There is huge potential for solar rooftop in Vietnam and chances for domestic solar power development are still very big, attracting many domestic and international investors

Ten renewable power projects among 18 in the south-central province of Ninh Thuan with the greatest potential for renewable power generation were forced to reduce capacity after the grid was recently overloaded, with damage estimated to be up to VND500 billion ($21.7 million), according to a report sent to Vietnamese government agencies to prevent a recurrence.

The issue has been created by a boom in solar power projects when the current grid is not ready to handle the onslaught, putting renewable energy ventures in Vietnam at risk.

Victim of its own

Lured by a feed-in tariff (FiT) of 9.35 cent per kilowatt-hour introduced in 2017 for solar schemes, Vietnam has attracted development of 4.46GW of solar capacity as of the end of June, according to state-run Electricity of Vietnam (EVN).

The US-based Institute for Energy Economics and Financial Analysis (IEEFA) stated in its report mid-September that Vietnam’s renewable policymakers have been rewarded for their steady management of the FiT programme, with impressive renewable capacity gains. It validates the renewable energy ambitions of the Vietnamese government.

However, Chairman of Ninh Thuan People’s Committee Luu Xuan Vinh complained that the province got the nod for 30 solar projects with total capacity of 1,817MW and, while 18 renewable projects including both solar and wind have officially been put into operation since June, all of them face difficulties to connect fully to the grid. The province reported that most of the 110 kilovolt and 220kV transmission ventures currently under construction are behind schedule, while additional transmission capacity will not be carried out until after next year.

Previously, Binh Thuan Wind Power Association petitioned the Ministry of Industry and Trade (MoIT) and EVN not to cut capacity of Phu Lac and Binh Thanh 1 wind power projects in the province. According to the association the power purchase agreement (PPA) of these two wind schemes, unlike their solar power equivalents, contain no provisions to cut capacity if the grid is overloaded. Therefore, the association claimed that the reduction in their capacity is unfair and goes against the agreement.

The association blamed the overload on the scores of solar power projects in some provinces, such as Binh Thuan and Ninh Thuan, as well as the lack of synchronisation between the planning and execution stages of power source and grid projects.

It takes three years on average to build a power grid project, while a solar power plant needs only 12 months to be put in place. As a result, grid development cannot catch up with the proliferation of solar and wind power projects. However, existing solar power developers were aware of the risk on the grid limits, as well as bankability concerns in PPAs.

The limited grid connection also just happens in some provinces that have highest potential renewable sources. IEEFA’s energy finance consultant Melissa Brown pointed out that the challenge now is to “prioritise programmes that can deliver the right kind of grid capacity for renewable solutions.”

What is next?

A reduction in FiT may serve as a tool that the government can wield to deal with the severe solar power generation surplus. Under the latest draft for the next round of the FiT mechanism to be applied for projects reaching commercial operation date (COD) between July 1, 2019 and December 31, 2021 and applied for 20 years from the COD date, there will be only one region for the rate instead of four regions now.

The new proposed single FiT for the whole of Vietnam sits at VND1,620 (7.09 US cents) per kWh for ground-mounted solar energy projects, from 9.35 US cents per kWh.

In recent talk with VIR on future solar policy, Le Nho Thong, senior account manager at Huawei, said that the solar power sector is one of the fastest-growing in the world.

“But in the next phase, solar power production costs are expected to be lower than power production of conventional sources of energy such as coal, petroleum, natural gas, and nuclear energy,” Thong said. “Once entering the final phase, Vietnam will then reach a level of sustained energy development.”

However, chairman of the Vietnam Energy Association Tran Viet Ngai said in a document to the prime minister that a fixed FiT for whole country would put the risk of local overcrowding on hold.

“The price of solar power by regions has been applied in many countries. This will bring some efficiency, facilitating regulators and operators. The power system has many options in integrating solar power sources with other types of power plants in the region to bring the highest efficiency,” said Ngai.

Regarding Ninh Thuan province, the draft continues to incorporate a special policy by allowing certain solar power projects with total combined capacity cap of 2,000MW and achieving actual COD before 1 January 2021, to be eligible for the extended FiT of 9.35 US cents per kWh.

However, given the overall reduction on the proposed rates under the second programme compared to the first that ended in June, the upcoming policy may have a significant impact on private investors’ considerations on making investments in the solar farm space, according to Baker Mackenzie.

The firm pointed out that in an MoIT report outlining its proposal on a new draft decision on mechanisms for solar power projects, the second FiT programme aims to mobilise the development of projects already included in the master plan with a total capacity of about 4,800MW, and a “part of other projects” with total capacity of about 17,000MW.

As a concluding proposal to the government, the MoIT proposed that total capacity of 6.3GW for solar power projects until 2023 should be considered for inclusion in the master plan during the second programme.

According to a preliminary calculation by the MoIT, during the 2021-2023 period, in addition to renewables projects already included in the master plan, the government expects that its demand for newly-proposed solar power projects to be included in the master plan will be about 6.3GW or 8GW.

Representatives at Baker McKenzie elaborated that, from the private sector’s perspective, it is important to clarify how much room there will be for the government to approve additional capacity, taking into account various factors such as the market status of developing projects in the energy mix, and progress of new grid system investments in order to meet demand and energy security.

Rooftop for future

The next FiT for solar farm and float solar project is going to slash, but FiT for rooftop solar projects plan to remain unchanged at 9.35 cent.

Phuong Hoang Kim, director of Department of Electricity and Renewable Energy under MoIT, said that the current draft to amend the prime minister’s Decision No.11/2017/QD-TT dated April 11, 2017 on incentive mechanism for solar power development in Vietnam has been finalised. However, for the solar rooftop projects installed after June 30, 2019, they still enjoy the FiT of 9.35 US cents with aim to encourage the development of rooftop solar power, increasing the supply of electricity in the context of the current shortage of power sources.

Samresh Kumar, managing director of Principal Investments at VinaCapital wrote this year for VIR that power generated in Ninh Thuan and Binh Thuan province will not be able to be sold to the grid, not only in 2019 or 2020, but the situation may not be rosy even by 2030. Building new transmission lines is not a short-term thing because it requires significant investment and time, and the sub-sector is not currently open for private sector investment, thereby necessitating the need to find creative partnership structures between private capital and the government.

“Talking of scale, we looked at different segments such as factories, commercial and retail establishments, and the residential segment, and we estimate that more than 4,000MW of power can be effectively commissioned through rooftop solar in the next 10 years, of which more than 95 per cent would be through industrial and commercial segments. The potential is even bigger,” he wrote.

According to Kumar, the potential for solar rooftop in Vietnam is absolutely clear and the chance for Vietnamese solar power development is still very big, attracting many domestic and international companies to invest in this field.

“In fact, once being applied, the rooftop solar power price is still higher than that of other countries in the Southeast Asia area, especially Thailand and Malaysia which share similar weather conditions and labor cost. They also have an encouraging policy to develop solar power a long time ago and are now getting to a stable price period,” he wrote.

Ho Chi Minh City reported up to August 2019 there are 3,923 customers installing solar photovoltaics on rooftop, with installed solar capacity hit 44.56 megawatt-peak. In which 3,829 customers have connected the grid and registered to sell the surplus electricity to the electricity industry. VIR

Experts suggest building solar power plants on reservoirs

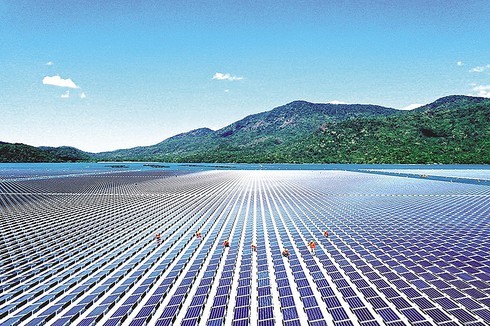

Some experts have proposed developing solar power projects on hydropower reservoirs to take full advantage of water surfaces, reported the Sai Gon Giai Phong Online website.

Households still waiting for rooftop solar power price approval

Many households and enterprises in Vietnam have proposed continuing the solar power purchasing price at 9.35 cent per kwh, as applied before June 30.

The country’s feed-in tariff has supported a boom for Vietnam’s solar sector, but now the Ministry of Industry and Trade proposes a rate reduction in order avoid solar projects becoming a victim of their own success.

The country’s feed-in tariff has supported a boom for Vietnam’s solar sector, but now the Ministry of Industry and Trade proposes a rate reduction in order avoid solar projects becoming a victim of their own success.