|

With more than 6,314MW installed as of the end of August, the market is expected to add 7,000MW newly-approved capacity while 13,000MW also awaits approval.

The new landscape has fuelled investor sentiment as they begin to assess risks from other perspectives instead of only focusing on models such as power purchase agreements due to bankability issues.

As a result, mergers and acquisitions (M&A) in the country’s renewables, especially in solar, have become more active since the end of 2018 thanks to a feed-in tariff (FiT) mechanism of 9.35 US cents for solar for phase 1, and each kilowatt-hour generated from ground-mounted, floating, and rooftop solar initiatives set at 7.09, 7.69, and 8.38 US cents respectively for the FiT2 rate.

|

| M&A renewables on upward trajectory in Vietnam. |

Under Decision No.13/2020/QD-TTg issued in April on encouraging mechanisms for solar power development in Vietnam, the deadline of December 31 was set for solar systems of any scale to attain a certificate of delivery and enjoy the FiT2 rate, which is considered financially attractive. Both developers and investors believe that acquisitions of operational plants may be far easier from a legal point of view, while also reducing the risk of forecasting generation as real data already exists, while they do not know if new projects can enjoy the preferential FiT rates.

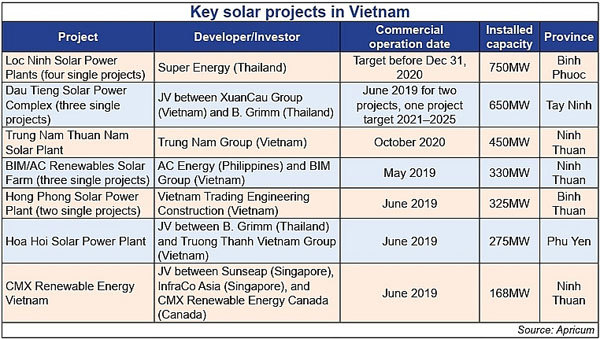

Moritz Sticher, senior advisor for Berlin-based cleantech advisory Apricum, said that the solar M&A landscape is looking up for several reasons. By the end of 2020, nearly 3,000MW of ground-mounted solar projects could potentially reach commercial operation date, adding to existing operational solar assets – many of which will be up for acquisition.

From FiT phase 1, additional ground-mounted projects are up for acquisition as well as rooftop solar projects that have been developed under both rate phases. This expected market supply of operational solar power plant assets, Sticher said, plus the number of ongoing transactions not yet finalised, is likely to create more traction for the solar M&A scene of Vietnam, driven by a rather oversupplied capital market looking for renewable energy assets.

Rong Viet Securities Corporation meanwhile added that M&A activities in renewable projects in Vietnam also contributed through high demand of electricity and attractive electricity tariffs in the country.

“Compared to other solar projects in some regions and potential future tariffs in Vietnam announced under competitive selection processes, the tariffs awarded under both FiT phases are high, allowing for relatively high returns,” explained a Rong Viet analyst at last week’s Vietnam M&A Forum 2020 in Ho Chi Minh City – an event that attracted more than 700 people.

At the forum, however, experts pointed out existing barriers for M&A activities including continuing COVID-19 pandemic setbacks globally, regulatory uncertainty, financing access, and environmental and social concerns. VIR

Nguyen Thu

Legal clear-up may assist M&A boom

Mergers and acquisitions are expected to receive a push in the months to come on the back of new rules on separation and merger of projects, taking effect from early 2021.

Vietnam’s renewable energy: Key guidance to investors

Solar power capacity is increasing thanks to significant changes in feed-in-tariff.