Over the years, Vietnam has pushed for many reforms that have supported sustained high growth. In 2020, continued reforms are needed to buttress growth and tackle economic challenges, HSBC has said in its latest report.

The first key area to focus on is infrastructure. As Vietnam’s fiscal pace has been limited but the need to upgrade and build new infrastructure is urgently required, the report suggested Public-Private Partnerships (PPP) would provide an ‘ideal’ source to fund large infrastructure projects.

Yet, more reforms are needed to solve PPP-related issues to incentivize participation of private investors. It is positive to see the authorities having already taken steps in this direction.

The revised PPP Law, looking to strengthen the legal framework and laying the ground for addressing lingering issues concerning investors, is expected to pass in 2020.

|

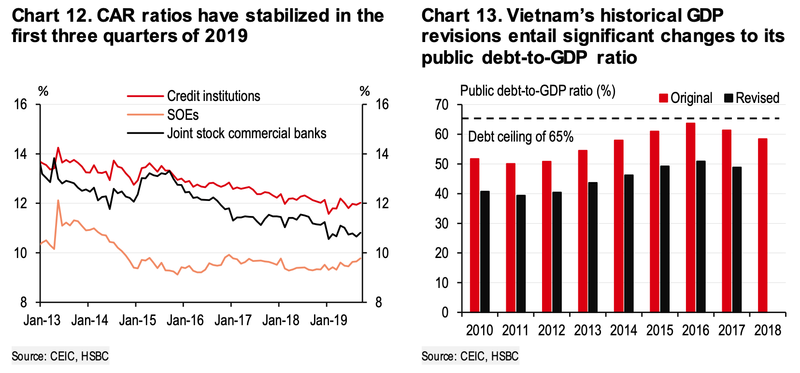

Meanwhile, reforms are also needed in the banking sector. From January 1, 2020, all banks in Vietnam will have to adopt Basel II standards, which requires a minimum capital adequacy ratio (CAR) of 8%. CARs on average have declined steadily since 2013, particularly among the state- owned banks.

The good news is that the CAR in state-owned banks has stabilized at 9.8% year-on-year as of September 2019, likely to meet the Basel II standards in 2020. That said, only 18 banks (16 domestic and 2 foreign) have met the requirements so far. In particular, small banks are under pressure to increase their capital to meet the new standard.

Additionally, improvements in data releases on a timely basis are needed for better economic assessment and risk management. More comprehensive and consistent data on the real estate sector, private sector debt and public spending and revenue would also enhance information availability for more calibrated decision-making by all economic agents.

|

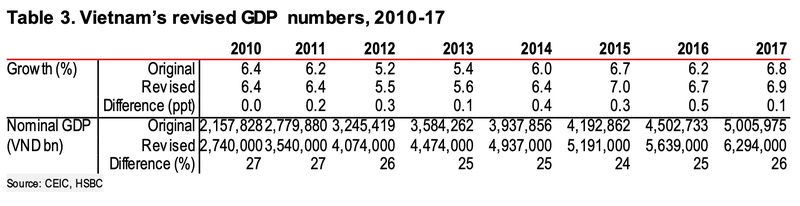

Recently, Vietnam’s General Statistics Office (GSO) released upward revisions of historical GDP data for the period of 2010-2017.

After the revisions, real GDP growth was raised by 0.3ppt per year on average and nominal GDP by 26% for the whole period, rapidly closing the gap of Vietnam’s economic size with that of the Philippines.

According to the GSO, with the help of the IMF and the UN, the revisions are aimed at meeting international norms and better reflects strong growth in Vietnam’s private sector. This will have profound implications in many respects.

For example, based on initial information, it appears that the public debt-to-GDP ratio would be lowered by 11.5ppt annually on average, falling below 50% in 2017.

That said, as historical data in 2018 was unchanged, it still remains to see how the authorities will reconcile data discrepancy between 2017 and 2018.

All in all, as FDI inflows continue to add production capacity, its manufacturing sector is likely to remain robust.

New trade agreements, such as the EU-Vietnam Free Trade Agreement (EVFTA) and the Comprehensive and Progressive Agreement for Trans- Pacific Partnership (CPTPP), will bring opportunities for Vietnam’s exports.

Meanwhile, services are likely to maintain its strong momentum as a result of continued thriving tourism and strong growth in domestic consumption. Hanoitimes

Ngoc Thuy

HSBC economists report on Vietnam’s prospects during 10-day visit

Limited land and labor resources, increasing wages and a lack of local suppliers in Vietnam could make the cost/benefit equation less attractive for FD) firms in the foreseeable future, HSBC said in its latest Asia Frontier Insights report.

Vietnam’s role in reshaping Asian supply chains is growing: HSBC

While the recent trade tensions have merely accelerated the movement of supply chains to Vietnam, they were not the trigger.

HSBC expected Vietnam’s economic outlook to remain positive and GDP to grow 6.6% in 2020.

HSBC expected Vietnam’s economic outlook to remain positive and GDP to grow 6.6% in 2020.