Eleven “rising star” startups in Southeast Asia in September converged at the “500 Startups Demo Day” in Ho Chi Minh City to spotlight the dynamic technology landscape in Vietnam and broader Southeast Asia.

“There’s more hype about Vietnam’s tech scene now than ever before, as this is an exciting time for Vietnam overall,” said Mr. Eddie Thai, General Partner at 500 Startups Vietnam.

“Vietnam is fast becoming an attractive destination for local and international venture capital funds, who are hoping to capture the growing consumer opportunities and leverage the Vietnamese entrepreneurial spirit.”

Rising appetite

|

Vietnam’s startup sector is growing at a rapid clip despite the global economic slump and is closing the gap with regional leaders.

In only two years, it has made a big leap forward in startup ecosystem rankings, jumping from the second-least active ecosystem to third-best among the ASEAN 6 countries, trailing only Indonesia and Singapore, according to regional venture capital firm Cento Ventures.

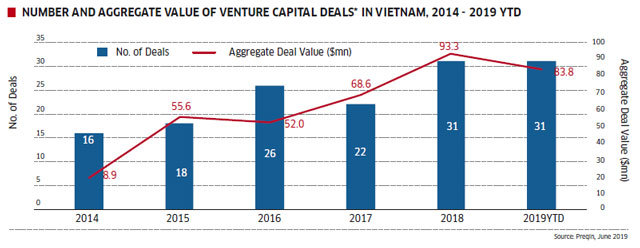

The amount of invested capital and number of tech deals done grew six-fold year-on-year in the first half of 2019.

There has been a definite spike in interest in Vietnam’s startup ecosystem. “The ecosystem has developed even faster than expected, across many factors, including founder quality, tech talent quality, interconnectedness with the community, and so on,” Mr. Thai said.

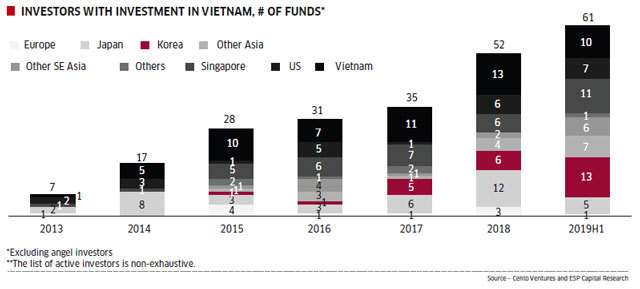

Moreover, the ecosystem is experiencing a rapid and exciting stage of growth. It has been nurtured by government initiatives as well as private funding, both domestic and international, according to Mr. Ee Fai Kam, Head of Asia Research & Operations at Preqin, a global alternative investment research firm.

The “Vietnam Tech Investment Report 2019” released recently by Cento Ventures and ESP Capital found that the country has witnessed a surge in both capital invested and completed deals since the beginning of 2018, with FY 2018 totaling $444 million and FY 2019 expected to reach $800 million, for a rise of at least 80 per cent.

Local startups raised a total of $246 million in the first half, of which the three largest investments were in Tiki, VNPay, and VNG, capturing 63 per cent of all funding.

“It’s expected that amounts raised in the second half will be significantly higher than in the first, as several later stage companies that fundraised in 2018 and early 2019 are either in the process of closing another sizeable investment round or expanding their current round,” the report noted.

In fact, 18 venture capital funds, both domestic and foreign, pledged to inject a combined $425 million into Vietnamese startups over the next three years within the framework of the Vietnam Venture Summit 2019 held in Hanoi in June. Eminent names include Alpha Venture, Insignia Ventures, Monk’s Hill Ventures, 500 Startups, Vingroup, and Jungle Ventures.

VinaCapital Ventures, the technology investment arm of VinaCapital, announced on the same day its strategic partnership with the Mirae Asset - Naver Asia Growth Fund, a $1-billion joint fund from South Korea’s leading financial group and fellow internet company Naver.

The South Korean-backed DT&I Investment, likewise, revealed its $1.4 million investment in Propzy, a local online-to-offline (O2O) real estate platform that seeks to rectify property buyers’ concerns over transparency, trust, and efficiency.

Apart from that deal, DT&I has also made two other investments in Vietnam, with one to food app Lozi, and is seeking to boost the number to ten or more this year.

Unlocking potential

|

Most Vietnamese startups are laser-focused on the domestic market; a trait found across the ASEAN region, perhaps with the exception of Singapore.

“Prominent companies that received recent venture capital funding like Sendo and Leflair are both e-commerce sites for local consumers, and the VIMO/NextPay wallet is also local,” said Mr. Kam from Preqin. “Logivan serves only the Vietnam market. And this is happening because the local market is big enough.”

The ASEAN 5 - Indonesia, Malaysia, Thailand, the Philippines, and Singapore - is often seen as the more investable segment in Southeast Asia, but increasingly the ASEAN 6, with Vietnam joining the mix, is the new standard.

“Vietnam is shedding its image as an emerging economy as its GDP grows,” he went on. “A business-friendly government, together with short-term benefits from the US-China trade tensions, are great tailwinds for Vietnam at the moment. Positive demographics also play a part, with a young, vibrant, and highly-educated / skilled population giving investors a lot to look forward to, and a rising middle class is also great news for the e-commerce, healthcare, and fintech sectors.”

Among the ten ASEAN countries, many investors agree that Vietnam is one of the most open, after Singapore, as it has been more consistent in attracting foreign investors with a range of policy and legal improvements compared to neighboring countries.

“Vietnam has emerged as a spotlight for South Korean, Japanese, Hong Kong and Chinese investors exploring investment opportunities,” said Mr. Chad Ovel, Partner at Mekong Capital. “This is a good time for them to enter Vietnam.”

The country’s economy possesses substantial potential for foreign investment. In terms of sector, the building blocks of the digital economy such as retail and payments captured almost 60 per cent of investment over the last two years.

Multi-vertical companies are emerging and captured a 12 per cent share of capital, while sectors that have been growing in other parts of the region, such as fintech (non-payment), real estate, and logistics are only beginning to pick up in Vietnam, collectively taking a 10 per cent share of capital in total, the Cento-ESP report noted.

Vietnam shares a number of similar trends with other Southeast markets, according to Ms. Le Hoang Uyen Vy, General Partner of ESP Capital. Online retail attracts a large portion of funding, while sectors that are trending regionally, such as financial services, real estate, and logistics are also gradually growing in Vietnam.

Multi-vertical companies, she said, are being formed as mature digital companies expand outside their core businesses and will likely attract an increasing share of funding in the coming years. At the same time, differences exist.

Education is among the better-funded sectors in Vietnam and payments firms still attract the majority of fintech investment, as the country continues to build the necessary digital payment infrastructure.

Adventures ahead

|

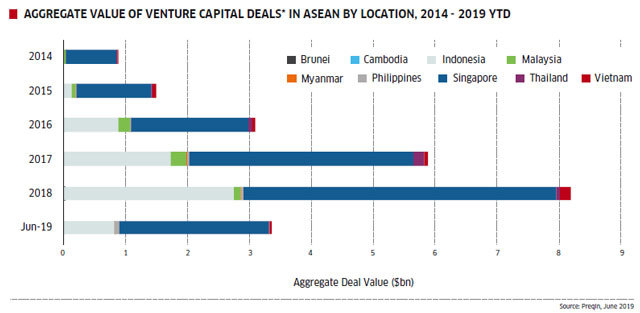

As much as there has been growth in the amount of capital flowing into Vietnamese startups over recent years, it is still only 2 per cent of what goes into ASEAN as a whole, Mr. Kam said.

Consequently, the maturity of startups in Vietnam is behind that in countries such as Indonesia and Singapore, with a significantly higher proportion of latter stage funding going to these places.

This gap should start to narrow as Vietnam rises in prominence as an alternative node in the global supply chain due to the ongoing US-China trade negotiations.

He believes that investors need specialists with boots on the ground who know how to navigate the regulatory / legal environment, culture, consumer preferences, and language.

Which is pretty much the same across most of ASEAN, since this is not a homogenous region. In this regard, major local players have succeeded in raising successive funds as they are able to demonstrate to investors their specialist knowledge in identifying the best deals, which pan-regional players cannot.

Despite last year’s record level of venture capital investment in Vietnam, it only accounted for less than a half of 1 per cent of global venture capital.

“There is still meaningful development required and some notable challenges to overcome,” said Mr. Thai from 500 Startups. “As Vietnam’s startups are generally smaller than their counterparts in other parts of Southeast Asia and much smaller than in China, this presents opportunities for partnerships or M&As but also some clear potential competitive risks.”

There are a lot of low-cost high-tech talent in Vietnam, but there are also dual pressures from rising salaries, because demand for talent from overseas companies has increased a great deal due to insufficient numbers of top-tier talent in the country, for example “cutting edge” experts in AI and robotics, etc.

Local investors are still learning about tech investment and foreign investors are still learning about Vietnam. This results in some inefficiency in capital, such as too much money going to certain projects, not enough money going to other deserving projects, process delays, or poor structuring, he added.

In fact, choosing the right local partner and investee companies who understand shareholder relations has also been a challenge, according to Mr. Hiroyuki Ano, Partner at ACA Investments.

“I am still in the process of learning, but investor’s contribution and contribution efficiency can be totally different if investee companies understand how to utilize such investor’s resource and network,” he said.

To attract more capital, he advised, Vietnam should work on developing a sophisticated capital market. Initial public offerings (IPOs) are a critical event for entrepreneurs and investors to find common goals and strategies.

This would significantly contribute to the sustainable growth of the national economy as well as the development of Vietnam’s startup ecosystem and the investment environment. VN Economic Times

Hong Nhung

Start-up enterprises need more incentives

A person's CV is one of the most important documents when it comes to starting or advancing a career, but many CVs are compiled manually which can lead to mistakes, especially if a new copy has to be submitted for every job application.

Vietnamese start-up eco-system fastest growing in ASEAN

Pham Hong Quat, head of the National Agency for Technology Entrepreneurship and Commercialisation Development under the Ministry of Science and Technology, talks about Techfest 2019 and the Vietnamese innovative start-up eco-system.

Vietnam's emerging startup scene is proving to be a case of right place, right time for local and international venture capital funds.

Vietnam's emerging startup scene is proving to be a case of right place, right time for local and international venture capital funds.