Vietnam stands out as the only ASEAN economy to achieve positive growth in 2020 and rebound to an 8.1 percent growth rate in 2021 – the highest in Asia, the Hong Kong Shanghai Banking Corporation (HSBC) said in a recent report.

In the report titled “Asia Economics: It's About Stamina”, HSBC affirmed that despite many significant challenges, Vietnam's economy rose 1.8 percent in the first half of 2020.

The government's efforts to contain COVID-19 significantly contributed to the country’s economic achievements.

However, the resurgence of the pandemic in late July impeded Vietnam's initial goal to bounce back early compared to other countries.

With its success in suppressing the new outbreak, Vietnam is put in the top position among the ASEAN economies in terms of potential growth in 2020, HSBC said.

This year Vietnam's GDP growth is expected to reach 2.6 percent, which is slightly lower than the previous forecast of 3 percent.

HSBC believes that Vietnam will benefit from the technology-led recovery and stable foreign direct investment (FDI) inflow in the year to come.

Therefore, the Southeast Asian nation still has a positive outlook with expected economic growth of 8.1 percent next year, compared to the previous projection of 8.5 percent.

“Vietnam’s growth rate this year is still quietly ‘skyrocketing’ and will stand out as the fastest-growing economy in the region by 2021," HSBC added.

HSBC is one of the world’s largest banking and financial service organisations./.

Khanh Hoa fishermen benefiting from fishing technology

Fishermen in south-central Khanh Hoa province have begun to apply technology in fishing over recent years and posted remarkable results in terms of catches and earnings. Modern technology has helped them improve their standard of living while also protecting national sovereignty at sea.

This is one of a few high-tech fishing vessels at Hon Ro Wharf in Nha Trang city, Khanh Hoa province. It cost over 20 billion VND and was put into operation in 2017. The vessel is fully equipped with LED lighting as well as high-tech digital equipment to ensure the safety of the fishermen onboard.

Khanh Hoa province has more than 700 offshore fishing vessels, 550 of which visit the Truong Sa and Hoang Sa archipelagos and DK1 rigs regularly to catch tuna. Local fishing vessels have been upgraded in recent years and are now equipped with high-tech equipment to improve efficiency and save money on each trip.

With fishing vessels upgraded, the province has also focused on improving processing facilities as catches rise. It currently has two wharves for high-capacity tuna fishing, 11 facilities building ships, and 20 facilities providing the necessary equipment.

A huge number of vessels catching 97,000 tonnes of seafood each year has enabled Khanh Hoa’s fisheries industry to boom in recent times. This is a major opportunity for the province to develop links, from fishing to processing and selling finished products./.

Young people kicking off profitable agriculture start-ups

With a number of initiatives on how to develop the local economy, many young people have returned to northern Bac Ninh province to enrich the land and improve livelihoods.

Back in 2013, Tran Van Truong had graduated and was working a 9-to-5 job but was unsatisfied with the salary. He decided to return to his homeland, in Bac Ninh province, to begin an agricultural start-up on 2 ha of family land and with a loan from the Bac Ninh Youth Startup support initiative. Several years later, his start-up posts annual profits in the hundreds of millions of dong.

Pham Van Son is another example of a young person daring to venture into start-ups. Having left a high-paying job as an IT engineer, he returned home to experiment with hydroponic vegetable cultivation, but success was hard to come by. After learning from his mistakes and acquiring more knowledge, in 2018 he decided to again experiment with clean agriculture products utilising high technology.

Over the last three years, Bac Ninh province has supported 81 start-up projects with total loans of up to 60 billion VND. Thanks to this timely support, its start-up scene has a vibrant outlook./.

Vietnam Support Industry Show 2020 to be held online

The Vietnam Support Industry Show 2020 and the METALEX Vietnam 2020 will be held online from October 23-24 to connect Vietnamese and Japanese firms in the support industry in the new normal situation.

Participating firms will have a chance to meet Japanese partners that want to seek suppliers in Vietnam, join a symposium and enjoy technological performance.

Le Thanh Phong, head of the investment promotion office of the Investment and Trade Promotion Centre (ITPC) of Ho Chi Minh City, said the event holds significance for firms operating in the manufacturing and support industries, enabling them to access the latest modern equipment and improve product value.

Hirai Shinji, Chief Representative of the Japan External Trade Organisation (JETRO) in HCM City, described Vietnam as the second attractive destination for Japanese companies which are operating in foreign countries and planning to expand operation. A number of Japanese firms also plan to shift their operations to Vietnam, he said.

He said via the event, Vietnamese firms will have a chance to join the global supply chain more deeply./.

Nearly 330 million USD mobilised via latest G-bond auction

Some 7.646 trillion VND (329.8 million USD) was mobilised for the State Treasury through a Government bond auction at the Hanoi Stock Exchange (HNX) on October 7.

The Treasury offered 9 trillion VND worth of G-bonds, including 5 trillion VND worth of 15-year bonds, 2 trillion VND of 20-year bonds, and another 2 trillion VND of 30-year bonds.

It raised 5 trillion VND worth of 15-year bonds with an annual yield rate of 2.66 percent, down 0.3 percent from the previous auction on September 30.

A total of 2 trillion VND was mobilised from 20-year bonds with an annual interest rate of 3.02 percent, down 0.24 percent from the September 30 auction.

Bonds with 30-year maturity raised 646 billion VND with an annual interest rate of 3.25 percent, down 0.23 percent compared to the previous auction.

So far this year, the State Treasury has collected over 236.34 trillion VND from G-bond auctions at the HNX./.

Profitable cold water fish farming model in mountainous areas

Nam Ty commune in Hoang Su Phi district, northern mountainous Ha Giang province, has been experimenting with cold water fish farming and the model has brought about high economic value.

Xin Van Vu’s household in Tan Minh village was one of the early pioneers. Starting in 2013 with just over a thousand fingerlings, six years later he has 5000 fish. He is now farming salmon as well.

Nam Ty commune is an under-developed area of Hoang Su Phi district due to its geography. It boasts suitable weather conditions, however, for both agriculture and fish farming, such as cool weather and abundant water resources. Many households have begun to farm fish varieties with high economic value, such as sturgeon and salmon.

Duc has also set an example by becoming involved in fish farming himself.

Local authorities in Nam Ty commune have been proactive over recent years in raising awareness among local people about the new economic model, which has been instrumental in cutting the ratio of poor local households from 11.67% in 2017 to 6.7% in 2019./.

Bac Lieu completes new-style rural building plan for ten years

All 49 communes of Bac Lieu have got the new-style rural area status, making the province the second locality in the Mekong Delta region to have 100 percent of communes recognised.

The information was released at a conference held on October 7 to review the province’s new-style rural building work over the past decade (2011 – 2020).

As heard at the event, investment was focused on rural infrastructure construction as well as development of culture, health, education, and human resources training.

As a result, by the end of 2020, it is estimated that the rate of poor households will be under 1 percent and per capita income will exceed 58 million VND (2,500 USD). More than 71 percent and over 99 percent of local households are expected to have access to clean water and electricity, respectively.

To date, Bac Lieu also has eight communes fulfilling the advanced new-style rural criteria, while all 67 local hamlets have been accredited as model new-style rural areas. Phuoc Long district was recognised as meeting the new-style rural standard in 2017.

Duong Thanh Trung, Chairman of the provincial People’s Committee, attributed the outcomes to concerted efforts by the political system and people, with residents donating dozens of thousands of square metres of land as well as thousands of workdays for the mission.

The function also revealed a number of the province’s shortcomings during the period in terms of transport, and cultural and educational infrastructure.

Bac Lieu has set a goal of having five out of seven districts satisfying the advanced criteria as well as 15 out of 49 communes meeting the model criteria by 2025. Phuoc Long district and Bac Lieu city, meanwhile, are expected to become model new-style rural areas./.

Vietnam adopts good policy in ensuring long-term growth: Australian scholar

Vietnam has adopted a good policy amid the COVID-19 pandemic, which is also crucial in ensuring the country’s long-term economic growth, said an Australian scholar.

Suiwah Leung, Honorary Associate Professor of Economics at the Crawford School of Public Policy under the Australian National University, made the remark in his recent article posted on the East Asia Forum.

In his article named “Vietnam’s economy weathers the COVID-19 storm - good policy or luck?”, Suiwah Leung said that “Vietnam’s economy and people are often described as ‘resilient’. Nowhere is this more befitting than in relation to the COVID-19 pandemic.

After successfully tackling the pandemic, the country still recorded 1.8 percent GDP growth during the first half of 2020 despite negative figures in most parts of the world.

He cited the World Bank’s July 2020 Taking Stock report as saying that Vietnam’s recent economic performance is a result of its twin engines of growth: export demand and domestic consumption.

According to this report, from January to mid-April, Vietnam’s exports recorded a 13 percent per month increase before its trading partners, such as the United States, Japan and China, began contracting. During this period, domestic consumption was subdued because of strict social distancing and lockdowns. Then from mid-April to the end of June, the domestic economy was in recovery mode with manufacturing growing at 30 percent while merchandise exports collapsed, he wrote.

He added that the World Bank forecasts an annual growth rate of 2.8–3 percent for Vietnam in 2020, and a return to pre-crisis growth of 6.8 percent in 2021.

This forecast is subject to the Government actively using fiscal policy to support growth in the very short-term, and the economy continuing to benefit from the trade and investment diversion in the medium term through participation in regional free trade agreements like the EU–Vietnam Free Trade Agreement concluded in June 2020, the author said.

One of the immediate measures to support growth is to ease mobility restrictions given tourism contributes around 10 percent to GDP growth. Other fiscal measures include ramping up spending on the approved public investment programme, in particular spending on Official Development Assistance (ODA) projects in the pipeline. Strategic support from the private sector, such as investment in the country’s digital infrastructure, is also being implemented.

In mid-August, the Ministry of Information and Communications announced the launch of the akaChain blockchain platform, which helps companies shorten the time spent on tasks like electronic Know Your Customer procedures, credit scoring and customer loyalty programmes. Improved security and transparency are also possible in future developments of this technology. In a country with a relatively young demographic, remote teaching and learning, as well as telemedicine, are advancements that have been given impetus by COVID-19, he said.

“While there might have been an element of luck in the short-term trade and investment diversion as well as in timing for handling the pandemic, good policy has generally been adopted and will continue to be crucial in ensuring Vietnam’s long-term economic growth,” Saiwah Leung concluded./.

Car wash operator raises 1.7 million USD from RoK firm

Vietwash, which runs a chain of car washes in Vietnam, recently announced it had raised 1.7 million USD for its current round of financing from the Republic of Korea’s energy company GS Caltex.

It said the money would enable it to further strengthen its position as a leader in the automotive services industry in Vietnam and improve the customer experience.

The company plans to expand to have more than 100 facilities in HCM City and other cities in the next few years, it said.

It will invest in training staff, upgrade waiting areas and acquire advanced car wash technologies.

GS Caltex, along with autoOasis, its auto maintenance franchise, plans like to create opportunity in auto maintenance services and help VietWash expand its services to car maintenance using Korean technology and know-how.

Lai Anh Vu, operations director of Vietwash, said: “We are honoured to welcome GS Caltex, a leader in the energy industry to join our roster of strategic investors and partners.

“After five years in the local market, Vietwash has established its credibility and remains the leading choice for Vietnamese customers when it comes to car services. This is timely to capture the local market’s automotive growth.”

The automotive industry is booming with car sales by unit growing at a compounded annual rate of 17.2 percent over the last seven years, thanks to rising incomes and improving road infrastructure.

The automotive maintenance market is expected to be worth $1.3 billion this year, but it is highly fragmented with authorised dealerships and individual players.

Vietwash, founded in 2014, is the country’s leading car wash operator with over 50 facilities./.

Vietnam’s biggest event for innovative startups slated for next month

The national festival for innovative startups, Techfest Vietnam 2020, will take place at the National Economics University in Hanoi from November 27-29.

The annual festival, the biggest of its kind, is jointly organised by the Ministry of Science and Technology, and other ministries, sectors, localities and socio-political organisations.

Themed "Adaptation - Transformation - Breakthrough", Techfest Vietnam 2020 will be structured into 12 technology villages that are expected to have at least 250 booths from potential startups and attract nearly 300 local and international investors, 150 corporations, enterprises and startup supporting organisations to attend both virtually and physically.

Notably, social impacts on innovative startups’ solutions and business models will be clearly presented in the Social Impact Technology Village, which will be coordinated by the United Nations Development Programme in Vietnam (UNDP Vietnam).

This year, the Ministry of Science and Technology will also coordinate with partners to organise a High-Level Policy Dialogue, in which the Government leaders will hold a discussion with the innovative startup community on how to solve difficulties in conducting business and create a favourable environment for the growth of startups./.

Vietnamese, UK firms look to bilateral FTA post-Brexit

An online dialogue on policies and markets held on October 6 offered Vietnamese and UK enterprises an insight into the opportunities and challenges in trade and investment ties between the two nations following the UK’s withdrawal from the EU.

Vietnamese Ambassador to the UK Tran Ngoc An told the gathering that not only are UK firms interested in the Vietnamese market but Vietnamese firms are also keen on boosting exports to the UK, primarily electronics, farm produce, and aquatic products.

Vietnamese exporters now enjoy benefits under the Generalised System of Preferences and the EU-Vietnam Free Trade Agreement (EVFTA). Post-Brexit incentives starting from December 31, 2020, however, depend on the outcomes of negotiations over an FTA between Vietnam and the UK.

The EVFTA, which took effect on August 1, applies to trade between Vietnam and the UK to later this year, when the UK ends the Brexit transition period.

The Vietnamese and UK Governments want to have an FTA next year with low or zero taxes on almost all goods, he said.

Commenting on the prospects for Vietnam-UK trade, Vietnamese Commercial Counsellor in the UK Nguyen Canh Cuong said that, in the last three years, Vietnam has annually earned nearly 6 billion USD from the UK while spending nearly the same on imports.

There remains huge room to move for Vietnamese goods in the UK, as they account for just 1 percent of the UK’s total imports of around 700 billion USD.

The prospects for bilateral trade ties, he said, rely on Vietnamese firms’ competitiveness and the two Governments’ efforts to reach a bilateral FTA on the basis of the EVFTA.

If a bilateral FTA is reached, Vietnamese goods would gain a competitive edge over those from China, India, Thailand, Malaysia, Indonesia, the Philippines, and Myanmar, which are less likely to sign a deal with the UK in the immediate future. Moreover, not many UK goods compete directly with equivalents made in Vietnam.

Instead of inheriting the EU-Vietnam Investment Protection Agreement, the UK wants to continue with the Vietnam - UK Investment Protection Agreement 2020, which will last until August 2022.

Without an FTA post-Brexit, Vietnam-EU trade ties will be adjusted in accordance with multilateral commitments in the WTO. Vietnamese exports to the UK will decline due to competition with 32 countries and economic alliances having FTAs with the UK.

Vietnam’s exports to the UK fell nearly 20 percent in the first half year-on-year but rose 14 percent month-on-month in August thanks to the EVFTA’s tax preferences.

Cuong said Vietnamese shipments to the UK are forecast to continue recovering between now and the end of the year. The two countries’ firms expect a bilateral FTA will be reached./.

Bac Ninh posts 6.8 pct. growth in nine-month exports

Bac Ninh province, a major investment magnet and industrial hub in the north of Vietnam, earned 26.13 billion USD from exports in the first nine months of 2020, up 6.8 percent year-on-year.

Exports by FDI firms made up 99 percent of the total and rose 6.4 percent, while those by private businesses surged 2.3-fold, according to the province’s Statistics Office.

Key exports posting high growth year-on-year included plastic products (53.5 percent), textile-garment materials (35.7 percent), and computers and components (80 percent).

Main export destinations were East Asia (32.1 percent of the total value), the US (13.6 percent), Western Europe (4.3 percent), and Eastern Europe (4.2 percent).

Meanwhile, Bac Ninh imported some 22.64 billion USD worth of goods during the period, an increase of 9.1 percent year-on-year. Imports by the FDI sector rose 8.2 percent and by private enterprises 75.4 percent.

Textile-garment materials, electronic components, and paper were among the major items purchased from abroad to serve local production, data shows.

The Statistics Office attributed the high import growth to the Republic of Korea’s Samsung SEV and Samsung SDV boosting the importation of components and materials to produce the new Samsung Galaxy Note 20, R180 Galaxy Buds, and accessories./.

Can Tho’s Q4 GRDP growth forecast at 2.91 percent

Gross regional domestic product (GRDP) growth in the Mekong Delta city of Can Tho in the fourth quarter of this year has been forecast at 2.91 percent, according to the Director of the municipal Department of Statistics, Le Ngoc Bay.

The agro-forestry-fisheries sector is likely to post growth of 1.83 percent, while the industry - construction and service sectors are thought to rise 3.34 and 2.97 percent, respectively.

The city’s economic growth is to increase 2.2 percent for the year as a whole, Bay said.

He noted that municipal authorities have paid due regard to promoting investment attraction, especially FDI, accelerating the disbursement of public investment, removing difficulties facing business and production sectors, and developing tourism into a spearhead economic industry in the time to come.

It has also focused on developing infrastructure networks, especially those serving logistics for processing farm produce for export.

Domestic demand stimulus programmes have been introduced, while culture, sports, and tourism activities will be held over the remaining months of the year to further promote consumption and create new value for the service sector.

The department reported that the city’s economy grew 2.49 percent in the third quarter, resulting in growth of 1.98 percent in the first nine months of 2020./.

Singapore an important market for SMEs to reach out to the world: Insiders

Promoting exports to Singapore, which has open trade mechanisms and high-quality services, is viewed as a shortcut for Vietnamese small and medium-sized enterprises (SMEs) to send their products out to the world, according to industry insiders.

At a conference held by the Ho Chi Minh City Investment and Trade Promotion Centre (ITPC) on October 7, centre deputy director Tran Phu Lu said Singapore plays an important role in Southeast Asia’s economy thanks to its strategic location and high-quality human resources.

As the 37th-largest economy in the world, its per capita income stood at 59,590 USD in 2019, he said, adding that as its domestic consumption relies a great deal on imports, Vietnamese SMEs could penetrate into the market, especially in the context of formidable challenges posed by COVID-19.

Vice President of the Vietnamese Chamber of Commerce Ltd (Vietcham) Singapore, Phan Phi Long, said that besides traditional distribution channels like FairPrice, 7Eleven, ShengSiong, Giant, Ang Mo Supermarket, and Market Place, Singapore also has a well-developed e-commerce space favoured by young people and high-income households.

Some 60 percent of its e-commerce revenue is from outbound orders. Along with Amazon, eBay, and Apple, other sites in the country such as Taobao, Qoo10, Lazada, Zalora, Carousell, Redmart, Reebonz, HipVan, and Alibaba have also posted impressive earnings.

In this context, Vietnamese companies could access these e-commerce platforms to sell products in Singapore and elsewhere at a lower cost compared to traditional distribution channels, Long said.

Meanwhile, Vietcham Singapore Vice President Phillip Phung highlighted the fact that over 99 percent of imports to Singapore enjoy tax exemptions (excluding cars, petrol and oil, alcohol and tobacco) and the country has excellent ports and logistics services.

Figures from the International Trade Centre show that Singaporean ports handle around 91,000 containers each day, with 5 percent of commodities consumed in-country and 95 percent shipped to other countries.

Phung said the Singaporean market could serve as an effective bridge introducing or expanding Vietnamese exports to larger markets.

Experts have recommended that Vietnamese SMEs pay due regard to improving product quality, ensure products are produced in line with international standards, and acquire product quality certificates such as HACCP or Halal, in order to successfully do business in the island state./.

RoK refiner acquire stake in Vietnamese startup VI Automotive Service

GS Caltex Corp, the second largest refiner by sales in the Republic of Korea, said on October 7 that it has signed a deal worth 39 billion VND (1.6 million USD) with Vietnamese startup VI Automotive Service in its first investment in the Southeast Asian country.

Under the deal reached during a videoconference on October 6, GS Caltex is set to acquire a 16.7 percent stake in the VI Automotive Service as soon as administrative procedures are wrapped up in Vietnam.

VietWash, a subsidiary of VI Automotive Service, operates about 50 car washes in Vietnam.

GS Caltex also said it plans to sell lubricant products in Vietnam.

GS Caltex is a 50:50 joint venture between GS Energy and Chevron Corp, the second-largest US oil producer./.

|

||

|

|

RoK firm invests in coal-fired power project in Vietnam

The board of the Korea Electric Power Corporation (KEPCO) of the Republic of Korea (RoK) endorsed investment in a project involving Korean and Japanese companies to build a coal-fired power plant in Vietnam, according to AJU, a RoK business newspaper.

KEPCO has set to complete the construction in January 2025.

KEPCO said its board has approved the planned purchase of a 40 percent stake in the construction of a 1,200-MW coal-fired power plant called Vung Ang 2 in the central province of Ha Tinh.

Samsung C&T, a key unit of Samsung Group, and Doosan Heavy Industries & Construction of the RoK will participate in design, procurement and construction operators.

Originally, the project worth 2.2 billion USD had involved Japan's Mitsubishi and CLP, an electric company based in Hong Kong. As CLP withdrew its participation from the project, KEPCO decided to buy a 40-percent stake held by CLP.

AJU said the annual growth rate of electricity demand in Vietnam has been faster than in other Southeast Asian countries. Electricity from fossil fuels still plays a key role in Vietnam's total power capacity.

KEPCO, which has invested in a coal-fired power station project in Indonesia, said it would use new technologies to minimise carbon emissions and install additional eco-friendly facilities for the Vung Ang 2 power plant./.

Industrial real estate expected to be a highlight this year and in 2021

Industrial real estate will be a highlight this year and next, despite the sector as a whole struggling with the impact of COVID-19, according to Nguyen Quoc Anh, Deputy Director General of Batdongsan.com.vn, the leading property website in Vietnam.

Industrial properties around the country have become more attractive to foreign investors thanks to the new EU-Vietnam Free Trade Agreement (EVFTA), shifts in global manufacturing bases, and its effective control of the coronavirus, Anh said at the release of a market report for the third quarter on October 6 in Hanoi.

Batdongsan.com.vn’s Q3 market report shows that industrial real estate enjoyed impressive growth during the period, while COVID-19 continued to cast a long shadow over other sub-sectors.

Data from the Ministry of Planning and Investment reveals that 336 industrial parks (IPs) were established in the first half of this year, 261 of which have been put into operation, on an area of 29,100 ha.

Searches for IPs were on the rise from June to September, according to the report. Compared to the same period last year, searches for Vietnam-Singapore Industrial Park (VSIP) Bac Ninh rose 22 percent, Tan Binh IP 20 percent, Hiep Phuoc IP 23 percent, and Tan Tao IP 37 percent.

Prices of land lots near IPs in Bac Ninh’s Tu Son and Yen Phong districts rose 1 percent quarter-on-quarter, while those in Binh Duong’s Di An and Thuan An districts also grew considerably.

The COVID-19 resurgence in late July and early August landed a punch on the chin of the real estate market. This was followed by the seventh month of the lunar calendar, known as the “Ghost Month” and during which people around the country avoid making big decisions like home purchases.

However, a survey conducted by the site indicates that real estate remains the leading investment channel. Even when the gold price hit a record high, 57 percent of the site’s users still leaned towards real estate as their choice of investment. And some 58 percent of respondents said they would still purchase properties during the Ghost Month, Anh said.

Condos remain the most popular choice, accounting for 29 percent of searches on the site, followed by land lots (23 percent). Some 64 percent of respondents said they would rather buy a condo than a house down a small laneway.

The site forecast that real estate prices would pick up by about 1.4 percent in Hanoi and fall by some 2 percent in HCM City in the final quarter of the year./.

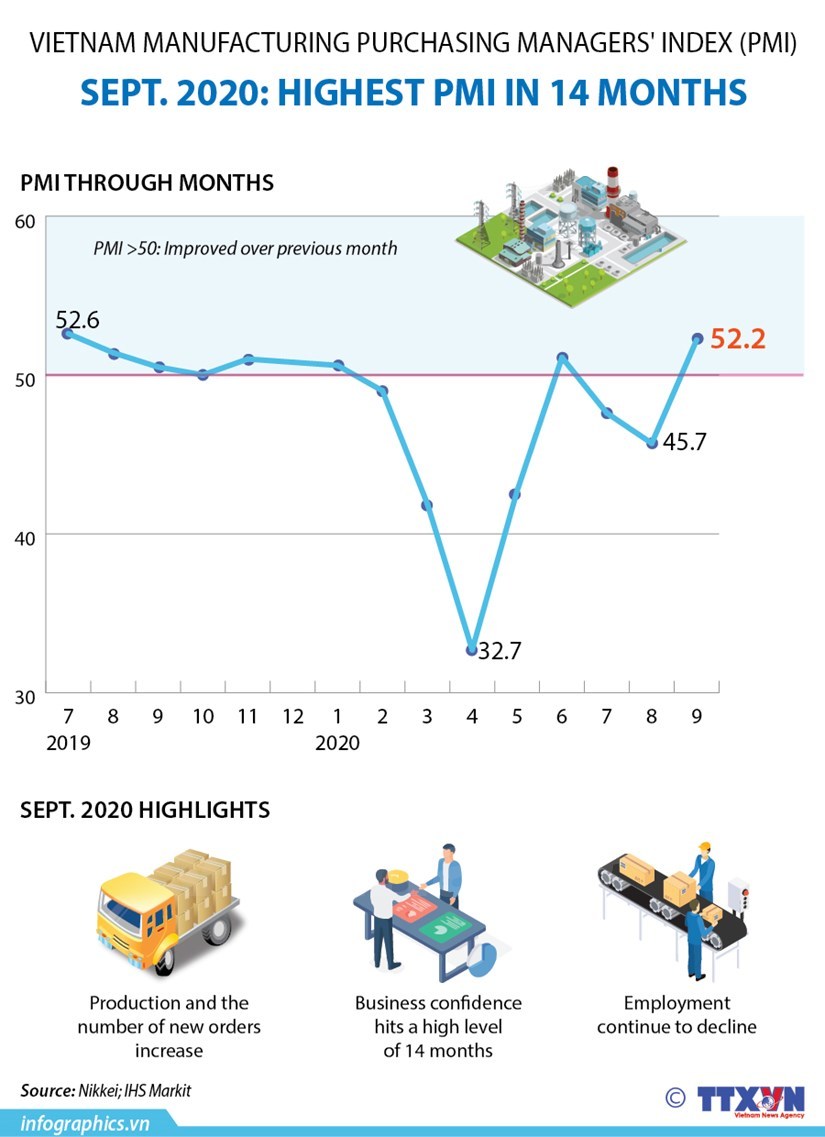

Local manufacturing industry enjoys solid growth in September

Manufacturing sector returned to growth in September as concerns around the outbreak of the COVID-19 pandemic in the country eased. Both output and new orders increased, while business confidence strengthened, and the rate of job cuts softened.

According to a monthly survey by Nikkei and IHS Markit, the Vietnam Manufacturing Purchasing Index (PMI) rose back above the 50.0 no-change mark in September, posting 52.2 from 45.7 in August. That pointed to the first improvement in business conditions for three months, and the most marked since July 2019.

Control over the COVID-19 pandemic was a key factor helping to support improvements in operating conditions, after increasing case numbers had been seen in the previous survey period.

Reduced case numbers contributed to stronger client demand, leading to a solid increase in new orders. New business from abroad also increased in September, the first time this has been the case since January.

Solid expansion in production was also registered, helped by higher new orders. In fact, the rise in output was the sharpest in 14 months.

Business confidence also improved at the end of the third quarter of the year, rising sharply from August to the highest since July 2019. Projected growth of new orders is expected to lead to increases in output over the coming year, but a number of firms mentioned that positive expectations were based on assumptions that the pandemic will remain under control in the country.

Rising new orders encouraged manufacturers to expand their purchasing activity for the first time in three months, and at a solid pace. This increase in purchasing contributed to a renewed accumulation of pre-production inventories. Some panelists reported efforts to build reserves.

The rate of input cost inflation quickened to a 22-month high and was broadly in line with the series average. Panelists often linked higher input prices to supply shortages for raw materials. This was also a factor behind a lengthening of suppliers' delivery times.

In response to higher input costs, firms raised their selling prices for the first time in eight months. The rate of inflation was only slight, however, amid ongoing competitive pressures.

Commenting on the latest survey results, Andrew Harker, Economics Director at IHS Markit, said: “After a rise in COVID-19 cases in late-July and early August briefly threw the sector's recovery off track in August, the September PMI results were much more positive.

"With control of the pandemic regained, firms saw an influx of new orders, ramped up production and were at their most optimistic for over a year. As ever though, sustaining these positive trends is dependent on virus cases not picking up again."

One new development in the latest survey was a return to growth of new export orders for the first time since the pandemic began, a welcome signal that international demand is becoming more supportive of the sector's recovery, he said.

In a monthly report on the industry and trade sector in the first nine months of this year, the Ministry of Industry and Trade (MoIT) said that the domestic industrial production had prospered in September and is expected to grow again in the last months of the year because the pandemic is basically under control.

According to its statistics, the index of industrial production (IIP) of Vietnam in September increased by 2.3 percent against August and by 3.8 percent over the same period last year.

The IIP in the first nine months of 2020 rose by 2.4 percent over the same period last year. This rate was lower than the growth rate of 9.6 percent in the first nine months of 2019.

The ministry said this was the lowest growth rate in many years.

The industry saw a reduction or low growth rates in IIP of some key industrial products during the first nine months. Of which, the index decreased by 16.7 percent for the liquefied gas (LPG); 14.6 percent for beer; 13.7 percent for crude oil exploitation; 11.8 percent for cars; and 9.1 percent for natural gas.

However, there were also a number of industries with a high growth rate in IIP over the past nine months, creating a great contribution to the overall growth of the industry. They included metal ore mining (up by 14.8 percent); manufacturing electronic products, computers and optical products (up by 8.6 percent); and tobacco product production (up by 8.2 percent)./.

Indonesia improves investment climate for economic revival

Indonesia will continue to encourage improvement of the investment environment despite the COVID-19 pandemic to revive its economy that is on the brink of recession, said deputy head of Indonesia’s Investment Coordinating Board (BKPM) Nurul Ichwan said on October 6.

According to Ichwan, the Indonesian economy has not shown any positive signals so far, however, its government is still optimistic about the domestic economic growth.

In the context of a slowing economic growth, investment is expected to be the main driver to boost Indonesia's growth, he said.

Managing director of the Institute for Development of Economics and Finance (INDEF) Tauhid Ahmad said investment activities can actually be used as a measure to promote economic growth.

Facing the current situation, many companies have decided to no longer depend on production sources in China, and tended to redirect their investment./.

Samsung adds spark to Viet Nam’s electronic components industry

The success of Samsung in Viet Nam has lured a series of South Korean enterprises wishing to capitalise on rising demand for electronic components, an official said.

“This offers an opportunity for businesses of the two countries to form a sustainable value production chain in the electricity and electronic sector, especially mobile phone components sector,” said Le Huyen Nga, Head of Investment Promotion Department, under the Foreign Industry Agency, at a seminar late Wednesday in Ha Noi.

Viet Nam Trade Promotion Agency (VIETRADE) and South Korea Trade Investment Promotion Agency (KOTRA) co-organised the seminar, themed “Policy dialogue on Mobile Phone Components sector”.

VIETRADE said the event aimed at creating an in-depth dialogue channel to support South Korean investors who wish to investment in Viet Nam, creating an exchange and connecting platform for trade co-operation among businesses of both sides, greatly contributing to further promoting bilateral trade and investment relations between the two countries in the future.

“Viet Nam's fledgling electronics industry, including mobile phone components, has been flourishing in recent years,” Nga said.

By the end of August this year, exports of mobile phones and its components reached US$31.58 billion, down 5.4 per cent over the same period in 2019. That of computers and electronic components totaled $27.73 billion, up 25.3 per cent year-on-year.

“The localisation rate of the electrical home appliances industry in Viet Nam stays at a high level of 35 per cent. Some businesses can even make high-tech mobile phone components or finished-products such as Viettel and Vsmart,” Nga said.

“But the industry still reveals a certain number of deficiencies due to poor business competency, weak technological resources and limited self-supply capacity of domestic firms,” she said.

“Most high-tech electric components are produced by FDI enterprises while local firms can often only make simple details with low added-value,” she added.

To develop the mobile phone components industry, the Government has issued many policies to promote the development of the industry.

Due to the impact of COVID-19 pandemic, South Korean and Vietnamese enterprises have encountered many difficulties. However, South Korea still retained its position as Viet Nam’s leading source of foreign direct investment (FDI), said Lee Jong Seob, Director General of KOTRA.

As of August 20, the total registered investment capital of South Korean enterprises in Viet Nam reached $70.4 billion, accounting for 18.5 per cent of the total registered FDI capital poured into Viet Nam, he said.

Samsung Vietnam is a typical example of a success story of South Korean investors in Viet Nam. After 12 years since Samsung received the investment licence for a $670 million mobile phone factory in Viet Nam, the investment capital of the company has soared by 26 times to total $17.3 billion.

Samsung’s export turnover accounts for 20-25 per cent of total annual export turnover of Viet Nam. Billions of devices are shipped worldwide from six Samsung factories in Viet Nam, collecting export sales of $59 billion in 2019, he said.

Viet Nam is currently Samsung's largest overseas manufacturing base, and Samsung has become the largest FDI investor in the Southeast Asian country. Samsung employs more than 130,000 Vietnamese skilled workers, he said.

Currently, overall investment is slowing down worldwide, but many South Korean companies are considering investing in Viet Nam to diversify production facilities, said Lee Jong Seob.

Vu Ba Phu, VIETRADE Director, said over the past years, the agency had co-ordinated with KOTRA to organise many trade promotion activities between the two countries in order to research market needs as well as exchange experiences with investment partners.

At trade-investment promotion events held in South Korea, South Korean businesses expressed their interest in investing in Viet Nam, studying the market as well as capitalising on the production potential of Vietnamese enterprises, Phu told Viet Nam News.

Currently there are about 8,900 South Korean businesses investing in Viet Nam, employing over 1 million employees and contributing about 33 per cent of Viet Nam's total export value.

South Korean FDI has a spillover effect on many economic sectors in Viet Nam such as agriculture, tourism and services.

Singapore promising market for Vietnamese exports: seminar

Vietnamese enterprises should capitalise on Singapore’s status as an Asian hub and biggest market in the region to boost exports to it after the Covid-19 pandemic ends, a seminar heard in HCM City on Wednesday.

Tran Phu Lu, deputy director of the city Investment and Trade Promotion Centre (ITPC), told the seminar on exporting to Singapore organised by the centre that both countries are members of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership.

Singapore is connected to the world through 13 bilateral free trade agreements with key partners, of which 12 are already in effect.

“Singapore is a promising market for Vietnamese micro, small and medium enterprises to export to.”

Vietnamese exporters could also co-ordinate with Singaporean service companies to distribute their goods globally, he added.

Phung Nguyen Phong, regional director of the Viet Nam Chamber of Commerce (VietCham Singapore), said in recent years a number of Vietnamese businesses have turned their attention to the Singapore market due to its various advantages.

Well-known global companies are present in Singapore to take advantage of the country’s tax incentives, he said.

The country has a highly developed market economy based on a history of extensive shipping trade and is one of the “four economic tigers” of Asia along with Hong Kong, South Korea and Taiwan, he said.

Phan Phi Long, national director of the Viet Nam Chamber of Commerce (VietCham Singapore), said the 5.8 million residents of Singapore enjoy a high standard of living and its GDP per capita is among the highest in the world.

It ranks fourth globally and first in the region for protection of intellectual property according to the World Economic Forum’s Global Competitiveness Report, he said.

It also has one of the most attractive tax systems in the world for both businesses and individuals, he said.

To export to Singapore, micro, small and medium-sized enterprises need to improve their product quality, packaging and designs to international standards to meet the strict requirements there, he added.

Last year bilateral trade was worth nearly $7.29 billion, down 5.6 per cent from 2018, according to the General Department of Customs.

Viet Nam’s exports were worth nearly $3.2 billion, up 0.1 per cent while its imports fell 9.6 per cent to $4.02 billion.

According to the city Investment and Trade Promotion Centre, in 2019 Viet Nam was the 22nd largest exporter to Singapore, which was the 21st largest importer of Vietnamese goods.

Halal market

Kanthiban Rajasegran, director of Business Engineers Asia, said Singapore is among the countries whose Muslim populations have the highest purchasing power.

So as a market for halal food in Southeast Asia it is only behind Malaysia and Indonesia, he said.

As global supply chains for Halal products have been disrupted by the pandemic, Vietnamese companies could tap this market, he said.

Vietnamese businesses must first obtain Halal certification by meeting strict religious requirements and comply with food safety and hygiene standards before their products could be sold in the market, experts said.

Viet Nam also has an advantage in raw materials for halal products such as coffee, rice, seafood, spices, beans, and vegetables.

Of the 1.8 billion Muslims world-wide, one billion are in Asia.

Lu, deputy director of the ITPC, said 84 per cent of businesses in HCM City face challenges due to the impacts of the pandemic.

“Micro, small and medium-sized enterprises, which account for 97.2 per cent of all enterprises in Viet Nam, are most vulnerable to the impacts of the pandemic.

“The centre has implemented many programmes to support SMEs such as those, including both online and offline platforms, to connect suppliers and buyers in the country and elsewhere to help boost exports.”

Credit growth expected to accelerate in final quarter

The State Bank of Viet Nam (SBV) expects credit growth to expand significantly in the remaining months of this year as the country has successfully contained the COVID-19 pandemic and the economy was expected to return to a recovery path.

The central bank’s updates late last week showed credit had expanded 6.09 per cent in the first nine months of this year compared with the end of 2019.

The highest pace was recorded in services, at 6.32 per cent, followed by construction (5.89 per cent), and agro-forestry-fishery (5.09 per cent), according to the central bank.

Credit has boosted a number of industries that drive the national economy like the production and distribution of electricity, gas, hot water and air conditioners, water supply, waste and wastewater management and treatment; construction, wholesale and retail, and the maintenance of cars, motorbikes and other motor vehicles.

Amidst economic difficulties, the SBV pledged to fully meet the capital needs of the economy and create the best liquidity for commercial banks to cut interest rates to support their clients.

SBV Deputy Governor Dao Minh Tu said credit growth would reach 8-10 per cent this year if the COVID-19 pandemic was well controlled and export and production bounced back.

The central bank from the beginning of this month cut the benchmark interest rate to support the national economy amid the pandemic. Accordingly, the refinancing rate was cut to 4 per cent per annum from 4.5 per cent while the rediscount rate went down to 2.5 per cent from three per cent.

Cuts by 0.5 percentage points were also given to the overnight electronic interbank rate, rate of loans to offset the capital shortage in clearance between the SBV and credit institutions and rate of bids of valuable papers through open market operations.

This was the third rate cut from the beginning of this year.

A recent report by HSBC said that support in terms of monetary policies was necessary as the pandemic was putting deflation pressure on the economy.

Viet Nam’s success in containing the reoccurrence of the virus helped the economy to come back to the recovery path though at a slower-than-expected speed.

Viet Nam traveller survey 2020: Tourists eager to resume domestic travel

About 68 per cent of surveyed people in Viet Nam stated their intent to resume travelling by the last quarter of 2020, showing their eagerness to travel and confidence in the Government’s handling of the pandemic.

The traveller survey was conducted in the midst of Viet Nam’s second wave of the COVID-19 pandemic by Indochina Capital and Wink Hotels. The survey reveals the travel habits and preferences of travellers in Viet Nam, including health and safety-related factors that would influence their hotel accommodation decisions.

Conducted in mid-August, the survey totalled 700 participants from first-tier cities, of which 90 per cent were Vietnamese and 10 per cent were foreigners. Insights gained from the responses were drawn to aid hoteliers and hospitality players grasp the new domestic tourism landscape, as the Ministry of Culture, Sports and Tourism pushes forward domestic tourism stimulus programmes and travel and hospitality companies gear up to launch new campaigns.

A silver lining amid the COVID-19 pandemic is the fact that Viet Nam travellers are as keen to travel as they were pre-pandemic – domestic travel grew from 57 million to 90 million from 2015 to 2019 and previous surveys have shown that Vietnamese customers are increasingly willing to spend more on holidays. Indochina Capital and Wink Hotels’ latest survey reinforces this trend as 99.7 per cent of respondents confirmed they travel at least once a year domestically for leisure purposes, while 83.7 per cent stated they travel at least twice a year.

“Tourism and real estate are bound to be major building blocks for economic recovery. As Viet Nam travellers are already planning their next domestic trip, the economy is going to rely on consumers to return to their pre-COVID-19 spending levels, which should be enabled by travel. With borders slowly and carefully being reopened, the domestic market will be the main driver for economic recovery. The impressive handling of COVID-19 has pushed Viet Nam’s position forward as a promising investment destination, and with this survey, we want to highlight elements which will help hoteliers and tourism-focused real estate owners enhance their financial returns,” said Michael Piro, COO, Indochina Capital and CEO, Wink Hotels.

The survey highlights the dominance of online channels for brand touchpoint and accommodation booking as 64 per cent of travellers will use online travel agencies to conduct their bookings and 91 per cent rely on digital advertisements for their hotel browsing.

The survey also underlines Viet Nam travellers’ preference for short leisure trips of less than four nights, with the majority of business trips lasting no more than two nights. On pricing strategies, just a quarter of respondents were willing to spend above VND2 million per night on personal trips, and they spend even less on business trips.

Other information in the survey includes who Viet Nam tourists travel with group travel, family travel or solo travellers, their preferred mode of transport, attractive features for a hotel/accommodation advertisement, decision-making factors when choosing accommodation and assessing the quality of a hotel stay.

The survey can be downloaded at Indochina Capital’s website indochinacapital.com.

Source: VNA/VNN/VNS/VIR/VOV/SGT/NDO/Dtinews