|

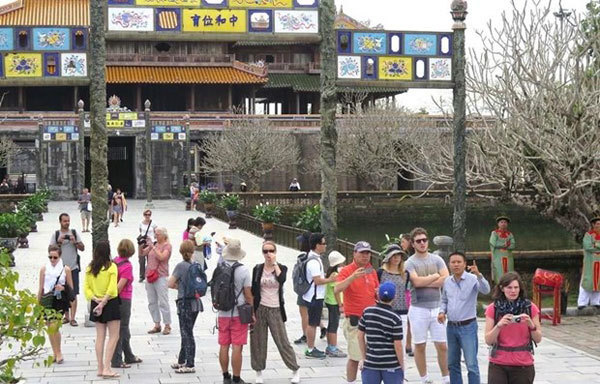

| Foreign tourists visit Hue Imperial Citadel in the central province of Thua Thien-Hue. A drop in tourism as a result of COVID-19 induced travel restrictions to cripple Vietnam’s services exports. VNA/VNS Photo Quoc Viet |

In a recent report on Vietnam’s outlook, the UK-based financial information services provider said this would mainly be due to the drop in tourism causing a sharp fall in the services trade balance.

"We expect the collapse in tourism as a result of COVID-19 induced travel restrictions to cripple services exports," Fitch said in a statement.

"Indeed, following border closures, tourist arrivals have fallen significantly from generally above a million every month to below 30,000 from April to July."

Meanwhile, Fitch said, the primary income deficit was likely to narrow slightly on the back of Vietnam’s economic growth outperformance relative to the global economy, which will support profits for foreign investors and by extension, the income paid abroad.

The external goods trade balance is likely to remain fairly stable, considering the high composition of intermediate goods in Vietnam’s imports for use in export manufacturing, which see both exports and imports track each other closely.

Fitch analysts said in their report: “We expect the positive goods trade balance to offset the sum of the services trade deficit and net primary income payments,” adding that COVID-19 grants from multilateral organisations such as the World Bank and other transfers from overseas persons and entities should keep Vietnam’s secondary income balance positive as it has been since 2012.

From a savings-investment perspective, Fitch said Vietnam’s negative savings-investment gap flipped positive since 2011, correspondingly seeing the current account post surpluses thereafter.

It added: “Since then Vietnam has been a net direct investor overseas and we expect this current account surplus to continue but narrow over the coming decade.

"This is because we believe that the Vietnamese authorities’ effort to reduce deposit interest rates to provide room for banks to lower lending rates accordingly to support economic activity amid the COVID-19 induced economic shock should also disincentivise savings in favour of investment, and accordingly see a rise in the investment rate. Risks to Vietnam’s external financing position will remain low over the coming decade.”

Fitch said it saw limited risks from Vietnam’s growing external debt burden, explaining given that more than 80 per cent of the country’s total external debt is in the form of long-term debt, it didn’t see major risks stemming from the need for high debt repayments over the short term, especially considering the low interest rate environment the world has been in for the past decade. VNS

Consumer lending: bad debts rise, creditors hire 'thugs' to collect debt

Because of Covid-19, 5 million workers have lost jobs or seen their income decrease.

Consumer lending expected to rise in Vietnam after Covid-19

The number of borrowers is expected to increase, but this also poses higher risks for finance companies.