After being severely affected by COVID-19, Da Nang city’s tourism sector now targets a strong recovery with several promotional campaigns having been launched.

Before COVID-19, no one could have thought that with 100 USD in hand they could take a nice holiday in Da Nang. But now, for that sum, not only can they fly to the beautiful central coastal city, they can also have a luxurious three-day stay in a four or five-star hotel.

Besides the two focal markets of Hanoi and Ho Chi Minh City, tourists from neighbouring localities are also being targeted by travel agents in Da Nang city.

Now that the end of the year is approaching, local travel agents and hotels are also focusing on Meeting Incentive Conference Events, or MICE, tours.

The city’s tourism sector is looking to introduce a year-end promotional campaign on November 25 with multiple new products to attract visitors to Da Nang at Christmas and New Year’s Eve./.

MoIT pledges to do its best to support Korean firms: Minister

The Ministry of Industry and Trade (MoIT) will make every endeavour to support Korean enterprises and attract high-quality investment from South Korea, Minister Tran Tuan Anh told a workshop hosted by the MoIT in Ha Noi last week.

The workshop was an opportunity for the MoIT and Korean firms to chalk out ways to foster investment and strengthen the multifaceted relations between the two countries.

The MoIT has pioneered in providing assistance to the entry of Korean experts into Viet Nam amid challenges posed by the COVID-19 pandemic, he said, adding that so far, more than 10,000 Korean specialists have been sent to Viet Nam this year to work for FDI projects. They are important to ensure the normal operation of the FDI businesses, including those of South Korea, in Viet Nam, Anh said.

Viet Nam has advantages and opportunities to create breakthroughs in the near future as the country has basically brought the pandemic under control and gained increasing confidence from not only the domestic business community but also foreign investors and partners, he noted.

The minister expected that Korean investors can take advantage of opportunities in Viet Nam, soon recover production and boost growth.

The Vietnamese government and the MoIT persist in supporting and facilitating domestic and foreign investors, particularly those from South Korea, to further expand investment and business in Viet Nam, the minister said.

The MoIT is willing to listen to ideas and opinions from Korean investors and businesses and will work harder to improve the local business climate, he added.

Speaking at the event, Korean Ambassador to Viet Nam Park Noh Wan highlighted Viet Nam as an open economy which has developed steadily and become a member of many free trade agreements. These are good factors for Korean firms to stay confident about their investment and business in the country, he said.

As the COVID-19 pandemic is causing disruption to global supply chains, enterprises from both nations need to exchange frequently and coordinate closely to further boost trade and investment, the diplomat said.

Currently, South Korea is Viet Nam’s third largest trade partner, after China and the US, with bilateral trade reaching nearly US$67 billion in 2019. It is also the fourth largest export market and second import market of Viet Nam. South Korea mainly imports agricultural and aquatic products, processed food, textiles and garments, footwear, timber products, and electronic products from Viet Nam.

The East Asian country is Viet Nam’s biggest foreign investor with more than 9,000 FDI enterprises based in Viet Nam and accumulative investment hitting about $70.4 billion as of October 2020, accounting for 18.5 per cent of Viet Nam’s total FDI.

Export price of Vietnamese rice at record high

The export price of Vietnamese rice has increased by US$20-30 per tonne compared to the previous month, a good signal for farmers and exporting enterprises in such a difficult year due to natural disasters and the COVID-19 pandemic.

According to the Agricultural Products Processing and Market Development Department under the Ministry of Agriculture and Rural Development, Vietnam exported 5.35 million tonnes of rice in 11 months of 2020 at a total value of US$2.64 billion. The average export price reached US$494 per tonne, up 13% over the same period last year.

The rice price increase was due to the increasing demand on rice reserves of the importing countries because of the ongoing complicated developments of the COVID-19 pandemic. Meanwhile, the rice production in some rice exporting countries such as Thailand has decreased due of the impact of climate change.

Director of the Institute of Policy and Strategy for Agriculture and Rural Development Tran Cong Thang said that figures show that Vietnamese rice has seen a positive change in price and added value with its increasing quality gaining recognition from the world.

“During the time when Vietnam and other countries are being affected by COVID-19, many Vietnamese agricultural products have suffered declines in terms of the market. However, rice is one of the bright spots, especially when the export price of Vietnamese rice is relatively high in addition to the slight price increases in the domestic market, which are some good signs,” Thang noted.

However, Director of the Agricultural Products Processing and Market Development Department Nguyen Quoc Toan said that despite the positive signals Vietnam should not be subjective, and the rice cultivation should follow sustainable standards to ensure the stable consumption and export of rice.

Hanoi’s economy estimated to grow by 3.94% in 2020

The economy of Hanoi is projected to expand by just 3.94% in 2020 due to the impacts of Covid-19, but the figure is still higher than other provinces and cities, according to the municipal government.

As a result, the average growth rate for the 2016-2020 period is expected at 6.67%, which is lower than the 7.36% recorded during the 2016-2019 period but still higher than the national average of 5.9%.

The scale of the capital city economy in 2020 is estimated at US$43.5 billion, with income per capita reaching US$5,250, a rise of 1.43 times compared with 2015, said Hanoi Vice Chairman Nguyen Doan Toan.

The industry and construction sector is expected to record growth of a decent 6.76%, bringing the average growth during the 2016-2020 period to 7.65%.

Thanks to the uninterrupted supply of goods and commercial promotion campaigns, growth in trade and service activities have been sustained, with strong growth in e-commerce and technology-based payment methods.

Total retail sales are estimated to increase by 2.4%, exports by 3.5% and services by 3.1%, while the consumer price index will be kept at below 2.8%.

Agriculture continues to affirm its role as the pillar of the economy amid difficulty, growing by an estimated 4.2% in 2020, the highest growth rate in recent years.

As a result, the city’s government revenue in 2020 is expected to increase by 3.5% over last year.

In 2021 Hanoi will continue to pursue the double goals of preventing Covid-19 effectively and capitalising on opportunities to boost economic recovery, striving for a growth rate of 7.5%.

RCEP to boost development of new supply chains

The Regional Comprehensive Economic Partnership (RCEP) will boost the development of new supply chains. It is the information given at the seminar on trade remedies amid the context of joining free trade agreements (FTAs): Opportunities and challenges for Vietnamese enterprises, held by the Trade Remedies Authority of Vietnam in association with the Ho Chi Minh City International Integration Support Center on November 27 in HCMC.

RCEP is the FTA with the largest market size in the world, accounting for 2.2 billion consumers, or 30 percent of the world's population, with the gross domestic product (GDP) of about US$26.2 trillion, or about 30 percent of global GDP. Its difference from the Comprehensive and Progressive Agreement for Trans-Pacific Partnership is that the levels of development of the RCEP member countries are the most diverse, with the participation of both the world's leading economies and underdeveloped countries. The agreement is expected to promote the development of regional and global value chains and promote the economic development of countries in the ASEAN, including Vietnam and partner countries.

Besides the advantages, the RCEP might bring competitive pressure on Vietnamese goods and services. Among the countries participating in the RCEP, there are many markets and regions that Vietnam sees the highest trade deficits, such as China, the ASEAN region, and South Korea.

On the other hand, the quality and added-value content of most exported products of Vietnam are moderately modest. Meanwhile, economies in the RCEP have many partners with similar product structures to those of Vietnam, but with stronger competitiveness.

Effective seaport use to drive economy upwards

Vietnam is situated within the most dynamic maritime transport network in the world. With a coastline of over 3,200 km, the country boasts huge potential for the development of sea transport and other maritime services.

On October 22, 2018, on behalf of the Party Central Committee, Party General Secretary Nguyen Phu Trong signed Resolution 36 on the strategy for the sustainable development of Vietnam’s marine economy by 2030 with a vision to 2045, which sets out numerous tasks for marine economic growth, including developing seaports.

Once seaports are properly linked to other transport networks and support services, the former’s potential can be unlocked.

Seaports are key gateways for import and export activities and seaports and port logistic services are crucial for trade and transport.

Vietnam is now home to 44 seaports and 263 harbours, with several deep-water seaports in operation in the northern and southern regions and others expected to be built in the central region. As seaports can handle 570 million tonnes a year, some 90 percent of imported and exported items receive clearance every year, greatly facilitating the country’s economic growth.

Vietnam’s seaport system planning to 2020 and vision to 2030 divides 45 local seaports into six categories. Two international gateways are now ranked Class 1A, 12 regional focal ports first-class, 18 local focal ports second-class, and 13 offshore oil and gas ports third-class.

Prior to 2007, Vietnamese ports and especially its harbours were infamous for their inferior quality.

Since then, however, the country’s seaports have improved significantly, marked by Cai Mep International Port in southern Ba Ria-Vung Tau province welcoming a container vessel with a cargo capacity of 18,300 twenty-foot equivalent units (TEUs) (or 194,000 deadweight tons) in October.

Seaport development has also caught the attention of the private sector. Multiple global port operators and major shipping lines have now exploited seaports in Quang Ninh province, Hai Phong city, Ho Chi Minh City, and Ba Ria-Vung Tau province.

Vietnam’s seaport development remains on track and is staying abreast of the country’s economic growth.

Prime Minister Nguyen Xuan Phuc recently issued a directive requesting the implementation of measures for effectively connecting transport infrastructure and lowering logistic costs, which now account for an average of 21 percent of a product’s price, which is very high compared to developed countries.

Logistics now account for 3 to 4 percent of GDP and post a rapid growth rate of 15 to 20 percent each year. The sector is expected to contribute 8 to 10 percent of GDP by 2025 thanks to lessons learned from logistics practices in developed countries.

According to Vietnam’s seaport system development plan, the country is looking to give custom clearance to 640 billion tonnes of goods in 2020 and 1.1 billion tonnes in 2030./.

Urbanization spurs socio-economic development

The Central Economic Committee in association with the Ho Chi Minh City Real Estate Association and HCMC Open University held a seminar on developing a transparent and sustainable housing market, promoting the process of urbanization and urban development in Vietnam to 2030, with a vision to 2045, on November 27.

Mr. Nguyen Duc Hien, Deputy Head of the Central Economic Committee, said that over the past ten years, urbanization and urban development in Vietnam had seen rapid growth, promoting the country's economic development and achieving many set targets. The space and number of urban areas have increased rapidly from 33.5 percent in 2010 to nearly 39 percent in 2020. Urban areas were evenly distributed, creating a nuclear driving force for the process of socio-economic development. The urban economy is one of the three pillars of the economy, accounting for more than 7 percent of the country's gross domestic product (GDP). However, urbanization and urban development still show many shortcomings, such as the risk of imbalance in development between urban and rural areas, overloaded infrastructure, and asynchronous connection.

Assessing the real estate market recently, Mr. Nguyen Van Sinh, Deputy Minister of Construction, said that the development of the real estate market is not sustainable. There is still a potential risk of instability. Real estate prices, especially housing prices, nail at high levels and remain in an upward trend, especially in big cities like Hanoi, Ho Chi Minh, and Da Nang. The structure of some real estate products, including housing, is imbalanced. There is a lack of small and medium-sized goods, with prices suitable to the needs of the majority of people, especially the lack of rental housing and social housing. Meanwhile, there are signs of an oversupply of luxury housing.

The mobilization of resources to implement social housing development programs to serve social policy beneficiaries, low-income people in urban areas, cadres, civil servants, public employees, armed forces, and workers in industrial zones remains limited. The situation of rampant and spontaneous investment or delayed projects with asynchronous investment and a lack of infrastructure connection still happens relatively common. High inventory causes a waste of land resources and social investment capital.

It is forecasted that the demand for housing in the period from 2021 to 2030 will continue to increase, especially in urban areas, due to the population growth rate and urbanization trend. Increasing people's income raises affordability in general and willingness to pay for housing demand in particular, the need to renovate and replace houses due to a lack of housing quality.

Experts said that the current urban population rate is about 40 percent and will increase to 45 percent by 2030, so it requires an annual increase of about 70 million square meters of urban housing. New housing demand will continue to concentrate in a few big cities and industrial zones, namely Ho Chi Minh, Binh Duong, Dong Nai, Vung Tau, Hanoi, Bac Ninh, Hai Duong, and Hai Phong. Hanoi and Ho Chi Minh cities - the two big cities with a high population attraction - which requires a rapid increase in urban housing areas, will account for over 50 percent of the country's urban area.

HCMC’s real estate market has the largest size in the country, reflected in the number of houses, office, and retail space, as well as rental accommodation. With a large population and the position of the economic center of the country, the demand for real estate products here is also huge and diverse. The operation and volatility of the real estate market in HCMC have a great impact on the real estate market of the country.

Mr. Le Hoa Binh, Member of the Standing Committee of the Party Committee of HCMC, Director of the Department of Construction, representing the city’s leaders to attend the seminar, said that the policy and the legal document system was one of the important factors, directly affecting the development of the city's real estate market. He said that the promulgation of tight monetary policies in 2008 and 2011 greatly affected the regression of the real estate market during this period.

Moreover, the enactment of the 2003 Law on Land has also resulted in strong land displacement for urban and residential development projects before the law becomes effective. Therefore, determining the impact of policies and legal document system on the real estate market in HCMC needs to summarize and assess the correlation between the development process of the real estate market and the time of issuance of the Law on Land, the Housing Law, the Real Estate Trading Law, and policies on housing and credit.

Concurring with this point of view, Mr. Le Hoang Chau, Chairman of the HCMC Real Estate Association, said that there is almost a maze of legal documents governing the real estate market. In general, it is very complicated, overlapping, even contradictory, like a matrix discouraging investors. But over the past ten years, the legal system has gradually improved, mostly shown through the promulgation of the 2020 Investment Law, the amended 2020 Construction Law, which simultaneously amending and supplementing some articles of the Housing Law, the Real Estate Business Law, and the Law on Environmental Protection. The Government is considering issuing a decree amending decrees on the implementation of the Law on Land, ensuring consistency and continuity, solving some major problems of the real estate market.

Farmer association loans members US$37 million to develop home businesses

For ten years, the Farmer Association in Ho Chi Minh has loaned its member VND859 billion (US$37 million) to develop household businesses.

At its conference to review ten-year implementation of the project “ Renovating and improving fund to help farmers for the 2011-2020 period” yesterday, the Farmer Association announced to loan 38,804 farmers VND859 billion to develop their household businesses as well as assist cooperatives to expand more.

Farmers have been decisive to invest VND1,718 billion in expanding and growing their entrepreneurial families to raise their income and create employment for 97,010 local laborers.

In fact, the sum is too small to help farmers invest in high-tech; therefore, just a few farmers have been applying technologies and participating in cooperatives. Accordingly, models of farmers who have been using the loan effectively for their businesses should be popularized.

Hanoi office market: Highest vacancy rate in three years

The reality is largely attributed to Covid-19 impacts.

The vacancy rate of Hanoi’s office market in the first nine months this year hit a three-year low, according to JLL, a leading professional services firm that specializes in real estate and investment management.

The new launch and the weak take-up during the quarter brought up the market average vacancy rate to 14.9% in the third quarter this year (3Q20), the highest vacancy rate since 2017, JLL has said in a recent report.

Three projects started operation in Hanoi in 3Q20, providing more than 122,000 square meters (sqm) of space, 75% of which came from Capital Place, a high-quality Grade A building.

Three new projects are scheduled for completion in the fourth quarter this year, bringing the total stock up to 2.2 million sqm by end-2020.

This is likely to drive up market vacancy, resulting in landlords more willing to negotiate with tenants. As tenants are likely to tighten their budgets until the pandemic is globally contained, market rents are expected to stabilize or even decrease in the near term, JLL predicted.

Demand for office in Hanoi in Q3 remained weak across the market. Most of the existing buildings recorded negative net absorption as tenants continued to either relocate to the buildings with lower rents or scale down their sizes.

During the period, three new completions were less than 20% occupied with notably low pre-commitment rate. This phenomenon has not been seen for a while with most new buildings during 2018-2019 period managing to record pre-commitment of more than 46% on average at the opening date.

Net absorption returned to positive territory in Q3, at around 19,500 sqm, which was mainly contributed by the take-ups in the new completions.

The average net rent of Grade A increased by 5.8% on-quarter to US$26.9 per sqm per month in 3Q20, which was due to the completion of the high-quality Capital Place project with higher-than-average rent.

Meanwhile, most buildings in the segment kept their asking rents constant yet with more flexible leasing terms to support the tenants.

Rental growth in Grade B has also slowed to almost a standstill since the first outbreak of Covid-19, given the softening occupier demand as they turned cautious amid uncertain situation. Rents therefore were kept unchanged at around US$14.5/sqm/month in 3Q20.

Generally, although the demand softened, landlords were not ready to reduce rents to a large extent yet as the average occupancy rate, albeit lower than before, remained at a fair level of more than 85%.

Hanoi retail market: Landlords reshuffle tenant mixes

Landlords need to be more open to different kinds of tenants to meet the actual requirements.

The Covid-19 pandemic has delivered a strong hit to shopping malls as consumers were cautious not only about going to malls where many people gathered but also spent.

Landlords, therefore, needed to reshuffle tenant mixes by replacing underperformed brands with more resilient ones like F&B and entertainment categories, leading professional real estate services and investment management firm JLL has said.

With many tenants moving out and malls changing tenant mix, Hanoi’s retail market saw significant increase in vacancy in the third quarter this year.

Total stock remained unchanged as no new supply entered the market in the third quarter of 2020 (3Q20).

Hanoi’s retail space was largely contributed by those in suburban districts where there remained more land bank available than CBD (districts of Hoan Kiem, Dong Da, Ba Dinh and Hai Ba Trung). These retail centers tended to be one-stop destinations, providing multiple types of goods and services that catered toward a diverse group of consumers.

Despite the challenging period, the average rents in CBD appeared to hold firm in 3Q20, given the high occupancy rate and lack of future supply in the area. Meanwhile, rents in suburban areas softened as many landlords were under pressure to maintain occupancy.

Although those supports from landlords in the beginning of the pandemic were lifted in most of the malls, some landlords were seen to extend certain aids on case-by-case basis.

According to JLL, supply will remain unchanged in CBD, while non-CBD will continue to see more shopping malls. In the fourth quarter this year, Vincom Ocean Park with approximately 33,600 square meters (sqm) will enter the non-CBD market.

This will be the first mall in Gia Lam district and is expected to become a new destination for residents in the area. The mall has achieved an impressive pre-commitment rate thus far.

As a notable trend, most developers are focusing on generating superlative experiences and value-added services to attract shoppers. Therefore, more shopping malls are expected to get rejuvenated with better tenant mix, infrastructure and added services in upcoming time.

Vietnam northern industrial property: Demand stays robust despite prolonged pandemic

Tenants are given opportunities to evaluate and secure land from distance thanks to intensified investment in online platforms.

Demand for industrial property in the northern region of Vietnam in the third quarter this year remained strong amidst the prolonged pandemic, according to leading professional real estate services and investment management firm JLL.

Travel restrictions during Covid-19 outbreaks have made it difficult for traditional site inspections and direct meetings, but the demand for industrial land kept momentum in the third quarter this year (3Q20) as Vietnam is still a favorable destination for investors.

The main sources of demand for industrial land remained manufacturers who wished to diversify their manufacturing portfolios outside China – especially in high-tech industries. Meanwhile key tenants for ready-built-factory (RBF) continued to be small- and medium-sized enterprises (SMEs).

To support the demand, more and more online platforms have been invested such as site virtual tours, online webinars, upgraded industrial parks (IPs)' websites.

Therefore, tenants still had opportunities to evaluate and secure land from distances. In addition, several transactions started before the outbreak and were only signed in 3Q20, which all brought the average occupancy rate up 74%, up by 160 basic points (bps) from that in 1Q20.

The supply for industrial land in the north is expected to rise further in the next five years to capitalize on the increasing demand in the region.

With large existing land bank, Haiphong and Bac Ninh were leading localities for industrial land supply in the north.

In anticipation of the upcoming investment waves, northern cities and provinces have planned to open new IPs and expand existing ones, among them Hung Yen and Hai Duong are the most active localities in new IP developments.

Given Vietnam’s potential as one of the most sustainable manufacturing hubs, most IP developers in northern markets maintained strong bargaining power regardless of Covid-19.

This lifted land prices to a new peak of US$102 per square meter (sqm) per lease term in 3Q20, up 7.1% on-year. RBF rents also inched up slightly, ranging from US$4.1-5.2 per sqm per month in 3Q20, an increase of 2.1% on-year.

Although Covid-19 may temporarily disrupt investments in Vietnam, there will remain great interests in the country, which is considered a new regional industrial powerhouse. This will support both demand and supply for industrial properties in Vietnam and the north in future.

Moreover, some innovations during the outbreak including virtual applications and online marketing platforms have shown effective and are expected to get more popular. Therefore, those developers who wish to push forward businesses amidst the rough time should consider seriously such platforms.

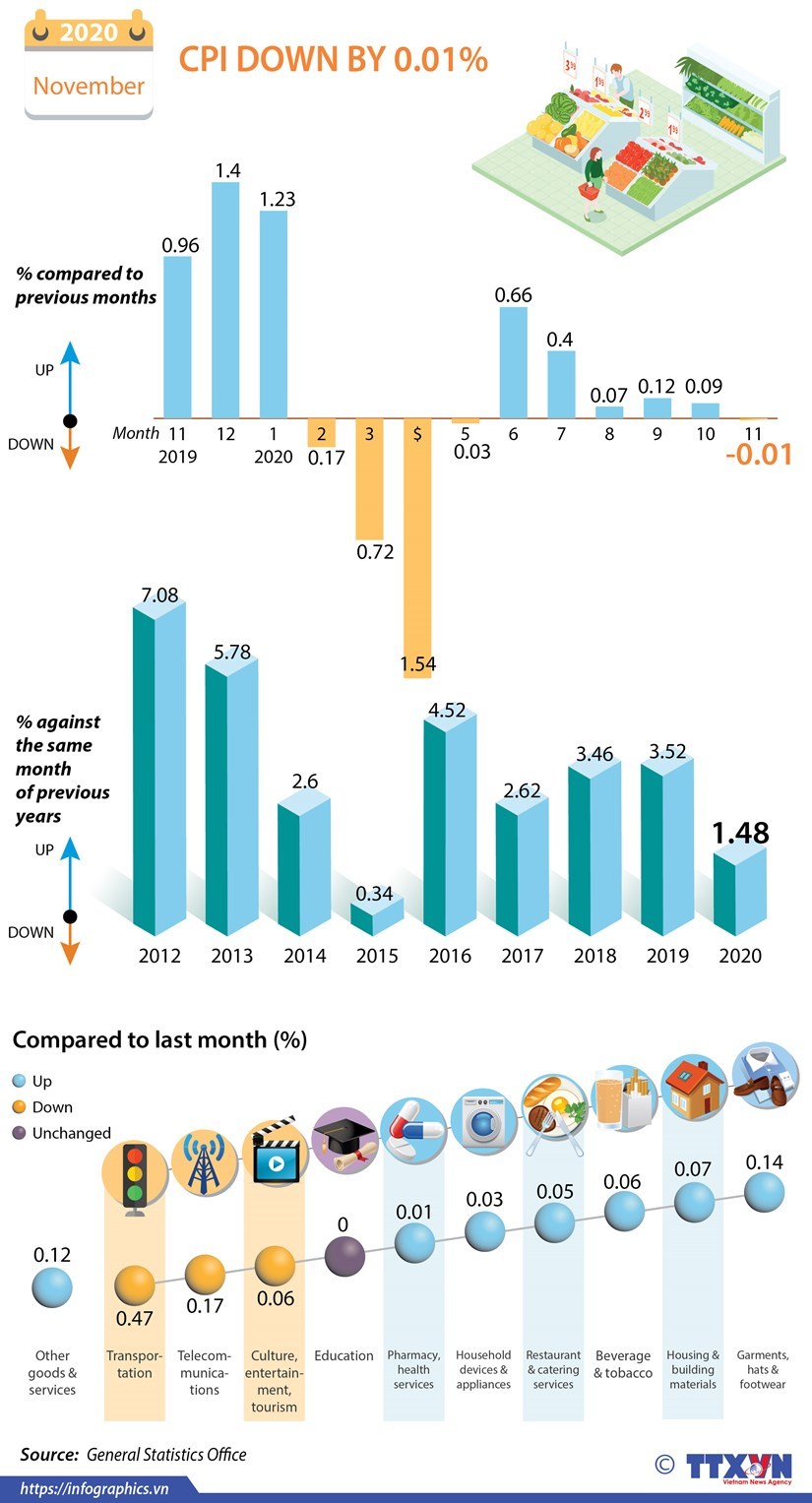

HCM City’s CPI inches up 0.06 percent in November

The Consumer Price Index (CPI) in Ho Chi Minh City rose by 0.06 percent in November from the previous month, raising the total CPI rise in the 11-month period to 2.94 percent, according to the municipal Statistics Office.

Among 11 groups of products and services in the CPI basket, five groups saw their prices decrease in the month, including beverage and tobacco (down 0.03 percent), housing, power, fuel and building materials (0.03 percent), transport (0.39 percent), post and telecommunications (0.38 percent), and garment, hat and footwear (0.001 percent).

The group of equipment and home appliances had the highest price increase of 0.54 percent, followed by culture, entertainment and tourism (0.27 percent), restaurant and catering services (0.22 percent), and other products and services (0.07 percent).

Meanwhile, the prices of medicine and healthcare services and education remained stable.

The office said the price of restaurant and catering services and food went up since corn, sweet potato and vegetables became more expensive as the result of heavy rain and storms.

It attributed the fall in the price of fuel to the adjustments of petro prices on October 27, November 11, and November 26.

Excluding from the CPI basket, the gold price in November rose 0.57 percent, while the price of the US dollar slipped 0.09 percent from the previous month.

|

Wood sector confident of achieving export target of 13 billion USD

The Ministry of Agriculture and Rural Development’s General Department of Forestry is confident of reaching the export target for timber and wooden products of 13 billion USD for the whole year 2020.

The export value of timber and wooden products during the January-November period was estimated at 11.7 billion USD, up 1.6 billion USD from the same time in 2019.

The forestry sector eyes 14.5 billion USD in export revenue in 2021, and 20 billion USD in 2025.

According to the General Department of Forestry, Vietnam has many opportunities to expand export markets and increase export value for timber and wooden products. The world's furniture and wooden product market is large with a value of about 430 billion USD, including 150 billion USD from furniture products. Meanwhile, Vietnam’s furniture products at present only account for about 6 percent of the global market share.

Besides traditional markets with high export value such as the US, Japan, China, EU, and the Republic of Korea, some other potential markets also bring more opportunities for Vietnam to promote furniture exports, like Canada, Russia and India.

The Voluntary Partnership Agreement on Forest Law Enforcement, Governance and Trade (VPA/FLEGT) between Vietnam and the EU effective from June 1, 2019 helps local businesses to improve competitiveness for wooden products exported to the EU, according to the department.

The US market's demand for wood products from other countries, including Vietnam, is likely to increase because high import tax imposed on Chinese products has reduced furniture imported from this market.

In addition, Vietnam has ratified free trade agreements with many partners such as the EU, Japan, Chile and the Republic of Korea and it is implementing those FTAs so Vietnam’s many goods enjoy reductions or elimination in import duties. That would create a competitive advantage for export goods of Vietnam to those markets.

Furthermore, the Government, ministries, sectors and localities are implementing many solutions to continuously improve the investment and business environment for businesses processing export wooden products, including reduction of administrative procedures./.

Businesses prepare for Tet, to ensure sufficient supply

Businesses in Ho Chi Minh City are increasing production to ensure sufficient supply of goods for Tet early next year and steady prices during the year's biggest shopping season.

The HCM City Department of Industry and Trade recently announced plans for its annual market stabilisation programme to ensure adequate supply of essential goods for a month each before and after the festival.

Demand for items such as drinks and confectionery is expected to spike by 20 per cent during Tet, while wholesale markets may need to stock 80 per cent more flowers than normal to meet demand.

According to the department, large retailers are set to stock goods two or three times as in normal months though most are reluctant to announce their exact business plans for Tet.

Many businesses feared that due to negative factors like the COVID-19 pandemic and flood in central Vietnam, demand during next year's Tet might be lower than normal.

Supporting innovative start-ups for sustainable development

Together with advantages of a golden population, abundant human resources and huge potential to grow, applying scientific and technological achievements would help Việt Nam catch up with the world, said Deputy Minister of Science and Technology Trần Văn Tùng.

In his opening remarks at the High-level policy dialogue on connecting resources to support innovation on Saturday, in the framework of TechFest Viet Nam from 27-29 November 2020, Tùng said that Việt Nam’s ecosytem for innovation had entered a new stage that requires further connections to make use of resources effectively.

“In order to have a close connection, the human factor is essential and indispensable,” Tùng said.

He said the Ministry of Science and Technology continued connecting Việt Nam’s start-ups with the US’ Silicon Valley, expecting that Vietnamese start-ups could gain international experience and build an innovative ecosystem which could create breakthroughs to adapt to the COVID-19 pandemic.

Start-ups in Silicon Valley usually heard that one would not succeed if they had not failed before, and that people could learn from failures, Tùng said, encouraging start-ups to “Go ahead! You may fail but don’t be afraid of failing.”

As the fourth industrial revolution was thriving, it was a must for Việt Nam to promote and speed up its innovation ecosystem so that innovative start-ups could connect and work with major groups as well as organisations, Tùng emphasised.

The forum brought together young entrepreneurs and start-up ecosystem supporters – policymakers, development partners, investors, bankers and researchers – to discuss how to support innovative start-ups and help them overcome challenges.

Deputy Minister Tùng reiterated the Government’s commitment to continuing to promote the development of the domestic start-up ecosystem, at the same time, attracting the participation of start-ups, investors, and the best experts in the world.

There are now more than 1,400 organisations capable of supporting start-ups in Việt Nam, including 196 co-working spaces, 69 business incubators and 28 business promotion organisations.

The number of venture capital funds that consider Việt Nam a target market or have operations in Việt Nam is 108. These numbers have continuously increased over the past years, demonstrating the active participation of the ecosystem.

UNDP Resident Representative Caitlin Wiesen in her keynote speech at the forum said that to transform into a start-up nation required an “entrepreneurial state” – one that promotes innovative and experimental approaches to policymaking, is ready to invest in Research and Development and innovation, provide resources and streamlined processes to support entrepreneurs and investors to grow and leave no one behind.

Swedish Ambassador Ann Måwe said: “Skype, Spotify, iZettle, Mojang and King, all started their journey as start-ups in Sweden a few years back, with a mind-set to go global. All of them have become unicorns.

"Sweden has unlocked the potential of the whole population and has the highest female and maternal employment rates in Europe," Måwe said.

Vice President of the Việt Nam Chamber of Commerce and Industry (VCCI) Hoàng Quang Phóng affirmed that start-ups and creative start-ups are the main engines for the country's sustainable economic development.

“Starting a business and a creative start-up is not only a requirement for establishing new businesses, but also a renewal requirement for all existing businesses. Especially, creative start-ups are an imperative of the digital era,” he said.

Panel discussions focused on issues including the network of Vietnamese Intellectuals supporting innovative start-ups, the role of technology corporations in the start-up ecosystem, supporting resources from the perspective of innovative start-ups; and how to promote domestic and international cooperation in supporting innovative start-ups.

In parallel with the high-level forum, a national dialogue took place on solutions to help start-ups recover and adapt to COVID-19.

Participants shared policies that support start-ups during the pandemic, investors' perspectives on effective business and how they can provide additional support for start-ups, as well as made recommendations for policymakers.

Techfest Vietnam 2020 is the largest annual virtual event organised by the Ministry of Science and Technology to work with international partners to develop and promote science, technology, and innovation.

Taking place amid global disruption caused by the COVID-19 pandemic, the event is part of an emerging nation eager to display the dynamism of its start-up ecosystem among investors/investment funds, enterprises, and experts worldwide via virtual events.

Themed 'Respond - Transform - Breakthrough', the event is structured into 12 technology villages: Medical Technology, Agricultural Technology, Educational Technology, Tourism and F&B Technology, Frontier Technology, Financial Technology, Smart Cities, Social Impact, Student Start-ups, Local Start-ups, Community and International village, with 250 potential start-up booths, attracting nearly 200 investors, 150 corporations, enterprises and business accelerators virtually and physically.

COVID-19 accelerates banking digitisation: seminar

The Covid-19 pandemic has speeded up the banking sector’s awareness of digitisation by three to five years and forced lenders to accelerate the process to survive and grow.

This is in line with global trends and provides a strong push for digitisation, delegates told the 2020 Viet Nam Retail Banking Forum titled ‘The role of retail banking services in promoting economic digitalisation in the post-COVID-19 period’ organised last week by the Viet Nam Banking Association and IDG.

Nguyen Toan Thang, secretary general of the Viet Nam Banks Association, said the pandemic has brought about a change in banking habits, with online banking transactions increasing sharply, especially during the social distancing period.

“Online banking has developed strongly with many new convenient services and products. Banks have invested plenty in modern technologies like contactless payment, super apps, virtual assistant.”

He quoted a report as saying that in the first six months of this year the number of customers using mobile banking services increased by 1.4-2.6 times year-on-year.

Mobile banking transaction accounted for 40 per cent of the total transactions during this period, and even 80 per cent in some banks, he said.

He also shared a report from the National Payment Corporation of Viet Nam that said the amount of money withdrawn from ATMs fell from 90 per cent of total transactions in 2015 to 26.5 per cent this year. The 24/7 online money transfer increased from 1.1 per cent to 66.6 per cent.

Vu Viet Ngoan, Vice Chairman of the National Financial and Monetary Policy Advisory Council said COVID-19 has completely changed people’s habits, forcing banks to change to meet these demands.

The other factor speeding up digitisation of the banking sector is the advancement of cutting-edge technologies like cloud, block chain and digital solutions, he said.

Digitisation of banking is inevitable and would only increase since Viet Nam is one of the first countries to deploy 5G technology.

Furthermore, the start-up eco-system, including fintech, has rapidly developed, which would foster digitisation, he said.

“Banking is an important part of the economy. The digitasation of the economy cannot happen without the digitisation of the banking sector.”

Participants also spoke about the difficulties they faced in digitising and said they should therefore join hands to seek solutions.

On the sidelines of the seminar an exhibition showcasing advanced technologies and products that have been used to digitise was organised.

The annual Viet Nam Outstanding Banking Awards were also given away. Instituted in 2012 they seek to honour the best banks and fintech companies and best banking services.

This year 16 banks and four fintech companies won them, with the Bank of Investment and Development Vietnam (BIDV), Viet Nam Joint Stock Commercial Bank for Industry and Trade (Vietinbank) and Saigon Thuong Tin Commercial Joint Stock Bank (Sacombank) being named the most outstanding retail banks.

Awards were also given for best digitisation, outstanding banking services and products and strong support to high-tech agriculture and small and medium-sized enterprises and community.

FECON to pay dividend in cash at 5%

Construction firm FECON Corporation (FCN) plans to pay 2019 dividend in cash at the rate of 5 per cent.

Each shareholder will receive VND500 for each share he or she owns. With 118 million outstanding shares, it is estimated that the company will pay a total of VND59 billion (US$2.6 million) to shareholders.

The payment date is scheduled on December 18, 2020.

In the first nine months of this year, FCN recorded revenue of VND2 trillion, up 11.8 per cent. Net profit reached VND83 billion, down 42.7 per cent.

As of September 30, 2020, FCN’s total assets reached VND6.3 trillion, an increase of 11.5 per cent compared to the beginning of the year, of which investment value into associates increased by more than VND200 billion.

One of the notable deals that the company made in the third quarter was the acquisition of 14.69 million shares, equivalent to 48.9 per cent of the charter capital, of Ecotech Vietnam Energy Investment Company Limited.

FECON is one of the biggest underground construction contractors in Viet Nam with 15 years of experience. The enterprise currently has 17 member companies, including joint venture enterprises in Myanmar. FCN shares closed Friday at VND12,500 per share.

South Korea fund sells 1.47 million shares of steel firm

KIM Vietnam Growth Equity Fund announced Friday it had sold an additional 1.47 million shares of steel company Nam Kim Group (NKG).

The transaction caused the South Korea fund, holding more than 8 million shares, equivalent to 4.68 per cent, to no longer be a major shareholder of NKG.

On the market, NKG shares are priced at VND12,200 (US$0.53) per share, 1.5 times higher than the beginning of November. After the sale, KIM is expected to collect about VND18 billion.

The South Korean fund sold nearly 4 million shares of Nam Kim Group in mid-August, equivalent to over 9.1 per cent of the steel company’s capital.

In early April, Dragon Capital fund group also divested tens of millions of NKG shares and is no longer a major shareholder since April 10.

The constant withdrawal of foreign funds caused the foreign ownership ratio in Nam Kim Group to decrease from 38 per cent in April to about 11 per cent as at present.

In Q3, Nam Kim Group recorded a 10 per cent increase in net revenue, reaching VND3.37 trillion and a profit of 13.3 times higher than the same period last year, reaching nearly VND83 billion.

Accumulated profit in 9 months was over VND141 billion, 3.5 times higher than the same period last year and fulfilling 71 per cent of yearly plan.

Recently, the company approved a plan to pay a dividend for 2020’s first phase in cash in advance at the rate of 3 per cent.

Foreign fund continuously divests from Mobile World

Pyn Elite Fund has divested capital from Mobile World Investment Joint Stock Company (MWG), said Viet Nam Securities Depository (VSD).

Pyn Elite Fund, a Finnish fund which focuses on Vietnamese shares, has transferred more than 6.45 million MWG shares to JP Morgan Securities PLC.

With MWG now being traded at a market price of over VND110,000 (US$4.77) per share, the above transfer deal is worth more than VND700 billion.

MWG was previously Pyn Elite’s largest investment for many years, but the foreign fund has continuously sold a large amount of MWG shares since the end of 2019. Particularly at the end of 2019, the fund sold nearly half of the MWG shares they were holding, earning trillions of Vietnamese dong.

According to the September portfolio report, the investment proportion at MWG still accounted for 5.56 per cent of Pyn Elite’s net asset value, equivalent to 24.8 million euros ($29.7 million). However, by October, this investment was no longer in the fund’s 10 largest portfolios.

To replace the investment at MWG, this foreign fund has continuously increased the proportion of investments in banking stocks such as VietinBank (CTG) and MBBank (MBB).

The current largest investment of Pyn Elite in Viet Nam’s market is into the Viet Nam Engine and Agricultural Machinery Corporation (VEAM), accounting for 10.4 per cent of the fund’s total net asset value.

Followed by three investments in three domestic commercial banks including VietinBank (9.6 per cent); HDBank (9.3 per cent) and TPBank (8.7 per cent).

In the fund’s 10 largest portfolios, there are currently five investments in the financial and banking sector. In addition to the three above banks, the fund also invests in Military Bank (MBB) (4.7 per cent) and Viet Capital Securities Company (VCI) (3.5 per cent).

MWG reported net revenue in the third quarter of over VND25.7 trillion, up 3 per cent over the same period last year. The after-tax profit earned in the quarter was VND951 billion, also up by 11 per cent.

In the first nine months of the year, the company recorded over VND81.3 trillion in revenue, up 6 per cent and after-tax profit reached nearly VND3 trillion.

Compared to the plan for the whole of 2020, the group has completed 74 per cent of the revenue target and 86 per cent of the profit target.

MWG is among the fastest growing stock group in the past three months with an increase of nearly 60 per cent. Each MWG share is currently being traded at around VND115,500.

Source: VNA/VNN/VNS/SGGP/VOV/NDO/Dtinews/SGT/VIR