The HCM City Stock Exchange (HOSE) announced that Duc registered to buy 50 million HAG shares in the time from October 19 to October 30.

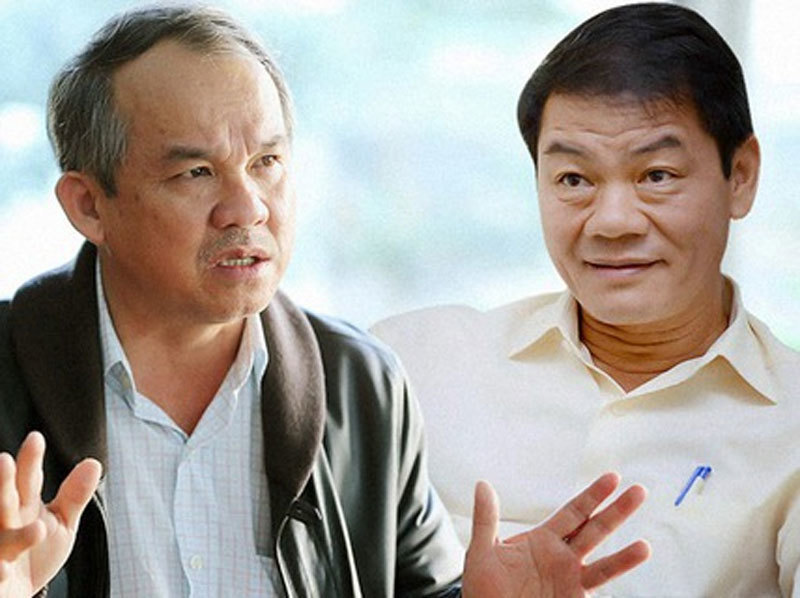

Boss Duc (left) and Thaco's Tran Ba Duong

If the transaction succeeds, Duc’s ownership ratio in Hoang Anh Gia Lai Group will increase from 326.7 million to 376.7 million, or from 35.23 percent to 40.62 percent, and his stock asset value will increase from VND1.643 trillion to VND1.894 trillion. Duc will still be among the top billionaires in the Vietnamese stock market.

HAG share price has increased rapidly from VND3,700 per share in late July to VND5,030 per share, a 36 percent increase.

Duc’s Hoang Anh Gia Lai Group has been undergoing a strong reshuffle in the last few years, but big difficulties still exist.

Duc was recognized as the richest businessman in the Vietnamese stock market in 2008 and 2009 with assets of VND6.2 trillion at that time. But lthe No 1 position has been held by Pham Nhat Vuong since 2010.

Over the last decade, Duc’s businesses have had difficulties because of scattered investments in many business fields. The decisions on shifting from real estate and hydraulic power to agriculture production, especially rubber plantations, could not bring the desired effects.

The sharp falls in rubber prices in recent years caused Duc’s calculations to fail.

The projects on raising cows, and growing sugarcane and chili are also unsatisfactory. Duc has sold the sugar cane farming segment to Thanh Thanh Cong of Dang Van Thanh, a major businessman in the sugar industry.

Currently, Hoang Anh Gia Lai focuses on farming fruits with support from a new big shareholder – Thaco, the automobile manufacturer of billionaire Tran Ba Duong. Duc has an ambitious plan to build an agriculture empire in Southeast Asia.

The relative stability again of Hoang Anh Gia Lai helped HAG shares recover. Duc can retain the large rubber field, 30,000 hectares, expected to be fully exploited by 2022.

In Q2 2020, Hoang Anh Gia Lai saw its revenue increase again and it made profit from core business. Its financial costs, mostly loan interest, decreased significantly, but debts to individuals, organizations and bonds remained high.

Duc now has high hopes for agriculture projects. HAGL Agrico (HNG), after a period of restructuring with the presence of Thaco, has shown positive signs. Its revenue in H1 increased sharply by 49 percent compared with the same period last year to VND1.17 trillion, with revenue mostly from fruit.

V. Ha

Billions of dollars worth of shares expected to enter bourse

A number of commercial banks are going to list their shares at the HCM City Stock Exchange (HOSE), and are expected to bring a breath of fresh air to the market, which has been stagnant because of the pandemic.

Covid-19 disrupts 'rules' of the Vietnamese stock market

Investors are concerned about the stock market performance, which has become unpredictable because of the pandemic.