The Vietnam Association of Foreign Invested Enterprises (VAFIEs) has shown its concern over the government’s intention to set a limit on foreign ownership ratio in fintechs.

The draft of the decree to replace Decree No 101/2012 says that the ownership ratio must not be higher than 30 percent.

The allowed foreign ownership ratio in payment firms still has not been set by SBV.

The capital ratios being held by foreign investors in some institutions licensed by SBV to provide intermediary payment services are higher than 51 percent.

|

To prevent manipulation by foreign investors and protect national sovereignty in the banking and finance sector, it is necessary to set the capital contribution level foreign investors can make. |

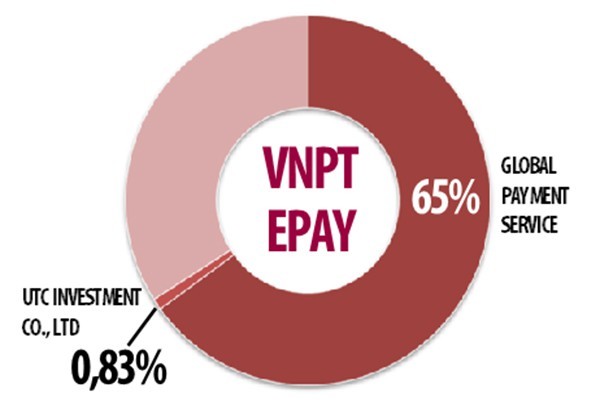

In VNPT EPAY, for example, 65 percent of capital belongs to two South Korean investors – Global Payment Service (64.99 percent), and UTC Investment (0.83 percent). Meanwhile, 90 percent of 1Pay is being held by True Money.

SBV stated that it plans to tighten control over the foreign ownership ratio in fintechs, a conditional business field. It also believes that setting a limit on foreign ownership ratio will help create fairer competition between Vietnamese and foreign companies.

An SBV official said fintechs operate in a conditional business field, which affects the stability and safety of the monetary policies of the nation. To prevent manipulation by foreign investors and protect national sovereignty in the banking and finance sector, it is necessary to set the capital contribution level foreign investors can make.

He said that it was normal to set foreign ownership ratio limit in fintechs. Other conditional business fields also have their limits. In Vietnam’s commercial banks, for example, the foreign ownership ratio must not be higher than 30 percent.

Meanwhile, the limit is 49 percent for non-bank credit institutions which operate in accordance with regulations on public companies.

In general, in the first phase of development, payment intermediaries, mostly fintech startups, only have ideas and technology, and lack capital to develop the ideas.

Therefore, governments do not need to restrict the sale of shares to foreign investors, so as to encourage foreign investors to bring money, technology, and corporate governance skills, thus helping markets develop.

However, when the intermediary payment market develops and reaches a certain scale, which may affect national security and banks’ operation, watchdog agencies will find it necessary to set up a suitable legal framework with limitations on foreign ownership ratio. This will better control the market.

However, strict control may result in foreign investors losing their motivation to join the Vietnamese market. If so, the capital flow to the Vietnamese market will decrease.

Mai Chi

In Vietnam, e-wallet is hottest segment in fintech field

Vietnam’s fintech includes payment solutions, blockchain, big data management, personal finance and group mobilization, of which payment solutions are the fastest growing segment.

Foreign investors to reset Vietnam’s fintech market

The number of fintech companies have increased rapidly in Vietnam in recent years as the industry has high growth potential while the government encourages cashless transactions.

Policymakers believe that the limitation on the foreign ownership ratio in Vietnam’s fintechs would help ensure transparency in payment activities, thus facilitating the development of companies.

Policymakers believe that the limitation on the foreign ownership ratio in Vietnam’s fintechs would help ensure transparency in payment activities, thus facilitating the development of companies.