During the period, total import-export revenue through border gates in Lao Cai reached over 11 million USD, including 2.4 million USD worth of imports, mainly fertilisers and farm produce, and 8.8 million USD worth of exports, mostly agricultural products.

In 2020, despite the impact of COVID-19, the Border Gate Customs Sub-Department under the Lao Cai Department of Customs completed its “twin targets” by processing customs clearance declarations for 516 businesses with import-export value of over 1 billion USD and ensuring safety from the pandemic.

In 2021, it will closely coordinate with other sectors to speed up administrative reform while exhibiting better performance in e-customs clearance activities to save time and cost, ensuring economic development and COVID-19 prevention and control at the same time./.

Local automobile group exports over 200 units, parts

Automobile producer THACO recently shipped more than 200 Kia vehicles and auto parts to Thailand, Myanmar, Japan, and the Republic of Korea (RoK).

The conglomerate’s largest export consignment to date, made on February 17, comprised of cars, buses and semi-trailers manufactured at its factories at the THACO-Chu Lai Industrial Park in central Quang Nam province.

The exports included 80 Grand Carnival cars to Thailand, the company’s seventh consignment to its partner, Yontrakit, since December 2019.

One hundred and twenty Kia Soluto cars were shipped to Myanmar, the sixth batch to this market.

Kia cars manufactured by THACO are increasingly appreciated by customers in ASEAN countries since their quality is equivalent to those made in the RoK and meets global Kia standards, while their prices are very competitive.

In 2021, THACO plans to export 1,480 automobiles to Thailand and Myanmar, expand exports to other markets, and gradually achieve its goal of becoming a production and export base for Kia Motors cars and spare parts in the ASEAN region.

This is THACO’s first export of semi-trailers to Japan, one of the most challenging markets in the world with stringent quality requirements.

Regarding semi-trailers, this is the first batch exported to Japan, which is a market with strict requirements on quality standards. After surveys and technical discussions of developing semi-trailers in Japan, the partner has cooperated with THACO in manufacturing and exporting semi-trailers to the country.

This time THACO also exported buses to Thailand via VOLVO Group’s VOLVO Buses Corporation, one of the world’s biggest manufacturers of large buses.

THACO buses were selected by VOLVO Buses for shipping and distributing in Thailand since they met all requirements in terms of technology, quality, safety, and competitive prices and Thailand’s standards and certification requirements (with respect to design, size, ECE certificates, and others). The company uses over 60 per cent locally made parts.

The shipment kicked off THACO’s plans to export 66 buses to Thailand and South Korea this year.

In addition to cars and semi-trailers, auto parts too were exported to the RoK, including seat covers, gearshift covers, air-conditioning radiators, and specialised vehicle components for Hyundai Santafe. The consignment was worth 200,000 USD.

With the import tax on CBU cars within the ASEAN bloc scrapped since the beginning of 2018, many car assemblers in Vietnam have switched to importing and distributing cars, whereas THACO has been expanding production and increasing the use of local parts to serve its strategy of exporting to Southeast Asia.

This year THACO will continue to export to existing markets Thailand, Myanmar, the Philippines, the US, and Japan and expand to other ASEAN countries, with a total of 2,500 vehicles. It expects to earn 30 million USD from exports of auto parts and other mechanical products.

Exports of large numbers of cars since last year have attested to the fact that cars made in Vietnam can compete in foreign markets, which is gradually helping raise the country’s profile in the global market.

THACO plans to increase exports to ASEAN and enter new markets in Africa, West Asia, South Asia, Australia, and elsewhere./.

Dinh An Economic Zone - driving force for Mekong Delta region

The Dinh An Economic Zone in the Mekong Delta province of Tra Vinh is one of eight coastal key economic zones in Vietnam. With an orientation to develop a multi-sector economic zone associated with sustainable marine economic development, Dinh An has focused on investment to become an economic driving force of the province and the Delta.

This is one of the first 5 wind power projects in Tra Vinh province and built at the Dinh An Economic Zone. The project has a capacity of 48 MW and is expected to be put into operation in April.

Dinh An has attracted nearly 50 projects to date with total investment capital of about 6.7 million USD. It is expected that by 2030 it will contribute up to 80 percent of the provincial budget.

Dinh An also has a strategic position in economic development associated with security and defence. Despite its huge potential, however, investment attraction in the zone is still lower than its potential.

Existing bottlenecks are hindering the Dinh An Economic Zone from becoming a driving force for economic development in Tra Vinh and the Mekong Delta as a whole./.

Conference discusses role of Vietnam in Asia-Europe partnership

A conference has been held in Moscow to discuss the outlook of the Eurasian Economic Union (EAEU) and the role of Vietnam and Belarus in the expansion of the Asia-Europe development space.

Addressing the event, President of the “Asia-Europe House” Association Alexander Makhlaev highlighted the role of Vietnam's traditional values in the country’s development.

He held that the political stability has paved the way for Vietnam’s economic development.

Meanwhile, Natalya Ivanova, an expert from AV Group, underlined the significance of international business environment in the integration process of each country.

She asserted that the EAEU is creating a new motivation, especially for the strengthening of cooperation among member countries as well as with partners, including Vietnam.

According to Chairman of the Council of Experts of the Eurasian Research Fund Grigory Trofimchuk, Vietnam, a dynamic developing country and a member of many integration mechanisms and international organisations, is working hard to speed up integration process.

Vietnam is the first partner to sign a free trade agreement with the EAEU in 2015, he noted, adding that the union should focus more on partnership with Vietnam as the country is a door to the world.

The official highlighted the dynamism of Vietnamese firms in Russia as well as other countries in the world. However, he said that Vietnam and the EAEU have yet to optimise each other's advantages and potential, while a number of trade barriers between the two sides are still existing.

He held that both sides should discuss the maintaining of trade defence measures to increase trade in the future, adding the EAEU should show its advantage in the current period when the COVID-19 pandemic is developing complicatedly in the world.

Within the conference’s framework, Trofimchuk introduced his book entitled “Vietnam wings up”, expressing his hope that the book will help Vietnam and Russia become closer together in economy, trade and humanity./.

Investment booms as Soc Trang improves business climate

Soc Trang province's efforts to improve its business climate is paying off with more and more investors, both domestic and foreign, coming since 2016.

The Mekong Delta province has worked with hundreds of potential investors seeking to invest in areas where the province has strengths like hi-tech agriculture, tourism and wind and solar power.

It approved 116 projects with a total investment of 27.3 trillion VND (1.18 billion USD) in 2016-20, 5.5 times the amount in the previous five years.

Nine of them are FDI projects.

Soc Trang authorities have been making efforts to improve the investment climate and provincial competitiveness by focusing on infrastructure and providing lands for projects.

They are keen on projects that are sustainable and environment-friendly.

Nguyen Thi Thuy Nhi, deputy director of the province’s Department of Natural Resources and the Environment, said her department had been reforming administrative procedures, boosting the province’s competitiveness in terms of attracting investment and business climate.

One key infrastructure project is the upgrade of Tran De deep-water port, which will reduce logistics costs for exports from the Mekong Delta.

The recently approved Chau Doc - Can Tho - Soc Trang highway will connect to the port, aiding goods transportation and improving links with the rest of the country.

The province is also creating a start-up eco-system with development assistance, incubation programmes and sponsorship for creative small and medium-sized businesses.

In the last five years 1,900 new businesses were set up, a 47.2 percent increase from 2011 – 15. Many companies have invested in manufacturing in the An Nghiep Industrial Park, creating tens of thousands of jobs.

In 2021 – 25 Soc Trang seeks to further improve its business climate and competitiveness, focusing on business assistance services, labour training and helping investors start projects smoothly.

There are 3,300 registered businesses in the province with a total charter capital of 33 trillion VND.

Soc Trang’s economy grew by 6.75 percent in 2020./.

|

|

|

Legal move supports realty market development in 2021

Vigorous legal changes regarding real estate investment and construction are set to beef up the realty market in the Year of the Buffalo.

The prime minister has just greenlit an economic security project on housing and real estate aimed at ensuring social well-being and helping the market to develop sustainably.

According to Ha Quang Hung, deputy head of the Housing and Real Estate Market Management Department under the Ministry of Construction, many policies regulating housing and real estate market growth have been improved and aligned with the current regulatory system on investment, construction, and doing business.

Significantly, the Law on Construction 2020 has been united with the Law on Housing, Law on Real Estate Business, and the Law on Environmental Protection regarding investment proposal approval, investor approval, or developer recognition, creating a healthier and more transparent investment environment while mitigating speculation and price manipulation activities.

“In 2020, despite the impacts of COVID-19, the real estate market still managed fair growth of about 8-11%, if indirect factors like capital, land, and building materials were taken into account,” said Hung.

Le Hoang Chau, chairman of the Ho Chi Minh City Real Estate Association opined that several revised laws (Law on Investment, Law on Securities Business, and Law on Enterprises) coming into force from January 2021 have bolstered market growth.

“The realty market has undergone the most difficult period and will gradually rebound. Positive legal changes would motivate firms to join the affordable housing and mid-level segments more robustly,” he said.

From another angle, Su Ngoc Khuong, senior director at Savills Vietnam, a leading real estate consultancy firm, noted that the success of the 13th National Party Congress would bring vitality to the whole economy, particularly the real estate, especially in Ho Chi Minh City and Hanoi – Vietnam’s two growth engines.

The new "city in city" urban form of in Ho Chi Minh City is deemed an inspiring breakthrough, whereas in Hanoi transport infrastructure has witnessed noteworthy improvements.

In addition, experts assumed that fiscal and monetary policies in the past decade have proven successful, with well-controlled interest rates.

Nguyen Van Dinh, deputy general secretary of the Vietnam Real Estate Association (VNREA), outlined two scenarios for market development in 2021.

In the first scenario, with the mindset “cash is king” lingering in the first and second quarter of 2021, the market will be full of challenges due to low transaction volumes. COVID-19 will only be contained by the middle or the end of the first quarter with no new infections reported, allowing the market to gradually rebound.

In the second scenario, the pandemic would drag on to be contained no sooner than June. In this scenario difficulties would continue mounting. Accordingly, housing prices in the primary market are expected to shed an average 5% compared to last year, with sales volumes taking a plunge.

For commercial real estate, the lingering pandemic would lower operation efficiency as well as occupancy rates, while resort real estate would remain in “hibernation” the way it was in early 2021.

The latest report by Colliers International Vietnam forecast that more than 4,000 shop houses would be released in the Ho Chi Minh City market in 2021. The birth of Thu Duc City would fuel the development in the city’s northeast. Colliers data also show that products from six projects in Thu Duc, Binh Chanh, and Nha Be districts will enrich supply in the upcoming time.

Businesses urged to capitalise on opportunities to increase exports

Local businesses have been advised to diversify their markets to intensify import and export activities this year, alongside maximising the benefits of free trade agreements (FTAs), restructuring export products, developing stronger brands, whilst grasping market information and changes in the policies of importers, according to insiders.

With an impressive trade surplus of over US$19 billion last year, the industry and trade sector aims to increase the total export turnover for this year by between 4% and 5%, with the country’s trade surplus anticipated to maintain its momentum.

Despite this, Vietnamese exports this year are largely dependent on the prospects of the global economy, particularly if the novel coronavirus (COVID-19) pandemic can be brought under control.

With regard to the export situation in the year ahead, Vu Duc Giang, chairman of the Vietnam Textile and Apparel Association (VITAS), said textile and garment exports this year will continue to face numerous difficulties ahead in the post-pandemic period. In line with this, Vietnam is likely to export goods worth between US$37 billion and US$38 billion providing that the pandemic is brought under control globally.

Giang pointed out that over the long-run, the Vietnamese garment and textile sector will continue to encounter challenges over the subsequent three years, noting that exports to major markets gradually return to a normal state once the pandemic is successfully curbed by the end of the third quarter of 2023.

He emphasised that new-generation FTAs, especially the EU-Vietnam Free Trade Agreement (EVFTA), the Regional Comprehensive Economic Partnership (RCEP), and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) can be expected to boost exports moving forward.

Experts have therefore attributed these difficulties to the current low level of market diversification among some agricultural and aquatic products, pointing out that although several products enjoy a tariff reduction of 0%, a number of domestic agricultural products have been not been allowed to gain entry into some markets.

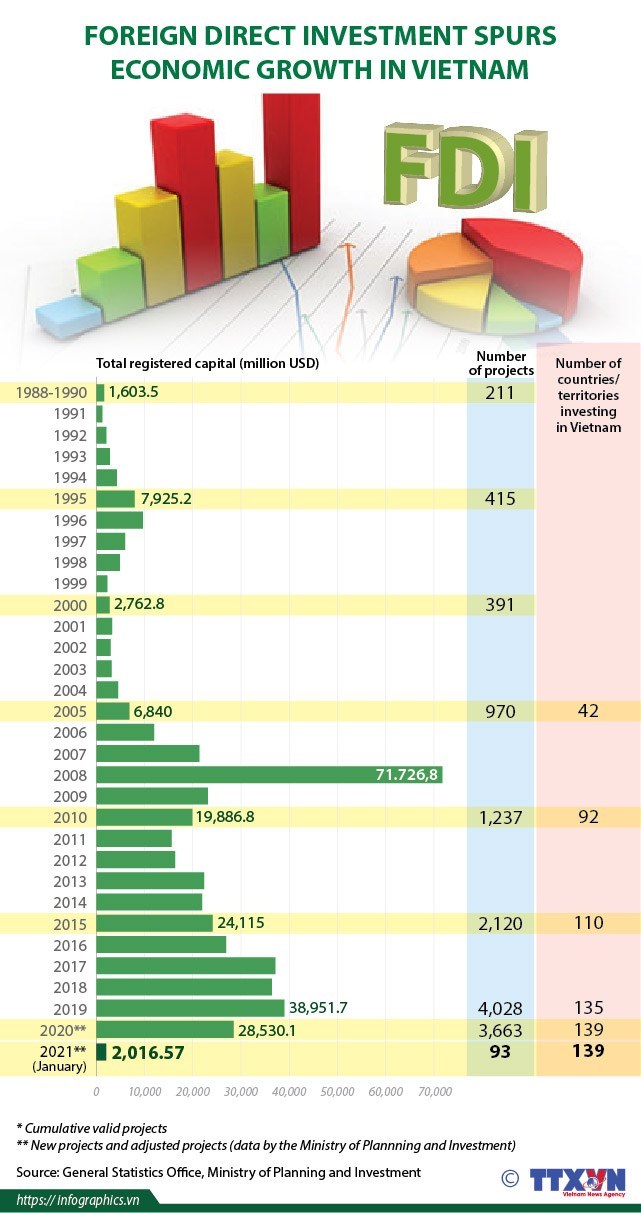

Furthermore, despite the proportion of the FDI sector’s export value decreasing in recent years, it accounts for over 64% of the country’s total export value. This is due to the sector’s production and export activities being largely dependent on regional and global supply chains.

Moreover, the impact of the rising trend of protectionism, trade conflicts, and complicated developments of the COVID-19 pandemic globally have changed the structure of global supply chains, with several countries, especially the United States and western nations, strengthening trade protectionism measures.

Phan Thi Thanh Xuan, vice president and General Secretary of the Vietnam Leather, Footwear and Handbag Association, revealed that the leather and footwear sector has made the best use of the EVFTA, adding that the industry’s exports are poised to grow by between 15% and 20% this year if the COVID-19 epidemic is successfully contained.

Xuan underlined the need to devise stronger policies aimed at accelerating the development of the local supporting industry so it can independently produce raw materials and avoid a heavy reliance on imports.

In an effort to maintain the export growth in the year ahead, the Ministry of Industry and Trade is expected to help businesses take full advantage of opportunities from FTAs by removing barriers for market expansion and keeping a close watch on the developments of the COVID-19 pandemic in order to take timely response measures.

She pointed out that new generation FTAs such as the CPTPP and the EVFTA are expected to provide fresh impetus to export growth over the coming year thanks to tariff incentives, adding that the shift in FDI investment flow from regional countries to the nation, along with the restructuring of supply chains, will also contribute to boosting exports this year.

Key solutions that can promote import and export activities moving forward will largely focus on diversifying markets, maximising the benefits from relevant FTAs, restructuring export products, developing brands, whilst grasping market information and changes in policies of importers, Xuan noted.

Deputy Minister of Foreign Affairs Le Hoai Trung also underscored the importance of opportunities brought about by FTAs while urging the local ecnonomy to improve its autonomy to prepare for any worse-case scenarios and utilising the system of commercial counselors to perform tasks in line with these changes.

Minister of Industry and Trade and deputy head of the Party Central Committee's Economic Commission Tran Tuan Anh, said there will be a positive outlook for the country in the years ahead thanks to favourable conditions from integration strategies and the enforcement of FTAs.

In addition, the Government’s schemes on economic restructuring, social security, reforms, open-door policies, and efforts to fine tune the legal system will also be beneficial.

Domestic food and beverage industry has development potential

The domestic food and beverage market has great potential for development despite the difficulties caused by the COVID-19 pandemic, according to experts.

Hanoi - The domestic food and beverage market has great potential for development despite the difficulties caused by the COVID-19 pandemic, according to experts.

Food and beverages are in the fast-moving consumer goods (FMCG) category. For many years, this has always been one of the important economic sectors with great potential for development, according to the Vietnam Report 2020.

The food and beverage market’s growth rate is forecasted to reach from 5-6 percent annually in 2020-2025.

Despite suffering negative impacts from the COVID-19 pandemic, the food and beverage industry in Vietnam also has many strong growth opportunities. At present, more and more consumers pay attention to nutritional foods of plant origin, organic foods or food with healthy ingredients.

A survey conducted by Vietnam Report at the end of 2020 showed due to COVID-19, half of customers have spent more on foods boosting their immune system and clean foods. Meanwhile, 63.7 percent of customers have cut spending on alcohol and beer. Therefore, businesses in this industry must adjust their production to suit demand.

Food businesses have to increase their production capacity by about 30 percent, while beverage businesses must reduce their production to lower than 80 percent compared to before the pandemic.

Besides that, Vu Dang Vinh, general director of the Vietnam Assessment Report Joint Stock Company, said COVID-19 has forced nearly 70 percent of food and beverage businesses to focus on the digital transformation for survival and development, reported the Vietnam News Agency.

Many businesses have built modern technology processes in production and management. Food and beverage companies have also sped up investment activities to renovate the distribution system and adjust the proportion between traditional and modern trading channels. They develop applications to enhance the customer experience when shopping and innovate packaging design, eco-branding and product line development.

Nguyen Dang Quang, chairman of Masan Group, said the COVID-19 pandemic is a good opportunity to promote e-commerce.

The group is building plans to attract more and more people to online shopping, he said.

Vinh said food and beverage businesses need to focus on strategies such as revenue growth, market development, promotion of research and improving product quality. They should also diversify supply sources with priority for domestic suppliers and develop online distribution channels on e-commerce platforms.

According to experts in the food and beverage industry, the stable macroeconomy and commitments in free trade agreements signed between Vietnam and its partners such as the European Union-Vietnam Free Trade Agreement (EVFTA) and the Comprehensive and Progressive Trans-Pacific Partnership (CPTPP) would bring export opportunities and more foreign investment. They would promote the transfer of technology and technological advancement in the industry.

Along with that, the food and beverage companies need to improve their competitiveness and increase investment in infrastructure systems and modernisation of production processes and corporate governance.

Foreign investors divest Ninh Van Bay due to bleak performance

Two foreign investors, namely Recapital Investments Pte., Ltd and Belton Investments Ltd., decided to divest Ninh Van Bay Travel Real Estate JSC, the developer of Six Senses Ninh Van Bay Resort in Nha Trang.

Notably, Recapital Investments Pte., Ltd. issued an announcement to sell 10.7 million shares at Ninh Van Bay Travel Real Estate to decrease its ownership from 11.9 per cent to zero. Recapital Investments is an investment fund owned by Rosan P. Roeslani, the former president of Inter Milan football club.

Besides, Belton Investments Ltd. has also registered to sell its entire 6.4 million shares, equaling 7.07 per cent of the stake, in this company. The sale is expected to be completed between February 5 and March 1.

Previously, in 2013 Recapital Investments bought 30 million shares at the price of VND7,500 (32.61 US cents) apiece. Belton Investments has been a large shareholder since 2012. However, since 2019, both investors started to decrease their ownership in Ninh Van Bay Travel Real Estate.

The reason for the divestment may be the bleak business results of Ninh Van Bay.

Notably, the company listed its stake on the Ho Chi Minh City Stock Exchange in 2010 with the initial price of VND30,000 ($1.30) apiece, however, the stocks plunged to VND1,000 (4.35 US cents) apiece in 2017. Besides, the company suffered a loss of VND479 billion ($20.83 million).

After two years of restructuring, the company reported a profit of VND27 billion ($1.17 million) in 2019, more than 13 times the figure of VND2 billion ($86,960) in 2018. In 2020, the company acquired VND211 billion ($9.17 million) in net revenue, down 24 per cent on-year. The main reason for this bleak business result came from the impact of the COVID-19 pandemic.

At present, Ninh Van Bay stocks are traded at VND5,680 (24.70 US cents), rising 22 per cent over the past three months.

Upbeat export-import picture in early 2021

Many of Vietnam’s growth engines have posted impressive export-import performance, with Ho Chi Minh City, Bac Ninh, and Binh Duong being the top performers.

The latest statistics from the Vietnam General Department of Customs show that the country raked in $55 billion in total export-import turnover in the first month of 2021, a 48 per cent jump on-year.

Many localities have posted fairly impressive growth in their export import value compared to the corresponding period in 2020 despite the impacts of the recent COVID-19 reemergence.

Leading the list is Ho Chi Minh City which counted $8.9 billion in total export-import value, followed by Bac Ninh with $7.7 billion, Binh Duong with $5 billion, Thai Nguyen with $4.4 billion, and Hanoi with $3.8 billion.

Many localities have posted fairly impressive growth in their export import value compared to the corresponding period in 2020 despite the impacts of the recent COVID-19 reemergence.

It is noteworthy that Hai Duong province – the epicentre of the current COVID-19 resurgence – posted more than $1.3 billion in total export-import value in January 2021, with export value reaching $754 million and import value surpassing $568 million. Compared to the same period in 2020, its export value jumped nearly 37 per cent and import value picked up about 23 per cent.

This is an impressive performance as Hai Duong needs to ramp up efforts to carry out the dual target of preventing and curing COVID-19, while still ensuring socio-economic development.

Last year, the province attracted nearly $7.76 billion in total export value and more than $6 billion in total import value, and carved out a place among the localities with biggest export-import value in the northern region.

Quang Ninh, Lao Cai, and Lang Son (the major export players) have increased business even during the Lunar New Year holiday. For instance, on the first three days of the new year, the Lao Cai International Border Gate’s Customs Bureau had completed customs clearance for 4,000 tonnes of export-import goods valued at more than $2 million.

In Ho Chi Minh City, right on the eve of the Lunar New Year, Saigon New Port Corporation conducted a ceremony to receive goods marking the New Year of the Ox.

In 2020, the cargo volume calling on Ho Chi Minh City’s Cat Lai port rose 8.2 per cent, making it one of the top performers worldwide in cargo throughput volume. This year, the cargo volume through Cat Lai port is expected to surge 5 per cent.

More than 7,000 tonnes of goods passed through each day Mong Cai International Border Gate Customs Bureau under Quang Ninh Customs Department during the Lunar New Year holiday.

The Ministry of Industry and Trade forecast that export business would maintain its growth momentum in February, especially in localities hosting the manufacturing complexes of South Korean tech giant Samsung Group, leveraging the proliferation from January 2021. The exports of handsets and accessories could lift up, capitalising on Samsung’s fresh roll-out of new items such as Samsung Galaxy S21, Samsung Galaxy S21 Plus, and Samsung Galaxy S21 Ultra.

Larger frame of mind for logistics

Throughout more than three decades of economic reform, Vietnamese companies from many sectors have been venturing abroad and become role models. Yet, the logistics sector remains too focused on the domestic market. Tran Thanh Hai, deputy director of the Ministry of Industry and Trade’s Agency of Foreign Trade, emphasised that local players should follow regional examples and take their business to international arena.

Last year, the whole world suffered the consequences of the lasting pandemic, with even Vietnam facing economic uncertainties and natural disasters in the central region, causing huge damage to livelihoods.

In this context, logistics activities were affected significantly, with railways, roads, and air transport being the most heavily affected, while waterways and warehouses remained largely unscathed and even saw growing business due to rising inventory.

Different from five years ago, logistics have been given due attention by all state levels, as shown in the directive documents of the government, ministries, and branches, that all considered logistics a crucial aspect of the economy. From there, policy changes and significant investments in infrastructure could be accomplished, along with the easing of administrative procedures for businesses in this sector.

However, one of the current challenges is the lack of large-scale Vietnamese enterprises with influence in the logistics industry, while large foreign-invested enterprises (FIEs) such as FedEx, UPS, and DHL from the United States and Europe dominating the country’s logistics sector.

In Vietnam, telecom, real estate, and manufacturing enterprises have built outstanding businesses that drive their respective industries. Within the logistics sphere, however, there is no such role model.

Companies like Saigon Newport, Gemadept JSC, Transimex JSC, and Sotrans Co., Ltd. are contributing their share but can hardly be called outstanding yet. The general picture of today’s businesses is stiffening, with competing FIEs operating in Vietnam, while those from other countries are integrating into global markets.

Additionally, the domestic logistics sector remains rather small with limited international operations, while this industry is really about going global and partaking in imports and exports. So far, the number of Vietnamese enterprises operating in foreign markets is also small, with even the bigger names not providing services to foreign markets. In the era of global integration, we must go to the world to develop, and thus this remains the Achilles heel of the domestic industry. Moreover, weak links with other service providers elsewhere have not been established and utilised sufficiently. Although Vietnamese manufacturers have been able to export goods to Europe in large volumes, there is no logistical presence of local companies.

As such, logistics groups stop all operations at Vietnam’s gates, after selling and delivering goods to customers, resulting in low added value and a lack of competitiveness against foreign counterparts.

Against this backdrop, the largest difficulties relate not to capital but to the awareness of Vietnamese entrepreneurs, who are typically shy in new environments, especially when confronting foreigners. Many businesses dare to run their operations but mostly focus on the domestic market as they feel that doing business in their own country is easier. Problems here can be handled the familiar Vietnamese way, while they would have to follow foreign rules outside and establish new personal networks and relations. Within the current logistics community, FIEs and state-owned enterprises are relatively stable, but the private sector consists mainly of small-scale businesses, with some newly established or separated from others.

In Vietnam, the number of FIEs is increasing constantly, with nearly 40 multinational corporations and many smaller ones present in the market. However, companies from Japan and South Korea are very ethnocentric and prefer to use the services of their country’s enterprises, which support and protect each other. Meanwhile, European and American businesses are somewhat more open-minded. They use traditional services but do not pay much attention to their partners’ country of origin. Multinationals have financial advantages, so it is easier for them to establish a foundation and attract high-quality human resources than it is for domestic ones. They also make great use of experienced CEOs.

The great advantage of FIEs is their cooperative relationship with partners worldwide. From these relationships, they provide most of the services requested by manufacturers at competitive prices. The service quality of these enterprises is often at a higher level than that of domestic ones, reflected in their professionalism, the assurance of standardised service quality, and strict rules and norms, which provide credibility for these businesses.

Those businesses also pay special attention to customer care and focus on the long-term benefits, instead of immediate returns. Therefore, at some stages, they even accept losses to win customers’ sympathy and build a reputation. Meanwhile, some Vietnamese businesses follow a fast-paced approach that aims for quick profits rather than long-term relationships and market presence. Such a mentality will also not pay attention to quality.

Models to follow

According to one of the prime minister’s decisions, it is a crucial task to form strong logistics groups and leading companies. Vietnam has a convenient location, with a long coastline, and the entire facade of the Southeast Asian peninsula serves not only as a service point for transit to and from China, Laos, Thailand, Cambodia, and Myanmar but is also a stopover transshipment point for major transports from Europe to Australia and from Northeast Asia to South Asia. Currently, the other regional countries take advantage of this though they do not have the same premises as Vietnam.

With a growth rate of 12-14 per cent per year, Vietnam’s logistics sector is growing, albeit merely gradually. It may take another 5-10 years to see strong differences today. As this speed remains slow, Vietnam’s logistics needs to go faster to avoid lagging behind other countries.

Up to now, Vietnam’s logistics growth has mainly relied on the scale of commodity production, consumption, and import-export, which are natural factors for growth advantages. However, these are not intrinsic factors of the logistics sector, they are just objective ones.

If one of these factors changes – such as COVID-19, natural disasters, and the declining domestic demand – the sector’s growth will suffer if it is not well established in foreign markets.

Thus, Vietnamese groups need to step out of their comfort zone, adapt quickly, and avoid thinking of themselves as small and inferior. Small does not mean weak.

At present, Vietnamese enterprises focus only on the domestic market, and give little thought to venturing abroad. Meanwhile, I am confident that Vietnam’s logistics can provide decent services to the regional market, such as Laos, Cambodia, and Thailand – all of which are close by and of similar development levels. Vietnam already has top enterprises in leather, footwear, steel, and automobiles. Thus, the logistics sector can build on their experience and develop leading groups from those sectors.

Singapore can also be a good example for Vietnam. Its government was determined to put all its advantages into developing the logistics sector and to turn Singapore into the largest transshipment port in the world. To do that, Singapore has largely sacrificed marine tourism. Nowadays, the island nation is housing some of the leading enterprises in logistics fields. It boasts PSA Co., Ltd., the world’s largest port operator, which also has a joint venture in Vietnam’s Cai Mep port complex in the south.

In the aviation industry, it has Singapore Airlines – a 5-star airline which for many years maintained its position as the world’s leading airline. Before the pandemic hit, Changi Airport was consistently one of the busiest airports in the world.

Another model is Taiwan, which has strong logistics development. Of course, there are also more developed economies like Japan or Germany whose level of development is already at a much higher level. The country needs it, the government needs it, and the businesses that want to grow strong also need to be bold and venture abroad with an outward-looking spirit. Vietnam opened its doors to global integration 35 years ago, but it is now up to businesses to step out or not. The government alone cannot do this.

Vietnam's mobile devices reached the export value of $51 billion last year

Mobile devices and components produced in Vietnam last year were exported to 50 markets and reached the export value of more than $51.18 billion, according to the latest data published by the General Department of Vietnam Customs.

In comparison with 2019, export value was slightly down 0.4 per cent. Nevertheless, it is still one of the Vietnamese economy’s main sectors by occupying nearly one-fifth (18 per cent) of the export value.

China remained the largest consumption market for the goods category with $12.34 billion, making up 24 per cent of Vietnam’s export turnover from mobile phones, and up 48.8 per cent on-year. Europe was the second-largest export market with a turnover of $9.9 billion, up 18.9 per cent on-year.

The runners-up were the US, South Korea, and the United Arab Emirates with $8.79 billion, $4.58 billion, and $2.53 billion. In addition to China, other markets like Hong Kong, Canada, and Japan last year increased their purchasing of mobile devices and components from Vietnam by 44.14 per cent to $1.73 billion, 34.3 per cent to $826.23 million, and 16.5 per cent to $937.75 million, respectively.

2020 is the first year Vietnam has seen a plunge in the export turnover of mobile devices and components. Over the previous 10 years, the sector has been going from record to record, even recording triple-digit growth in a few years like in 2011 when it hit 178.3 per cent.

Thanks to that, mobile devices and components exceeded garment and footwear production to become the sector with the largest export value for Vietnam, mainly driven by foreign-invested enterprises, lead by Samsung. To date, about 60 per cent of the South Korean giant’s items are produced in Vietnam.

Impetus for rubber suppliers to bounce back even higher

Although expectations for an increase in rubber prices remain low, the recent spikes have left rubber growers in Vietnam less worried. Nevertheless, to cash in on the recovering carmakers and other industries after the pandemic, as well as compete with regional rivals, local latex gatherers may need to step up their game and apply for official certificates.

More than an hour’s drive from Pleiku, the capital of the Central Highlands province of Gia Lai, small roads are running through immense rubber forests. The town of Ia Kha is crowded with more than 8,000 people, but unlike in the past, these people are less occupied with farming than before.

Ro Mah Kiu, a worker in the 15 Corporation at 74 Company, often wakes up at 3am to scrape latex. When he was still farming, he lacked the necessary skills, often left behind a wasteland, and struggled all year round. As his life remained difficult, Kiu became worried about his future.

Eventually, he joined 74 Company’s local farmer support group to focus on latex extraction. But it was not easy to become a latex farmer. Proper care for mature rubber trees is tricky and learning the right technique for extracting the latex from the tree even more so.

The pandemic caused a scarcity in labourers and made it difficult to gather and process latex. Colonel Hoang Van Sy, commander of the 15 Corporation, told VIR, “The recruitment of new workers is cumbersome. Workers lost their jobs in other industries and returned to their localities in huge numbers, but after being recruited for latex exploitation, it always takes a lot of time training for them to become skilled enough for the job.”

In addition, between 2018 and 2019, the corps saw nearly 3,000 workers reaching retirement age, leaving a hole in the corps’ workforce that has yet to be filled.

Unlike in many other sectors, workers in the rubber industry are not just dependent on markets but also the weather, which sometimes leads to heavy impacts on price calculation.

“We are forced to cut input costs to a minimum, from over VND50 million ($2,175) per tonne of latex to VND32 million ($1,400) to reduce the pressure on prices,” Sy said.

The long chain of declining prices in the rubber sector had lasted for nearly 10 years, with few people thinking they would ever bounce back. However, in the last months of 2020, rubber prices at the Osaka exchange – the reference for the natural rubber market in Europe and Asia – experienced nine consecutive gains. On October 28, the most-traded April 2020 futures contract increased by ¥20 (19 US cents, equalling 7.9 per cent) to ¥274.3 ($2.65) per kilogramme, the highest closing price since March 2017. The increase in this session was also the highest since the end of 2008.

Reversing prices for rubber can be easily envisioned in a period of economic development, but with 2020, a year of stagnation and economic decline amid the pandemic, market interference from the Chinese market becomes more apparent. Statistics of the Chinese Customs Department said that in the first 11 months of 2020, China’s rubber imports reached $9.76 billion, up 4.5 per cent compared to the same period in 2019.

The staggering market recovery can also be explained by the fact that rubber production in China last year dropped by 30 per cent on-year, due to massive storms on Hainan Island and droughts in Yunnan province.

China has seen a significant increase in imports with only a gradual decrease in consumption. The 11-month data of Vietnam’s Ministry of Industry and Trade shows that China spent $4.34 billion, up 35.2 per cent over the same period in 2019, for the import of a popular mixture of natural and synthetic rubber.

Meanwhile, the Chinese auto industry – one of the key sectors for rubber consumption – remained on a downturn due to the global health crisis. Although the situation is slowly improving, the China Association of Automobile Manufacturers estimates that sales in 2020 dropped by 10 per cent, much lower than forecast.

The ability for rubber prices to recover globally stands in stark contrast to the decrease in supply. The Association of Natural Rubber Producing Countries (ANRPC) predicts that in 2021, global rubber production could recover to around 13.7 million tonnes, an increase of 8.6 per cent compared to last year. However, even with this increase, 2021’s production would still be lower than that of 2019 and 2018, with about 13.8 million tonnes.

Rubber production across Southeast Asia, which accounts for two-thirds of global natural rubber supply, has been severely affected by labour shortages due to the pandemic, natural disasters, and other disadvantages. The demand-supply gap is widening, while rubber traders fear the supply shortage will be further exacerbated by the continuing political instability in Thailand and the uncontrolled pandemic.

According to the ANRPC, 2020’s production decreased by about 6.8 per cent compared to 2019, to 12.9 million tonnes, mainly due to the decline in Thailand and India, of which Thailand’s output decreased by about 332,000 tonnes. This corresponds to the forecast of the Rubber Authority of Thailand on last year’s production, which was already estimated to be about 10 per cent lower due to the constant rains in the south of the country.

In Vietnam, the trend of decreasing latex plantation areas is also apparent at some large suppliers.

Dong Nai Rubber Co., Ltd., which had specialised in natural rubber supply, has started its plan to reduce 40-50 per cent of its exploitation and preliminary processing by 2025 to switch into fields with higher margins. According to Do Minh Tuan, general director of Dong Nai Rubber, latex exploitation so far contributed around 70-75 per cent of the company’s revenue. Last year, the firm even recruited 250 more locals as workers but remained unable to make up for the shortage to meet production goals.

Less worried farmers

Data from the Vietnam Rubber Association shows that the development of national plantations for rubber has expanded the area to nearly one million hectares, of which nearly 70 per cent is meant for direct latex extraction with an estimated output of about 1.1 million tonnes per year, making Vietnam the third-largest natural rubber exporter in the world. However, as around 80 per cent of the country’s natural rubber is meant for export and domestic consumption, there is little room left for deeper processing and refining, resulting in excessive dependence on global rubber prices.

Although some multilateral deals like the EU-Vietnam Free Trade Agreement have opened a door for exports to grow, Vietnam’s rubber sector has yet to make real use of these opportunities. The EU market has a large demand for high-end rubber, for which Vietnamese producers could provide the input materials. According to statistics from the General Department of Customs, the European market accounted for merely 5.1 per cent of the total export volume of 1.1 million tonnes of rubber within the first nine months of 2020.

Meanwhile, Huynh Tan Sieu, head of technology and environment at the Vietnam Rubber Industry Group, pointed out that local businesses also miss out on the opportunity to further the competitiveness of Vietnamese rubber in the global market by not applying for the FSC forest management certification, which confirms social and environmental characteristics of a company’s operations.

John Heath, commercial director at London-based natural rubber company Corrie MacColl Ltd., said in January that the European market is currently paying much attention to FSC-certified rubber. His company is distributing about 500 tonnes of certified latex to the European market each month, “a very small fraction of the growing demand for FSC-certified rubber in this market,” Heath explained.

In response to growing pressure from civil organisations and consumers, companies take more responsibility for supply chains, and Heath said that Corrie MacColl aims to “do the right thing, so it will not buy rubber from customers who cut primary tropical forests to plant rubber.”

Good products and official forest certifications have enabled 15 Corporation to access markets outside of China, led by the desire to reduce the focus on a single export market. As such, customers from Russia, Sweden, India, and Japan are considering buying the company’s latex and rubber.

However, since costs are currently higher for sourcing from the Central Highlands, “sustainable solutions with mutual benefits have to be agreed on,” said Sy of the 15 Corporation.

He hopes that the output of the 40,000ha will suffice this year to reach the targeted 10-15 per cent increase in revenue and secure the jobs of more than 10,000 workers. In 2020, the corporation banked a gross revenue of over VND1.5 billion ($65.2 million).

Vietnam leading car dealers struggle with Covid-19 impacts

While car prices in 2020 were significantly lower compared to the pre-Covid-19 period, customers had become more cautious in spending, leading to an 8% year-on-year drop in car sales to 296,634 units.

Major car dealers in Vietnam, including Savico, Haxaco and City Auto, posted modest return on sales (ROS) of 1-2% in 2020, mainly due to customers tightening their belt amid a difficult Covid-19 year.

“The pandemic had led to fierce competition in car prices, causing a downturn in the company’s business performance,” stated Savico in its financial statement.

Savico, a distributor of major car brands of Toyota, Volvo, Honda, Mitsubishi, recorded the highest revenue among the three with VND16.13 trillion (US$700.2 million), down 12% year-on-year, and profit of VND224 billion (US$9.72 million), or ROS of 1.38%.

While car prices in 2020 were significantly lower compared to pre-Covid-19 period, customers had become more cautious in spending, leading to an 8% year-on-year drop in car sales to 296,634 units, data from the Vietnam Automobile Manufacturers’ Association (VAMA) noted.

City Auto, a major distributor of Ford and Huyndai, suffered a same fate with a decline of 11% year-on-year in revenue to VND5.67 trillion (US$246.1 million) and net loss of over VND4 billion (US$173,800).

Last year, City Auto predicted a challenging year of 2021 for the automobile industry following a sharp drop in market demand.

In a letter to the Ho Chi Minh City Stock Exchange, City Auto attributed its negative business performance to lower car sales volume.

In contrast, Haxaco, a leading Mercedes-Benz car dealer in Vietnam, recorded a rise of 8% year-on-year in revenue to VND5.57 trillion (US$241.8 million) and after-tax profit of VND125 billion (US$5.42 million), up 150% year-on-year.

A senior official at Haxaco said the firm took advantage of the government's policy of reducing 50% of the registration fee for domestically-produced cars to boost sales revenue. However, Haxaco’s ROS remained at a modest rate of 2.24%.

A study from SSI Securities Corporation suggested 2021 could start the upward trend of Vietnam’s automobile industry with a 16.3% year-on-year growth rate in terms of car sales number, citing high demand from the domestic market for cars.

Source: VNA/VNS/VOV/VIR/SGT/Nhan Dan/Hanoitimes