|

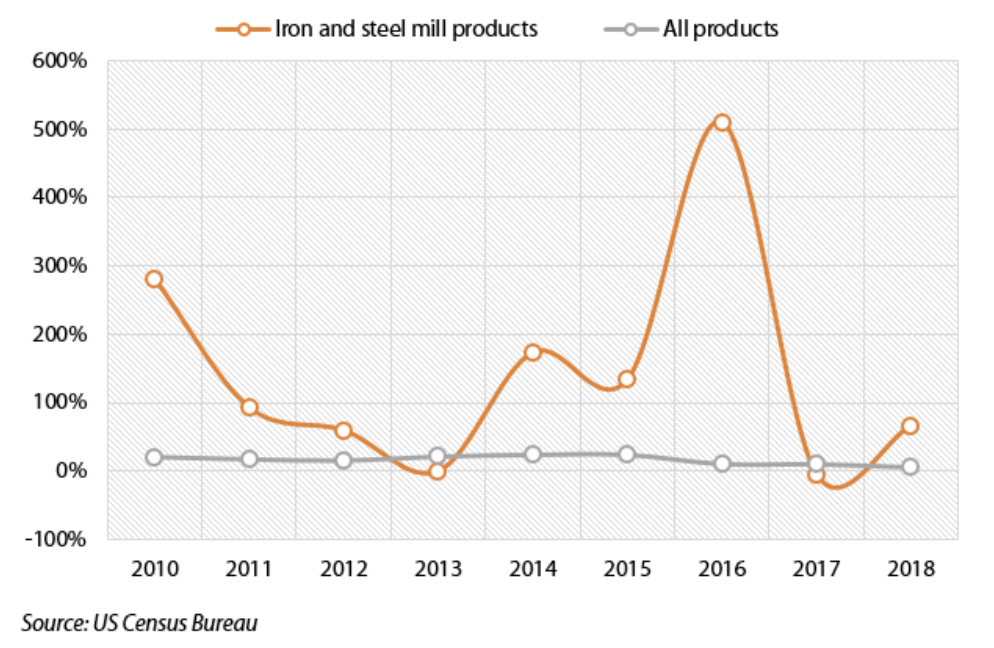

Vietnam’s steel exporters are reaping the benefits from US’s decision to impose more than 400% countervailing duty on Vietnamese steel products using substrates from South Korea and Taiwan, according to Viet Dragon Securities Company (VDSC).

In the first half of 2019, construction value growth slowed down to 7.85% year-on-year, lower than the rate of 9.16% in 2018, in turn affecting the demand for steel. The domestic steel industry in the first half of the year produced a total of 12.6 million tons of steel, sold 11.6 million tons, of which 2.5 million tons were exported, increasing by 7.7%, 9.8% and 6.3%, respectively, compared to the same period of last year, according to the Vietnam Steel Association.

There is a correlation between the steel industry and the construction industry as the latter is the largest consumer of steel, although each steel product grows at a different pace. Construction steel grows in tandem with the construction industry. While the steel pipe segment growth was slow the coated steel sheet segment has started to experience oversupply. In addition, trade protection from major export markets has made the segment see a negative growth of 5% in the January – June period in consumption, while exports dropped by nearly 19% over the same period.

Regarding the hot rolled steel segment, Formosa Ha Tinh mill has supplied a total of 2.1 million tons of hot rolled coil (HRC) steel in the six-month period, 42% higher over the same period and exported about 20% of production, while most HRC is consumed domestically.

Growth of Vietnam's exports to the US. |

Vietnam’s processing capacity (cold rolling, plating and color coating) increased strongly recently while the upstream production chain was not prioritized, so most of the exporters had to import HRC. Therefore, Vietnam coated steel sheets using HRC from China, Taiwan, and South Korea have been imposed with countervailing duties by the US. In the future, it is expected to see about 5 million tons of HRC from Formosa Ha Tinh and 3.5 million tons of HRC from Hoa Phat Dung Quat in the market.

Accordingly, the domestic coated steel production chain will be completed, improving added value. It is going to provide opportunities for local producers to penetrate many potential markets that are applying safeguard duties on large steel producers, stated VDSC.

Major steel producers on the rise

Meanwhile, with the Ministry of Industry and Trade's decision to impose anti-dumping duty on color coated steel imported from China and South Korea, Nam Kim Group and Hoa Sen Group are predicted to benefit from this decision.

The amount of imports into Vietnam is estimated at 200,000 tons in 2018, while Hoa Sen Group is the leading enterprise that sold a total of 282,000 tons of color coated steel sheets in the domestic market in 2018, accounting for nearly 35% market share. Therefore, VDSC expected Hoa Sen Group to be the largest beneficiary of the duty. In addition, Nam Kim Group sold more than 80,000 tons of color coated steel in 2018, of which 50,000 tons are consumed in the domestic market, presenting opportunity for the group to take over market shares from foreigners owing to the anti-dumping duty.

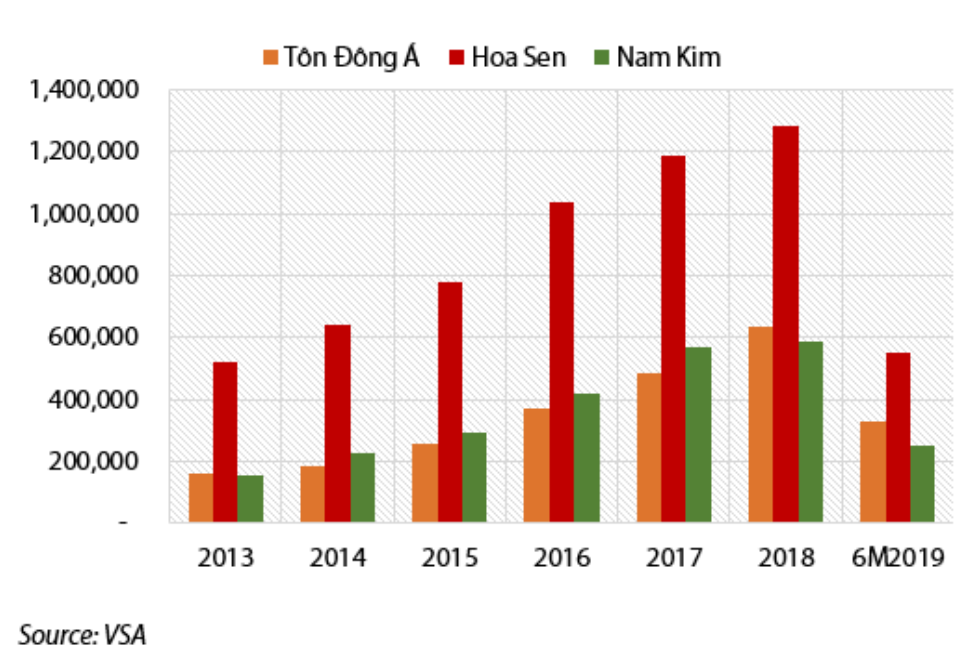

Leading companies' sales (in tons). |

In terms of market share, there are minor changes in the construction steel segment as Hoa Phat Group still maintains its market share over 25%, followed by Pomina and Posco. After its Dung Quat mill was put into operation, Hoa Phat Group is expected to continue to increase its market share to nearly 30% in 2020-2021.

Hoa Phat Group is also the steel pipe brand with the leading sales in the first six months with 32% market share, which is far ahead of Hoa Sen Group with 17% market share. In return, Hoa Sen Group maintained its position in the coated steel segment because of its own retail network. As a result, Hoa Sen Group's market share has been kept steady over 30% in recent years and surpassed all other domestic competitors.

Notably, Ton Dong A is growing strongly in terms of market share, reaching 18% in the first six months of 2019, surpassing Nam Kim Group (14%) to become the industry runner-up in sales. Looking into Ton Dong A’s sale structure, the company is understood to have advantages in the southern market, selling 178,000 tons of galvanized steel, higher than Hoa Sen Group (157,000 tons) in this region in the January – June period. Hanoitimes

Hai Yen

Vietnamese origin of steel products needs to be transparent

Vietnamese steel manufacturers must be transparent about the origin of their products when exporting to all markets, experts say.

VN steel industry forecast to maintain stable growth

Vietnam’s steel production and consumption in the first half of 2019 recorded respective increases of 7.7 percent and 9.8 percent year-on-year, according to the Vietnam Steel Association (VSA).

The domestic steel industry in the first half of the year produced a total of 12.6 million tons of steel, sold 11.6 million tons, of which 2.5 million tons were exported, increasing by 7.7%, 9.8% and 6.3% year-on-year, respectively.

The domestic steel industry in the first half of the year produced a total of 12.6 million tons of steel, sold 11.6 million tons, of which 2.5 million tons were exported, increasing by 7.7%, 9.8% and 6.3% year-on-year, respectively.