, formerly Kinh Do, posted its highest revenue growth for three years in 2018 after selling its snacks business.

The new strategy - fast-moving consumer goods (FMCG) including cooking oil, instant noodles, and frozen foods - lay behind the growth.

When penetrating into new markets, the group defined its priorities as market dominance and testing as well as developing its ice cream category, with the aim of remaining the market leader despite the increasing competition and slowing growth in FMCG.

Less-than-expected growth

Kido Foods, which owns ice cream and other frozen food brands, holds a 40 per cent market share and has a huge distribution network of up to 70,000 points throughout the country.

Ice cream contributes up to 80 per cent of its total revenue, but revenue growth from ice cream fell 12.3 per cent last year compared to 2017. Promotional campaigns and declining retail prices of rival products were behind the fall.

Similarly, the Hanoi-based Thuy Ta JSC, which has sold Thuy Ta ice cream for 65 years, earned VND46 billion ($19.8 million) in revenue in 2018, down 3.1 per cent against 2017. This was also the second consecutive year after-tax profits were down significantly.

Its market share has fallen to 9.7 per cent from 10.9 per cent in 2012, according to a company report, due to a lack of investment in new flavors, package labeling, and proper marketing strategy, according to local insiders. Though in the market for many years and with 260 sales points, the brand only focuses on Hanoi.

|

Ms. Nguyen Phuong Nga, Business Development Director of the Worldpanel Division at Kantar Vietnam, told VET that growth in the ice cream market is driven by consumption demand in the south, mainly in Ho Chi Minh City and rural areas, with potential to expand further in the Mekong Delta’s Can Tho city.

“Ice cream has already reached nearly 50 per cent of households in the south and is continuously attracting new shoppers,” she said. “This implies there is a huge room for further expansion in terms of both consumer base and spending.”

Ice cream sales recorded double-digit growth in FMCG Monitor September 2018 conducted by Kantar Vietnam and continued to be among the hot categories in FMCG Monitor June 2019.

Ms. Nga said there is headroom for further development of ice cream in Vietnam in terms of both value and volume, especially in the south, thanks to Vietnam being a tropical country with a young population, there being huge demand for ice cream, rising disposable incomes leading to greater spending power, and innovations and new launches made to excite the ice cream market.

Segment focus

Product diversity is a strategy that many local brands have taken to retain and expand market share. Local brands have created new products, seeking ways to combine new flavors or follow global trends favored by Vietnamese consumers.

In 2018, Vinamilk, which holds the second-largest market share, launched a new product line called Yolo, while Kido Foods previously launched a range of flavors such as banana, fish, and mochi.

TH True Milk, the latest player in the market, also launched new flavors such as durian and strawberry after launching its ice cream brand in June last year.

|

The market is becoming more dynamic thanks to innovation and Kantar Vietnam sees a rising trend of new flavors and ingredients that are good for the health, such as beans, green tea (matcha), almond, chestnut, or mixed flavors, such as 2in1 and 3in1, albeit from a low base.

The average price per kilogram for in-home consumption is around VND87,000 ($3.7), it found, with the mainstream segment driving growth. Consumers, though, show a tendency towards premium options with new flavors and tastes.

Annual ice cream consumption per capita in Vietnam is about 444 grams, against 675 grams in Indonesia, 973 in Thailand, and 1,557 in Malaysia, according to Euromonitor International’s forecasts.

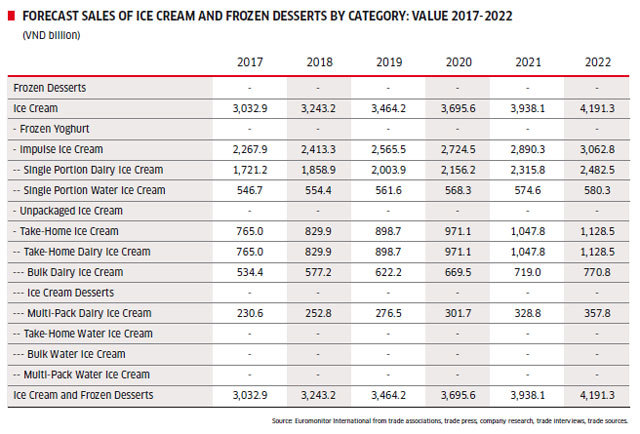

Ice cream and frozen desserts will record annual compound growth of 7 per cent in 2017-2022, with revenue at some VND4.2 trillion ($180.6 million) next year.

Given the potential, foreign ice cream brands targeting the high-end segment have increased their presence in major cities over recent years.

The US-based Baskin-Robbins plans to have 100 stores in Vietnam next year, having entered Vietnam in 2015.

South Australian premium ice cream producer Golden North sent its first 12,000-liter shipment to Ho Chi Minh City at the end of July.

Its exports to Vietnam are to reach one container per month - triple their Chinese sales - within a year, according to the company.

Vietnam’s ice cream market is growing and local consumers are looking for an Australian product, it said, which represents a great opportunity.

With lower growth last year, this year Kido Foods has focused on developing best-selling products such as Celano and Merino and other high-end products with handsome profit margins, and cautiously introduced new products after researching the behavior of Vietnamese consumers.

“We will focus on developing core products, continue to implement advanced product strategies, and enhance the development of local tastes, which will increase our market share and profit,” a representative from the Kido Group said. “Modern distribution channels are also part of the strategy.”

To win over Vietnamese consumers, local and foreign ice cream brands need to understand local consumer behavior and preferences to stay abreast of the latest trends, which include health and nutrition and indulgence, by offering new products and new tastes and flavors, Ms. Nga said.

They also need to leverage different consumption occasions to increase volumes for in-home and out-of-home consumption, parties, office get-togethers, impulse shopping, and single or shared usage, through marketing communications and convenient pack types and sizes.

Affordable pricing is also key, with smart pack size strategies to stimulate trials and increase consumer loyalty with added benefits and rewards, as are better distribution with an omni channel strategy and innovating new retail formats direct to consumers or unmanned stores, to reach as many shoppers as possible, she added.

Nghi Do

Taiwanese ice cream brand stirs up ice cream market

The quality of products and the scale of distribution network are the two decisive factors that determine success of every ice cream brand.

New faces and flavours intensify ice cream competition

Not much after going on sale in Taiwan, brown sugar bubble ice cream has been selling through online shops in Vietnam since May.

Ice cream is also a market where local and foreign brands are battling it out for market share.

Ice cream is also a market where local and foreign brands are battling it out for market share.