|

|

|

The Hanoi city government has requested its subordinate agencies to implement a range of measures to boost labor productivity.

A new foreign direct investment (FDI) attraction strategy for the 2021 – 2030 period is among a number of measures pushed forward by Hanoi’s authorities to boost productivity.

The municipal Department of Planning and Investment, the agency in charge of drafting this strategy, is tasked with cooperating with the Ministry of Planning and Investment in initiating the campaign “National productivity” and a national strategy for the development of information technology firms; encouraging private enterprises to expand operations to regional and global markets; working with the Hanoi Institute for Socio-Economic Development Studies in promoting a sharing economy model.

The Hanoi People’s Committee has directed the municipal Department of Industry and Trade to work with the Ministry of Industry and Trade in finalizing a legal framework for e-commerce; focusing on high-added value and sophisticated products; helping firms further integrate in global value chains, particularly those in the manufacturing and processing sector.

The Department of Industry and Trade would continue to contribute to the nationwide ongoing efforts to restructure the industry sector in the 2018 – 2020, with a vision to 2025.

The Department of Agriculture and Rural Development is responsible for setting up restructuring plans for the sector in the 2021 – 2025 period, with a vision to 2030, aiming to industrialize agricultural production, manufacturing and distribution processes.

The local government also asks the Department of Labor, Invalids and Social Affairs to improve efficiency during labor training, so that the workforce is equipped with required skills and capable of taking part in smart production using high technologies.

The Department of Education and Training is tasked with finalizing policies to ensure the development of private educational facilities in line with global trends, placing an emphasis on priority sectors with high impacts on Hanoi’s socio-economic development.

The Department of Information and Communication is urged to facilitate the progress of the proposal for “Establishing of Hanoi smart city until 2025, with vision to 2030” and Hanoi’s e-government.

The city considers digital transformation key to boost labor productivity and socio-economic development. To ensure the target is met, Hanoi expects the business community, government agencies and citizens to actively participart in the process.

The Department of Finance is requested to speed up the privatization and divestment processes at state-owned enterprises under the instruction of the government.

The State Bank of Vietnam – Hanoi branch must ensure provision of sufficient capital for production and business activities, especially those in priority fields.

Last but not least, local authorities at district, ward and commune levels are asked to continue accelerating administrative reform and business environment improvement, a move considered essential to create favorable conditions for enterprises to expand operations.

With the local government's tireless efforts to ease doing business, Hanoi attracted US7.5 billion in FDI commitments in 2018 and US$8.45 billion in 2019, taking the lead among localities in Vietnam. In the first four months this year, foreign investors registered to pour US982 million in the city.

NA deputies want to keep household businesses out of enterprises law

The concept of household business should not be a part of the revised Law on Enterprises and should be regulated by a separate law, National Assembly (NA) deputies said on Thursday.

According to deputies, household business is a different form of business so it is not suitable to make those businesses comply with the Law on Enterprises.

Household business is regulated in Chapter 7a of the revised Law on Enterprises. If the revised law is passed by deputies, it would only solve problems with the State management of household businesses.

The revised law may increase risks and costs for household businesses and there are no rules that help improve the freedom, environment and security for household businesses and protect their rights and benefits.

According to the Vietnam Small- and Medium-Sized Enterprises Association, there are now 5.5 million household businesses. Their total assets are worth VND655 trillion (US$28.17 billion), total revenue is estimated at VND2.2 quadrillion and tax payments are worth VND12.36 trillion. Such businesses employ nearly 7.95 million people.

It may take lawmakers some time to assess the impact of the law on household businesses before legalising this form of business because there are still many problems with defining a household business.

Nguyen Dinh Tue, Director of Small- and Medium-sized Enterprise Support Centre at the HCM City Enterprises Association, said the concept of household business should be studied more.

State agencies license individuals, not their households, he said, adding the lawmakers should know whether an individual or their household is held accountable to the law.

Duong Minh Tuan, a delegate from Ba Ria-Vung Tau Province, said as a separate form of business, household businesses must be bound to a law instead of a decree – which is a sub-regulation of a law.

Issuing a new law on household businesses would help the Government improve the management of the business form while increasing the quality of those businesses, he said.

The scale and operation of a household business are very different from a normal company, deputy Tran Van Tien from Vinh Phuc Province said.

If the policymaking process is not appropriate, millions of household businesses will be hurt and a new law will be needed to supervise them, he said.

According to Minister of Planning and Industry Nguyen Chi Dung, legalising the role of household businesses in the revised law will help the community gain benefits and access support programmes.

Household business, when regulated in the revised Law on Enterprises, will see barriers and administrative procedures cut and the private sector will develop, he said.

“The law will encourage households to develop into private companies if they are capable,” the minister said.

Under existing regulations, a household business can only employ a maximum of 10 workers. However, some have recruited hundreds of workers and recorded huge amounts of revenue without being taxed like a normal enterprise.

“That leads to the Government missing a huge source of income for the State budget,” minister Dung said.

Covid-19 - catalyst for Vietnam to reap benefits from global digital economy

Covid-19 showed the urgency for governments to go digital, and fast with their public services, said a World Bank executive.

The Covid-19 pandemic is no doubt a catalyst for both the Vietnamese government and business community to rebound, transform, and get the most dividends of the global fast-moving digital economy, according to Ousmane Dione, the World Bank’s country director for Vietnam.

“Vietnam’s success in containing the Covid-19 has been recognized globally. But if there is one thing that needs highlighting as a lesson learnt, it is the need for governments to go digital, and fast with their public services,” Dione said at an online conference introducing the national e-service portal on May 19.

The value of the national e-service portal has been proved during the Covid-19 pandemic, Dione added.

According to Dione, while physical and social distancing orders were in place to contain the pandemic, service users and government employees were able to access and provide essential public services remotely, for the safety of all parties involved.

Dione referred to a statement of Minister - Chairman of the Government Office Mai Tien Dung that after five months since the launch of the portal, there have been nearly 37 million visits, and hundreds of services that are available to firms and citizens via the portal.

Notably, Dione proposed three measures, one to the business community and two to the government, as ways forwards for deepening the on-going digital government reforms.

For the business community, Dione said it is the right time to step up with digitalization.

“The Covid-19 is also a wake-up call for business leaders,” he said, adding business continuity today seems impossible without the right technology in place, with online businesses experiencing less severe disruption than offline businesses as seen during the crisis.

A study performed in Singapore in 2019 showed that the use of digital technologies such as e-commerce, electronic payments, artificial intelligence/machine learning and big data analytics can increase SME’s value add and productivity by 26% and 17% percent, respectively.

From a macroeconomic perspective, the digitalization of enterprises can also enhance a country’s economic activity. It is estimated that the digitalization of SMEs in the ASEAN region could add US$1.1 trillion of GDP value across the region by 2025.

For the government, the first proposal would be to begin with simplification of business processes via e-services.

“Regardless of how many services are available online, if those services do not reduce time and transaction costs for businesses, the online services will mean little to them,” Dione said.

Thus, it is important for the government to understand where more time and cost incur during the whole service delivery chains in order to optimize the business processes and to make the services more flexible and convenient, he continued.

Other databases, such as business registration, investment licensing, construction permits, tax payments will also be useful pointers if being analyzed for e-Service optimization purposes.

Secondly, the government can serve as a launching platform for the private sector to go digital more quickly. Pointing to various government-led initiatives that have supported firms in the respective countries to adopt new business models, Dione said all these resulted in significant increase in firms productivity and profitability in their countries.

While the world is moving fast with growing uncertainties, Vietnam should be fully prepared to act against any potential shock. In this regard, digitalization should be key measures for Vietnam to go forward, Dione stated.

Vietnam to hold video conference promoting footwear trade with 60 US firms

While footwear is one of Vietnam’s key export staples, the US is a major market for these products.

An interactive video conference aimed to promote Vietnam – US trade in footwear in the post-Covid-19 period is scheduled to take place for the first time on May 28 – 30, 2020, with the participation of 60 US traders.

The event will be jointly held by Vietnam Trade Promotion Agency (VIETTRADE) under the Ministry of Industry and Trade (MoIT), the Vietnam Trade Office in the US, and the Footwear Distributors and Retailers of America (FDRA).

At the conference, both sides would discuss the current situation of the US footwear market amid the Covid-19 pandemic, its outlook and potential cooperation between enterprises from the two countries in the footwear industry.

While footwear is one of Vietnam’s key export staples, the US is a major market for these products.

In 2019, Vietnam’s export turnover of footwear products hit US$18.3 billion, up 12.8% year-on-year. The US remained the largest buyer, spending US$6.65 billion on Vietnamese footwear, up 14.2%.

Despite a positive export growth rate in footwear to the US market in the first quarter, many Vietnamese firms have expressed concern that the Covid-19 pandemic and its severe impacts on the US economy are causing a stagnation in the signing of new contracts in the second and third quarters.

In addition to a decline in orders, many US traders have canceled existing orders without notice, in turn putting their Vietnamese partners in a difficult position.

As Vietnam has received praisesglobally for its efforts in containing the Covid-19 pandemic, the country is now focusing on boosting economic growth. Experts predicted once the pandemic is put under control, demand for footwear in the US market would surge.

According to the MoIT, it is essential for Vietnamese firms to start promoting trade to the US market. The ministry expected the conference would help two sides gain better understanding and boost trade turnover for mutual benefit, and more importantly, to prepare for a new global trade environment after the end of the Covid-19 pandemic.

Vietnamese enterprises face risks of being acquired at low prices

Under the severe consequences of the pandemic, local enterprises are put into a more vulnerable position and become easy target for foreign companies.

As the disruption to global supply and value chains could not be immediately addressed amid the complicated progression of the Covid-19 pandemic, Vietnamese enterprises are facing the risks of being acquired at under market prices, according to Minister of Planning and Investment Nguyen Chi Dung.

The situation comes as a direct result of M&A activities which are set to intensify in the coming time, Dung noted at a national online conference on May 9.

Countries, especially those heavily impacted by the pandemic, are looking at measures to reduce their reliance on one single market, Dung added.

Such a trend causes foreign-invested companies to restructure their sources of input materials and look for new investment destinations based on new criteria of cost-efficiency, safety and sustainability, Dung said.

Under the severe consequences of the pandemic, local enterprises are put into a more vulnerable position and become easy targets for foreign companies looking to penetrate the Vietnamese market.

Instead of taking time to register new establishments, there have been cases of foreign investors investing via capital contribution at local firms, a practice also known as merger and acquisition (M&A).

Data from the Foreign Investment Agency (FIA) under the Ministry of Planning and Investment revealed in the first four months of 2020, while the number of fresh FDI projects in Vietnam declined by 9.1% year-on-year, projects received capital contribution from foreign investors soared 32.9% year-on-year to 3,210, representing a 3.3-time increase compared to freshly-licensed ones, but with only US$2.48 billion, down 65.3% year-on-year in value.

Among the 3,210 projects, the foreign investors contributed capital to around 2,600 with a combined value of US$1.6 billion, but did not result in increases of the target companies' registered capital. They also invested in other 580 companies and lifted their capital bases by US$900 million.

China, Japan and South Korea made up 40% of total projects with foreign capital contributions in Vietnam. Japan claimed the first spot in terms of value with US$743 million, followed by South Korea with US$365 million, Singapore (US$333 million) and China (US$230 million).

The manufacturing and processing sector attracted the most attention from foreign investors, with 822 projects worth over US$1 billion, while wholesale, retail and transportation vehicles reparation stood right behind with 1,000 projects for US$500 million.

At the conference on May 9, Chairman of the Vietnam Chamber of Commerce and Industry (VCCI) Vu Tien Loc added foreign investment funds and companies are looking to buy Vietnamese enterprises on the edge of bankruptcy, especially those in the real estate and retail sectors.

Loc proposed a temporary halt of M&A activities during the pandemic, saying this would help protect local companies.

However, FIA Head Do Nhat Hoang told VnExpress that such measures should only be applied to core enterprises, not at a large scale.

Many countries in the world are facing a similar issue as Vietnam, when investors are taking advantage of plunges in stock values to buy enterprises with high potential for cheap prices.

Most recently, the Japanese government has put Toyota, Sony and 516 other firms on a “national security” list to prevent them from being acquired by foreign investors, reported the South China Morning Post.

Covid-19 beats shops in Hanoi's commercial streets

The Hanoitimes - Despite rent cuts, many shops in main streets of the city have had to shut down.

“Retail premises for rent” signboards are seen in Xa Dan, Chua Boc and Thai Ha, the bustling commercial streets of Hanoi. Suffering heavy losses in the pandemic time, many tenants have to terminate their leasing contract ahead of time and give back the retail locations to landlords.

Nguyen Thi Hoai, the owner of a fashion shop on Chua Boc street, told Kinh te & Do thi that due to the sharp decline in the number of customers and revenue, along with high rent, she has no other way out but to close the business and return the premises to the owner.

It is now a tough time for many landlords owning prime locations in Hang Bong, Hang Ngang, Hang Buom, Hang Gai streets as they have been unable to find tenants.

Tran Thi Minh, the owner of a shop on Hang Dao street, said that before the pandemic, she paid up to VND1.5-2 million (US$64.2 - US$85.6) per sq.m per month for rent and the landlord found no difficulty to find lessees. “However, supply is currently higher than demand as many properties have been returned before the expiration of contract,” she said.

In order to attract tenants during the post-epidemic period, many landlords are willing to reduce 20-30% of the rent. On the e-commerce marketplace Cho Tot, a 4-storey building with an area of 70 sq.m on Hang Bai street could be leased with VND150 million (US$6,419) per month along with the first two months rent-free, representing a fall in rent by 20% compared to the end of 2019.

Nguyen Hoang Anh, the owner of a street house on Chua Boc street, has lowered the rent by 30% but has not found tenants during the past months.

Economist Nguyen Minh Phong told Kinh te & Do thi that the trend of returning premises is also the process of restructuring in the post Covid-19 retail market. However, given the economic stagnation, landlords should reduce rent rates to a reasonable level, he added.

The latest survey by CBRE Vietnam released on April 27 showed that 79% of tenants are worried that their business would be worse in the second quarter of 2020. Of the 180 respondents, 43% of tenants anticipated drop by 10-30% of their revenue in 2020. Meanwhile, 61% of tenants have not received support from landlords and the 27% expected landlords to offer more support.

Vietnam started a social distancing campaign on April 1 and only loosened in on three weeks later. During the period, many non-essential businesses had to close to prevent the spread of the coronavirus.

Vietnam’s solid macro-economic base enables c.bank to further cut policy rates

Lower policy rates would enable commercial banks to cut interest rates in a more sustainable way, which in turn contribute significantly to economic recovery, said a central bank official.

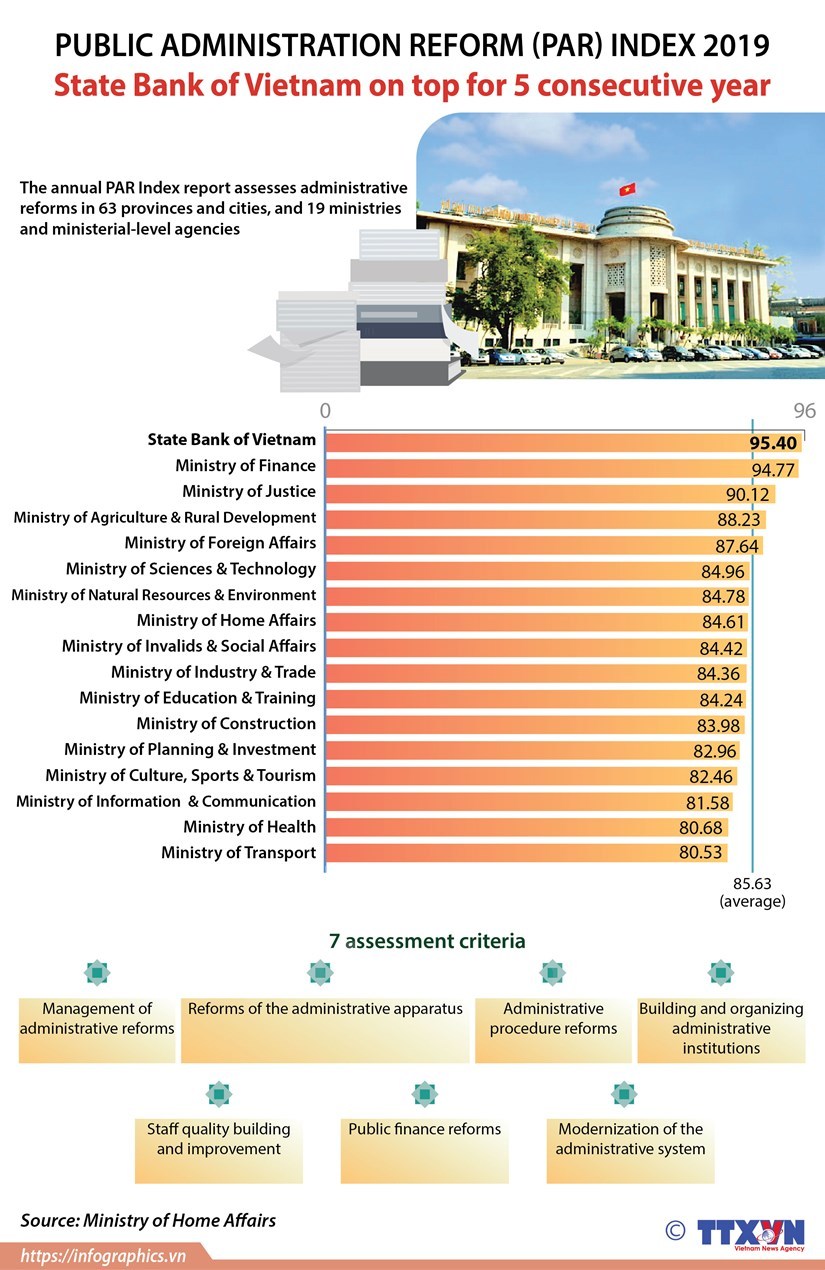

Vietnam’s solid macro-economic base has created room for the State Bank of Vietnam (SBV), the country’s central bank, to maneuver its monetary policy and further cut the benchmark interest rates, according to Pham Thanh Ha, head of the SBV’s Monetary Policy Department.

The SBV’s decision to adjust the policy rates is based on the actual situation of the global financial markets, where major central banks have eased their respective monetary polices and help economies avoid recession, Ha told the SBV’s portal on May 13.

“The SBV has taken into consideration macro-economic factors and inflationary pressure before making proceeding to lower interest rates,” said Ha.

He went on to say that the monetary and foreign exchange markets remain stable while inflation continues to stay under control.

The SBV is committed to ensuring liquidity for credit institutions, which serve as a key channel in providing capital for the economy, he said, adding lower policy rates would help commercial banks cut interest rates in a more sustainable way, which in turn contribute significantly to economic recovery.

In the coming time, the SBV would continue to closely monitor the macro-economic conditions, especially the global financial market to ensure proper and flexible management of the monetary policy, Ha stressed.

After cutting the policy rates by 50 – 100 basis points in March, the SBV on May 12 further slashed the rates by 50 basis points. Accordingly, the refinancing interest rate is down from 5% per annum to 4.5%, rediscount rate from 3.5% to 3%, overnight interest rate from 6% to 5.5% and interest rate via open market operation (OMO) from 3.5% to 3%.

The SBV also lowered the interest rate cap to 4.25% annually from 4.75% for deposits with maturities of one month to less than six months.

Meanwhile, the SBV ordered banks to lower the maximum lending rate for short-term loans to 5% from 5.5%, with the aim of helping companies operating in the fields of agriculture, high-tech industries and exports, among others. Similarly, that rate at people’s credit funds and micro finance services is down from 6.5% to 6%.

The deposit rate for maturities of over six months is subject to each credit institution’s decision on the basis of supply – demand.

Đồng Tháp grants code for 133 fruit-growing areas for export

The Đồng Tháp Province's Department of Agriculture and Rural Development has granted a production unit code for 133 fruit-growing areas that qualify to produce fruit for export.

Most of the code-granted areas, which cover 7,000ha, grow mango, longan, dragon fruit, jackfruit and rambutan.

To be granted the production unit code, each fruit growing area has a minimum area of 10ha, grows one variety of fruit, and grows fruit under Vietnamese good agricultural practices (VietGAP) standards or other equivalent standards.

Code-granted areas have to meet many other requirements, including keeping a cultivation diary for traceability and following pesticide use regulations.

Nguyễn Phước Thiện, director of the department, said of the province’s fruit growing areas with the code, more than 5,000ha area are for export to mainland China and the remaining for export to the US, Australia, Japan, South Korea, New Zealand, the EU and Taiwan.

Farmers in the province who plant fruits in code-granted areas have higher profits than farmers who grow the same fruits under normal farming methods.

In Châu Thành District, which has the largest longan growing area in the province, farmers who plant the fruit in code-granted areas have a yield of 17 – 25 tonnes per ha a year and a profit of VNĐ400 million (US$17,000) per ha a year, VNĐ100 million ($4,300) higher than longan planted under normal methods.

Đồng Tháp has 16 longan growing areas with a total of 634ha that have been granted the code.

The province, which is the largest mango producer in the Cửu Long (Mekong) Delta, has 77 mango growing areas on a total area of 4,000ha that have been granted the code.

Mango planted in code-granted areas sell for VNĐ5,000 - 10,000 a kilogramme more than mango planted under normal farming methods.

The province has more than 9,650ha of mango with an annual output of nearly 127,000 tonnes. Most of the province’s mangoes are sold domestically and a small amount is exported.

The province’s mangoes are exported to many markets, including the US, Japan, South Korea, Australia, Singapore and Russia.

This year, the province targets increasing its mango growing area to 10,000ha with an annual output of 140,000 tonnes.

The province has been granted geographical indication certification for its Cao Lãnh mangoes grown in Cao Lãnh City and Cao Lãnh District.

Chợ Rẫy Hospital, Vietcombank unveil debit card

HCM City’s Chợ Rẫy Hospital and State-owned Vietcombank are issuing debit cards for use by outpatients.

Speaking at a ceremony on Monday to release the new card, Deputy Minister of Health Nguyễn Trường Sơn said the adoption of e-payment would help patients save time and efforts and increase transparency and patient satisfaction.

Besides, at this time of COVID-19, cashless payments help reduce contact between people, he said.

The Ministry of Health encourages health facilities across the country to go cashless, especially major central hospitals, he added.

Nguyễn Tri Thức, director of the hospital, said the hospital provides treatment and health checks to nearly 10,000 inpatients and outpatients every day.

“The [debit] cards will record patients’ personal information and medical history, making it more convenient for follow-up examinations.”

“It also helps streamline the workflow for medical personnel.”

Inpatients can also pay using apps that enable various cashless payment methods such as through bank accounts, credit cards and e-wallets, he added.

Construction of giant industrial park begins in Long An Province

TIZCO Joint Stock Company and Viet Nam Innovation Parks Management Corporation broke ground on Sunday (May 17) for the 1,800ha Viet Phat Industrial Park in Long An Province, one of the largest IPs in the country.

Situated in Thu Thua District’s Tan Long Commune, the IP will have an advantageous position in the Southern Key Economic Region, with convenient road and waterway transportation links with HCM City and other localities in the south.

Le Thanh, chairman and general director of TIZCO Joint Stock Company, said there would be a 1,200ha industrial park and a 600ha urban area. All the land has been acquired and cleared, he said.

He said with the goal of developing a new-generation industrial park to facilitate green and sustainable development, the partners have chosen Singapore’s Surbana International Consultants Pte. Ltd and Jones Lang Lasalle Co, Ltd for planning, design and exploitation of the project.

“Viet Phat Industrial Park will prioritise green areas, adopt the latest technologies in management, operation, waste treatment, and protection of water and other natural resources to create a green, clean and modern living environment for the community and make it an ideal destination for investors.

“We believe … Viet Phat Industrial Park will not only help attract large investments to Long An Province, especially after the COVID-19 pandemic, and catalyse its sustainable socio-economic growth, but also offer locals stable jobs and increase incomes.”

Nguyen Van Ut, vice chairman of the Long An People’s Committee, said the project is a significant development for the province to proactively attract high-quality FDI amid a wave of investors shifting away from China and increasingly setting their sights on Southeast Asia.

HCM City seeks to speed up tardy public spending

HCM City is seeking to speed up public spending after many projects reported delays this year.

A report tabled at a recent meeting showed that only 10.3 per cent of the funds earmarked for this year, or VND3.48 trillion (US$149.3 million), had been disbursed in the first quarter, much lower than in other localities in the Southern Key Economic Region and putting it among localities with the country’s lowest disbursement rates.

A senior official in the Management Board for Traffic Works Construction and Investment, which manages many key transport projects, said after having fund allocated in December, the board immediately began to work on projects, designing and submitting to competent authorities for approval, selecting consultants and evaluating bid documents.

These took a lot of time, leading to slow disbursement in the first quarter, but things would speed up from the middle of the second quarter, he assured.

The board has started work on 13 transport projects costing over VND3.5 trillion ($150.28 million), including the six-lane 75m My Thuy 3 bridge in District 2, a pedestrian bridge in front of the new Eastern Bus Station on Hanoi Highway in District 9 and a subway under it.

It has also co-ordinated with contractors to speed up work on other projects such as upgrade of Nguyen Huu Canh Street, Y-shaped Bridge, An Suong underground tunnel, To Ky Street and others.

Other construction and investment management boards in the city have also sought to speed up their work.

To improve the situation, city authorities are considering new procedures that would improve the management and disbursement of public funds.

The city is urgently implementing Decree No.40/2020/ND-CP governing the implementation of a number of articles of the Public Investment Law and Resolution No.27/NQ-CP on piloting mechanisms and processes to reduce the time required for land acquisition.

The city holds meetings every two weeks to review and evaluate public spending hoping to achieve a disbursement rate of over 80 per cent by October 15.

According to analysts, the most difficult aspect is land acquisition. Delays in this not only affect disbursement progress and investment efficiency, but also causes many projects to stall.

The second inherent bottleneck involves administrative procedures and co-ordination between authorised agencies in carrying out public projects.

All projects take three to four months merely to complete investment procedures, while the selection of contractors takes 45 days.

At a recent meeting Vo Van Hoan, vice chairman of the city People’s Committee, called on relevant agencies to review and handle these problems to speed up public spending.

US producers ask for investigation on Vietnamese tyres

The US Department of Commerce (DOC) has received a petition for anti-dumping investigation on imports of passenger vehicle and light truck (PVLT) tyres from South Korea, Taiwan, Thailand, and Viet Nam.

The petitioners accused the tyre firms of dumping and subsidising into the US market, causing significant damage to their domestic manufacturing industry.

Under US regulations, DOC will consider initiating an investigation of the case within 20 days after receiving it.

During this time, the Vietnamese Ministry of Industry and Trade will exchange and consult with the DOC to clarify contents in the petitions as well as provide information for the DOC to accurately assess before deciding whether to initiate an investigation or not.

In case the DOC decides to initiate an investigation, the ministry will closely co-ordinate with export associations and enterprises in the investigation process and support to protect rights and interests of Vietnamese enterprises.

Moody’s reaffirms B1 rating for SeABank in 2020

Moody's has announced it would maintain the B1 long-term rating for Southeast Asia Commercial Joint Stock Bank (SeABank) in its latest periodic review.

According to the international rating agency, this result reflects the bank's financial capacity, good risk management and long-term development opportunities.

Accordingly, based on business results as well as SeABank’s management, Moody’s continues to maintain the results of B1 long-term rating. Factors such as equity, profitability, debt solvency, asset quality, capital, liquidity and risk management in 2019 have significantly contributed to a positive evaluation result for SeABank in this ranking in the context of the negative effects of the COVID-19 pandemic.

As of December 31, 2019, SeABank had total consolidated assets of nearly VND157.4 trillion (US$6.84 billion), equity of nearly VND10.93 trillion. Profit before tax reached VND1.39 trillion. The average return on equity (ROE) was 12.03 per cent. SeABank's separate NPL ratio continued to be strictly controlled at less than 2.31 per cent.

Besides, 2019 was also the year of SeABank when it was approved by the State Bank of Viet Nam to apply Basel II standards with capital adequacy ratio reaching 12.12 per cent, higher than the minimum of 8.0 per cent according to the SBV's regulations.

By the end of the first quarter of this year, despite being affected by the COVID-19 pandemic, SeABank proactively offered many solutions to ensure operational safety, deployed credit packages to support customers suffering from the pandemic and flexibly transformed its business strategy focusing on services, digital banking, cutting several types of transaction fees on digital banking channels through Internet Banking (SeANet) and SeAMoblie application.

In addition to these solutions, in order to contribute to the Government and people nationwide, SeABank and BRG Group donated VND5 billion for the prevention of COVID-19. Besides, SeABank Trade Union also donated VND400 million to prevent the pandemic and drought in the Mekong Delta.

Recently, SeABank with the support of BRG Group and donors, also presented 16,052 necessities, including 42.7 tonnes of rice, more than 115,000 packs of instant noodles and other items for poor people in difficult circumstances across 25 provinces of the country. The total budget for implementing the programme was nearly VND1.4 billion.

EVNGENCO 2 valued at $2 billion, IPO expected in December

The value of the Power Generation Corporation 2 (EVNGENCO 2), a subsidiary of Vietnam Electricity, has been determined at VND46.1 trillion (US$2 billion) as of January 1, 2019, of which the real value of State capital is more than VND26.6 trillion.

The company’s valuation, used for its equitisation process, was announced by the Commission for the Management of State Capital at Enterprises on Tuesday.

Assets not included in the enterprise’s value are fixed assets formed from the reward and welfare fund with the remaining value of VND 5.7 billion which was transferred to the trade union organisation to manage and use for the benefits of employees in the company.

The valuation is calculated by the auditing and tax consulting firms AASC and UHY based on financial statements audited by KPMG.

According to Ho Sy Hung, vice chairman of the commission, enterprise valuation is the first step during the equitisation process with the hope of providing the public information in a transparent manner to attract investors to a future IPO.

The result was reviewed carefully based on publicity, transparency and democracy in compliance with the law and supervised by assistance teams from the equitisation steering committee and tax agency with the approval of land use plans of the People’s Committees of relevant provinces and cities and audited by the State Audit Office of Viet Nam, Hung said.

EVNGENCO 2 is among the six State corporations due for equitisation this year.

The company was established in 2012 with a charter capital of VND11.7 billion. Vietnam Electricity (EVN) holds 100 per cent of its charter capital

Nguyen Xuan Nam, EVN’s deputy general director, on Tuesday pledged to take drastic measures to complete equitisation on schedule.

“This valuation is an important step for EVNGENCO 2 to make its initial public offering (IPO) by the end of this year, helping attract investors to participate and contribute to the development of the company,” Nam said.

The Commission for the Management of State Capital at Enterprises has instructed EVN and EVNGENCO 2 to urgently implement the following steps to conduct its equitisation plan, which will be submitted to Prime Minister Nguyen Xuan Phuc for approval in August.

Its IPO is expected to take place in December this year.

EVNGENCO 2 reported net sales of goods and services in 2019 reached VND27.1 billion, up 16 per cent year-on-year. However, due to interest expenses exceeding VND1 trillion, its after-tax profit was VND3.1 billion.

Plastic firm sees slight revenue growth in 2020

Tien Phong Plastic JSC (HNX: NTP) is aiming for revenue growth of 6.25 per cent in 2020 to VND5.1 trillion (US$221 million).

Post-tax profits are projected to fall slightly by 0.25 per cent to VND470 billion.

The earnings targets were passed by shareholders at the firm’s annual meeting on May 18.

In 2019, the company earned VND4.8 trillion in revenue and VND471.2 billion in post-tax profit, up 5.95 per cent and 24 per cent on-year.

Shareholders at the meeting also approved the company’s plan to pay a 20 per cent cash dividend for 2019, divided into two payments.

The first payment was made in January 2019 at 10 per cent.

The dividend rate will be kept the same in 2020. In 2018, the company paid a 10 per cent cash dividend and a 10 per cent share dividend.

Charter capital will be raised by 20 per cent through the issuance of 19.6 million shares at VND10,000 apiece this year.

From 2020-25, the company’s board of directors expect revenue to increase 8 per cent and profit to gain 6 per cent compared to 2015-20.

Tien Phong Plastic shares rose 0.9 per cent to end Tuesday at VND35,300.

UPCoM firms suspended for failing to release audited reports

The Ha Noi Stock Exchange (HNX) has suspended 21 companies on the Unlisted Public Company Market (UPCoM) for three days over failure to release audited 2019 financial reports.

The companies have not published their full-year financial reports within 45 days after the reports were audited.

Their stocks will be suspended for three trading days between Friday (May 21) and Monday (May 25). The suspension will be lifted once the companies make their official financial statements.

The companies’ stocks will fall into the restriction list after the suspension if their audited reports are still not published.

Among 21 companies are Power Engineering JSC (PEC), Saigon Plastic JSC (NSG), Hau Giang Agricultural Breeding Centre (HGA), 145 Truong Son Company (TS5) and Thang Loi Coffee Company (CFV).

Some of those stocks have remained inactive since their debuts such as HGA, CFV and TS5.

The secondary market tracker UPCoM-Index gained nearly 1.0 per cent to end Tuesday at 53.80 points.

Vingroup introduces VinHR solution to improve labour productivity

Vantix Solution and Technology Service JSC, an affiliate of Vingroup, on Tuesday announced it will introduce VinHR to improve labour productivity.

VinHR is a management solution capable of increasing the production abilities of unskilled workers by as much as 25 per cent.

It will allow management to collect data from individuals through smartwrist devices to improve productivity. Tests carried out on staff working a number of VinGroup sectors have already shown positive results.

This will allow Vingroup to become one of the first units in the world to provide solutions to optimise labour productivity through personal Internet of Things devices and artificial intelligence.

VinHR uses a specific learning model to train and automatically identify employee's movements through technology, including Vband, a smartwrist device, AI infrastructure and management software, in addition to an intelligent measurement system providing a comprehensive and detailed vision of performance for managers and business owners.

According to Vantix's test, VinHR solution helps increase 25 per cent of labour productivity, especially suitable for unskilled employers who are working at predefined processes such as tourism, hotels and factories.

Developed by Vantix and VinSmart, the price of Vband is only by one-tenth of others of the same kinds on the market.

Vantix is currently actively cooperating with international experts and lecturers of the University of Washington to meet the requirements of user data security according to General Data Protection Regulation, which is a strict EU regulation with many provisions to protect users' personally identifiable information.

Nguyen Quang Huy, General Director of Vantix Company, said VinHR does not only optimise operation efficiency but also creates new opportunities and values in operation, contributing to improving the competitiveness of businesses.

“The VinHR solution set has been tested at Vinpearl since May, followed by VinSmart and VinFast. With positive practical results, Vantix is ready to widely commercialise VinHR solution for businesses in the market,” Huy said.

Thaco eyes increase in exports of auto accessories

Thaco Auto Seat Plant (Autocom) is expected to earn US$10.5 million from exports this year, up from $6.2 million last year.

The 12,000sq.m Autocom in the Thaco Chu Lai Industrial Zone in Quang Nam Province has a capacity of producing 100,000 sets of auto seats/beds for the domestic market and 300,000 sets of seat covers for exports annually using 100 per cent locally sourced materials.

Autocom’ s main products include passenger car seats (Kia, Mazda, and Peugeot), truck seats (Towner, Ollin and Forland) and bus seats (Thaco).

It has also produced and supplied high-quality auto accessories and interiors with modern designs such as seat covers, wrap seat covers, car steering wheel covers, gear covers, floor mats, car covers, truck tarpaulins, backrest sets, neck pillows, utility bags, and others.

But seat covers are the plant’s main exports. They are made from high-quality materials such as leather, PVC and felts that are resistant to fire and scratches, helping increase the aesthetics of and add value to the vehicle.

Thanks to a diverse range of models, high durability and advanced features that help create comfort, the plant's seat products have been bought and appreciated by large car manufacturers.

It exports items such as passenger car seats and gear stick covers to top-tier car brands such as Honda, Hyundai, Kia, and Haval around the world, with South Korea and Malaysia being key markets.

In 2019, it earned $5 million from exports of seat covers and $1.2 million from gear stick covers.

It targets increasing them to $8 million and $2.5 million this year besides expanding its markets to the US, Thailand and Japan.

Autocom will this year develop a variety of products to meet specific customer requirements such as high-end specialised car seats, ship seats, car seats for children, and other accessories.

It also plans to increase annual exports of seat covers and gear stick covers to Korean partners to 150,000 and 1.2 million, and expand its domestic market by entering the supply chain for bus seats and car seat cushions.

The plant is equipped with modern technology and machinery and equipment such as cutting and stitching lines with equipment like automatic CNC cutting machines, automatic fabric spreading machines and automatic diagram printing machines imported from Germany and Japan.

Seat cushions are manufactured on an automatic line with turntables and latest foaming machines imported from Italy. Finished seat cushions are tested for hardness and elasticity by specialised testing machines imported from the US.

The assembly stage of finished seat products is carried out on automatic conveyors to improve productivity and quality.

To satisfy export standards, the plant applies a quality management system in accordance with IATF 16949 and ISO 9001: 2015 standards.

EVNGENCO 2 valued at 2 billion USD, IPO expected in December

The value of the Power Generation Corporation 2 (EVNGENCO 2), a subsidiary of Vietnam Electricity, has been determined at 46.1 trillion VND (2 billion USD) as of January 1, 2019, of which the real value of State capital is more than 26.6 trillion VND.

The company’s valuation, used for its equitisation process, was announced by the Commission for Management of State Capital at Enterprises on May 19.

Assets not included in the enterprise’s value are fixed assets formed from the reward and welfare fund with the remaining value of 5.7 billion VND which was transferred to the trade union organisation to manage and use for the benefits of employees in the company.

The valuation is calculated by the auditing and tax consulting firms AASC and UHY based on financial statements audited by KPMG.

According to Ho Sy Hung, vice chairman of the commission, enterprise valuation is the first step during the equitisation process with the hope of providing the public information in a transparent manner to attract investors to a future IPO.

The result was reviewed carefully based on publicity, transparency and democracy in compliance with the law and supervised by assistance teams from the equitisation steering committee and tax agency with the approval of land use plans of the People’s Committees of relevant provinces and cities and audited by the State Audit Office of Vietnam, Hung said.

EVNGENCO 2 is among the six State corporations due for equitisation this year.

The company was established in 2012 with a charter capital of 11.7 billion VND. Vietnam Electricity (EVN) holds 100 percent of its charter capital

Nguyen Xuan Nam, EVN’s deputy general director, on May 19 pledged to take drastic measures to complete equitisation on schedule.

“This valuation is an important step for EVNGENCO 2 to make its initial public offering (IPO) by the end of this year, helping attract investors to participate and contribute to the development of the company,” Nam said.

The Commission for Management of State Capital at Enterprises has instructed EVN and EVNGENCO 2 to urgently implement the following steps to conduct its equitisation plan, which will be submitted to Prime Minister Nguyen Xuan Phuc for approval in August.

Its IPO is expected to take place in December this year.

EVNGENCO 2 reported net sales of goods and services in 2019 reached 27.1 billion VND, up 16 percent year-on-year. However, due to interest expenses exceeding 1 trillion VND, its after-tax profit was 3.1 billion VND./.

|

|

|

Construction plan for Tan Son Nhat Airport’s third terminal approved

Deputy Prime Minister Trinh Dinh Dung has given the green light to the construction of Terminal 3 at Ho Chi Minh City’s Tan Son Nhat International Airport.

The terminal has a designed capacity of 20 million passengers a year, which is expected to help ease the overload at Terminal T1.

Total investment for the project is estimated at 10.99 trillion VND (470.6 million USD) that will be fully funded by the Airports Corporation of Vietnam. The project is scheduled to take 37 months.

Tan Son Nhat International Airport is the busiest airport in Vietnam, with Terminal 1 and Terminal 2 for domestic and international flights, respectively.

The two terminals handled over 40 million passengers last year, 1.6 times higher than their designed capacity of 28 million passengers per year./.