Vietnam’s southern metropolis of Ho Chi Minh City remains attractive to investors with an exciting quarter marked in office and ready-built landed property, but few new launches of apartments, the latest report by JLL has shown.

Apartment for sale: thin supply

HCM City's apartment market in Q1. Photo: JLL Research

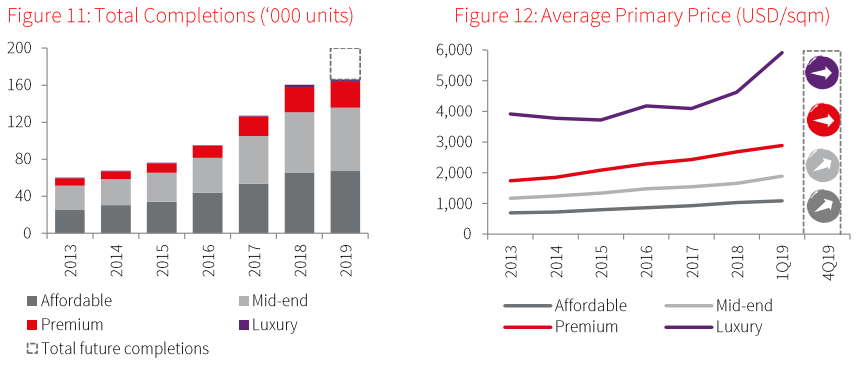

The number of new launches in Q1 was about 4,500 units from eleven projects, falling 50% from the previous quarter due to the prolonged construction approval experienced recently.

The figure became the lowest level of new launches since the market rebounded in 2014, a result of slow approval procedures recently.

The market trend will be more sustainable mode with prominent proportion of new launches coming from affordable and mid-end projects.

Prices elevated, driven by exceptionally high prices in luxury launches. The high-end segment marked an exceptionally high price level thanks to the entrance of some new luxury projects in CBD area, pushing the market-wide price to increase by 22.7% on year.

In Q1, the slower investor demand became more evident after a period of strong growth. The current high price level made the premium apartment a less attractive investment channel, regarding both capital and rental yield perspective.

On a project basis, primary prices maintained flat or slightly improved after a period of strong growth. Chain-linked growth in prices recorded at 2.9% on quarter and 7.5% on year, with good improvement across the board.

Outlook: As the prevailing delay in approval procedures is expected to continue, the projected supply pipeline in 2019 is subject to greater uncertainty, vary between 30,000-45,000 units, JLL said in the report.

The number of new launches in 2019 will heavily depend on the improvement of procedures and the developers’ ability to acquire relevant legal documents to officially launch the projects.

Projects that can manage to be officially launched and focused on owner-occupiers will still record good sale rate, underpinned by strong bookings recorded over the soft launches of new projects in 2018.

Prices should increase further but at a slower pace.

Office market: strong demand

Office stock and rents in HCM City in Q1/2019. Photo: JLL Research

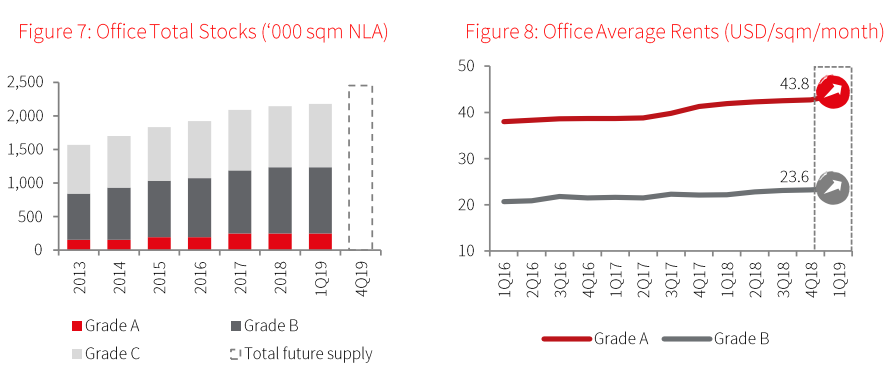

Demand remained positive during the quarter on the back of limited supply with the domination of companies working in services, financial, and manufacturing sectors.

Flexible space operators have been a major source of office demand as they sought to expand their operations across the city.

At the end of Q1, HCM City's office market posted more than 2,178,000 square meter (sq.m) in stock.

Of the supply, no new Grade A and B stock entered the market during Q1. Meanwhile, Grade C start the new wave supply of this year with additional 16,000 square meter (sq.m) from four new buildings in District 3, Tan Binh and Binh Thanh.

Healthy demand amid tightening supply drove rent growth for a seventh consecutive quarter with average rent of Grade A and B stood at US$27.9 per sq.m per month, up 1.8% on quarter and 5.4% on year. Meanwhile, Grade C was around US$23.6/sq.m per month, up 1.3% on quarter.

Outlook: Vacancy is expected to increase as a large volume of new stock is set to enter the market in the months to come. The robust growth of flexible space recently to provide various diversified options for tenants also likely put further pressure on filling up the new office properties.

Demand continues to pick up on the back of positive economic prospect. While higher rent is expected in new completions with better quality and project design, the new supply expected in 2019 may put some downward pressure on HCMC rents. Accordingly, developers should be flexible in leasing strategy to capitalize on the market.

Retail market: demand remains positive

HCM City's retail market in Q1. Photo: JLL Research

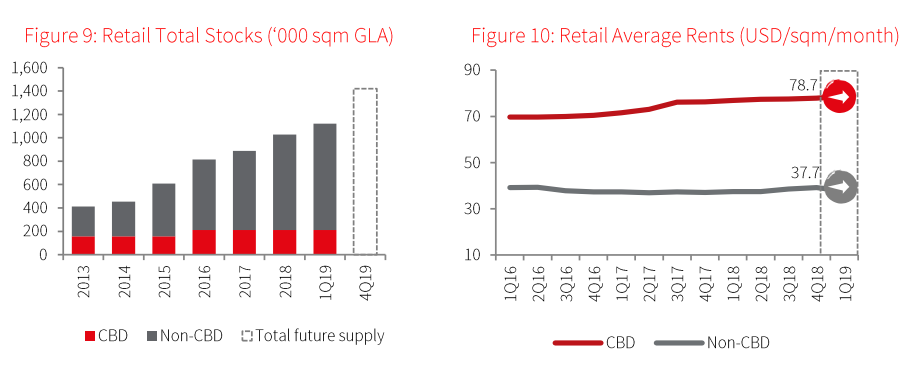

JLL said that demand remained positive as retailers in fashion, accessories and F&B categories were the most active in the quarter. Besides, car manufacturers, technology stores, education institutions, and healthcare stores with the plan to expand the footprint will emerge to drive the demand.

In general, demand remained healthy with overall occupancy registered at 88%, almost unchanged on quarter.

The total stock was added with 92,800 sq.m from Gigamall in Pham Van Dong, Thu Duc District. The mall is now the largest shopping center in HCM City.

Rents decreased during the quarter driven by lower rent level in non-CBD as lower-than-average rent in the new large scale completion in non-CBD has strongly impacted the market-wide rent.

As a result, average overall market rent in Q1 experienced a temporary decline to around US$45.4/sq.m/month, decreasing by 4.0% on quarter and 2.0% on year.

Regarding location, chain-link change in CBD rents slightly improved while that in non-CBD contracted by 0.4% on quarter, a result of large supply influx in this area.

Outlook: 2019 is expected to witness a sizeable amount of new supply coming on stream, approximately 300,000 sq.m GFA locating in non-CBD area, including 83,000 sq.m from Aeon Mall Tan Phu.

Tenants who require large space such as flexible space, clinic, education, entertainment will continue to fill up vacant space in upper floors of retail centers which usually attract less foot traffic versus the lower floors.

More international retailers are expected to enter the city, bringing more demand for high-quality space, especially in CBD.

Ready-built landed property: recorded strong sales

Ready-built landed property market in HCM City in Q1. Photo: JLL Research

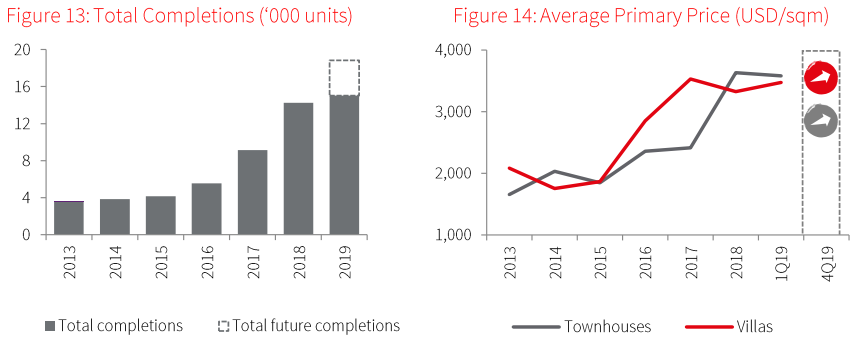

Demand moved in tandem with new supply. Sales totaled 468 units in Q1 with sale rates in new projects up to 97%. The demand for townhouses and shophouses products remains high, supported by strong demand from both owner-occupiers and buy-to-let investors.

New launches totaled 479 units, down 68.3% on year, mostly came from small to mid-scale projects.

Similar to apartment market, limited supply in ready-built landed property market was mainly attributed to the deferred procedures in granting developers the necessary legal documents to launch the project as planned.

During the quarter, 60.3% of total new launches came from less popular locations, namely District 12 and District 8. All of these units came from small-scale projects, at about 15 to 50 units per project.

As a result, the primary price in Q1 escalated to US$3,736/sq.m land, up 34.7% on year, possibly influenced by the record high prices in new supply of townhouse product type.

The market registered the chain-link growth of 10.2%, showing an attractive capital gain level that investors can achieve over the quarter.

Outlook: New launches are expected to reach 4,600 units in 2019, mainly from the eastern area including District 2, District 9 and Thu Duc District, with large-scale projects such as Vincity, Senturia Rach Chiec, and SimCity phase 2.

Similar to the apartment market, the projected launches during the year vary widely, due to the unpredictable timeline relating to legal procedures.

More favorable capital gain achievable in ready-built landed property market compared to high-end apartment, given the same investment amount, will continue to drive investor demand in this market, JLL concluded.

Hanoitimes