|

Vietnam’s energy sector has seen tremendous growth in the last decade. Generation capacity has grown at approximately 10 per cent each year and the country has achieved 99.2 per cent access to electricity - one of the highest rates in the region.

Looking ahead, Vietnam has also pledged its commitment to the Paris Climate Agreement, setting a target to reduce greenhouse gas (GHG) emissions by 8 per cent by 2030, a number the country believes could increase to 25 per cent if it receives additional foreign investment and support.

The BCG Group believes there are eight things that need to happen to unlock economic value in the range of $30 billion in annual GDP impact by 2030.

Drive cost-competitiveness and greenhouse gas reductions in Vietnam’s oil and gas sector;

Drive energy efficiency across the energy value chain;

Develop a vibrant renewable energy (RE) sector and foster a regional RE champion;

Manage and de-risk under- or over-investment in grid infrastructure;

Develop and accelerate the petrochemicals agenda;

Unlock the full potential of domestic gas;

Provide policy, regulatory, pricing, and investment certainty;

Accelerate technology adoption and Industry 4.0 to enable these priorities.

|

This agenda will require substantial investment - potentially of approximately $100 billion through 2030. However, with this will come new jobs and business opportunities for local firms and investors as well as more sustainable energy sources for the country as a whole.

Local players will have the opportunity to innovate and create new ventures related to renewables, energy efficiency solutions, and technology and digital solutions focused on the energy sector.

Vietnam has four things that can help drive the country’s ambitious energy agenda. Firstly, a successful history in developing the energy sector. Secondly, strong potential in renewables. Third, large potential in domestic gas. And fourth, a national commitment to sustainable development.

Vietnam has done this before, and it has done it well. Historically, it has a strong track record of growing its energy sector.

The BCG Group believes Vietnam should increase its focus on the renewables space. Wind and solar have significant potential but remain relatively untapped.

Total resource potential for solar has been estimated at 204 to 734GW, while the estimated range for wind is from 27 to 133GW.

Even assuming the lower end of these estimates, Vietnam has more than 200GW of renewable resources, or four times the current installed capacity potential, which it could exploit. A constant flow of international investment in the renewables sector is testament to its potential.

|

We also see gas as a key source of energy. Today, gas accounts for 48 per cent of Vietnam’s total oil and gas resources but only 6 per cent of this reserve is under production or development, while 76 per cent remains unexplored.

There have been many challenges to increase domestic production, forcing the country to become a net importer despite domestic resources. We feel that there are policy, regulation, and pricing levers that Vietnam can employ to maximize its domestic resources. One suggestion would be to enhance conditions to attract upstream oil and gas investments.

This would include taking a closer look at its fiscal attractiveness and measuring it in relation to key factors that are important to investors in upstream gas. Another suggestion would be to re-examine and possibly restructure the gas market in some areas.

The fact that Vietnam has a deep commitment to sustainability will help promote this agenda.

Among the eight recommendations BCG outlines, energy efficiency initiatives at scale will be particularly important to drive both unit cost reductions and GHG emission reductions.

We see three areas of focus being critical, the first being implementation of demand-side management practices. This refers to initiatives and practices that encourage energy consumers to optimize their energy use. Vietnam currently has the lowest energy efficiency level in the region.

Second, policy and regulatory incentives to provide fairer market conditions for renewable investments that reduce barriers to investment in renewable power generation. Third, leveraging technology at scale to support energy efficiency.

A number of digital solutions can enable better demand-side management, create efficiency in energy supply, and promote transparency in the energy system to inform policy changes.

Saudi Aramco, the world’s largest oil and gas company, publicly describes its competitive positioning as the lowest cost and lowest carbon intensity player. Lower cost and lower carbon intensity will be sources of competitive advantage in the future.

Energy efficiency initiatives in core oil and gas operations will help drive both cost efficiency and lower carbon emissions.

What is important to recognize is that there are many potential initiatives across the value chain and the wider economy. The key for Vietnam’s energy industry is to drive these ideas at scale.

This will require oil and gas players in the country consider the strategic positioning of energy efficiency at scale, think through the appropriate approach to manage the investment program, and rethink organizational models to make it happen.

Vietnam plans to continue to develop new coal-fired thermal power projects with estimated capacity of 43GW by 2030. Our expectation is that there will be a shift in the market in Vietnam towards gas and renewables compared to coal.

The economics of renewable energy sources has been steadily improving and is expected to continue to improve. Developing renewables at scale further improves renewable economics.

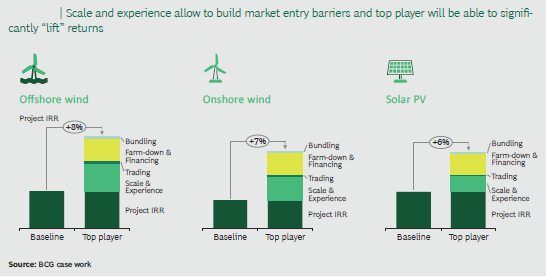

Globally, we have observed that leading renewable players who are competitive outside their home markets have successfully leveraged scale and experience to compete on price while maintaining high returns.

We spoke earlier about the potential of domestic gas in Vietnam. In addition, Vietnam plans to import LNG at a time when the global outlook on LNG prices are favorable towards buyers.

These factors, coupled with Vietnam’s sustainability commitments, can drive much higher renewable energy and gas-powered generation growth in the country, while reducing the contribution of coal over time. VN Economic Times

Minh Do

Experts warn of technical problems when developing solar power in Vietnam

With limitless potential, solar power is expected to become the solution for Vietnam to ease reliance on fossil fuel. However, after four years of mass deployment, many problems have arisen, including environmental risks.

Industry Ministry to submit new solar power price scenarios in September

The Ministry of Industry and Trade will submit to the Government new scenarios for solar power prices in two regions on September 15.

Mr. Dave Sivaprasad, Managing Director and Partner, and Ms. Tuyet Vu, Principal at the Boston Consulting Group (BCG), share about their views on Vietnam's transformation into a regional energy powerhouse.

Mr. Dave Sivaprasad, Managing Director and Partner, and Ms. Tuyet Vu, Principal at the Boston Consulting Group (BCG), share about their views on Vietnam's transformation into a regional energy powerhouse.